Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

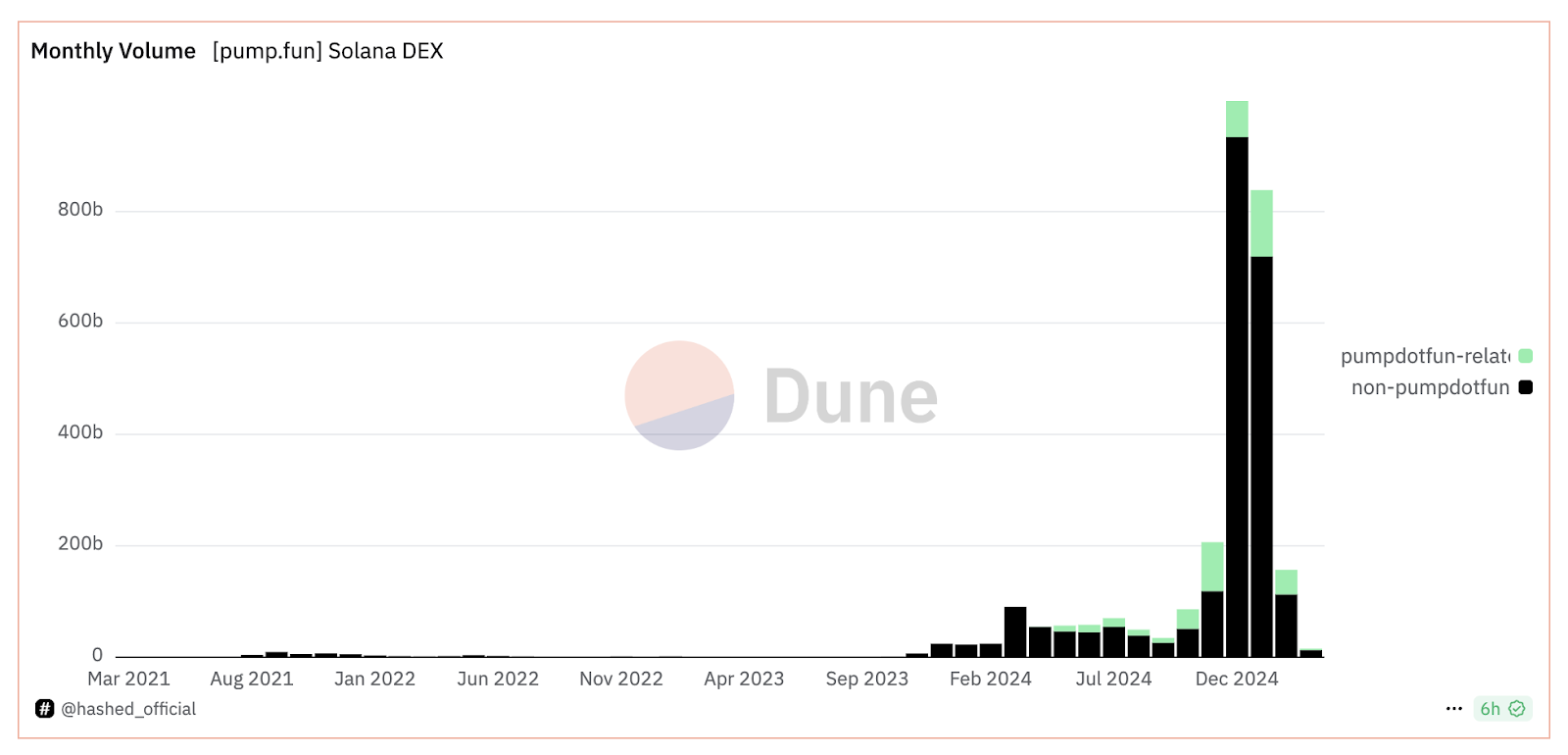

Trading volume on Pump.fun, a leading Solana-based token launchpad, has plummeted 63% from January to February 2025 due to the growing uncertainty surrounding meme coins.

According to data from Dune Analytics, Pump.fun’s trading volume fell from $119 billion in January to $44 billion in February—the lowest since October 2024. Trading activity registered at $2.1 billion in the past four days alone, indicating a sharp deceleration.

The decline in activity has also been reflected in new token listings. While the platform saw nearly 1,200 new token launches per day at its peak on January 24, this figure has since dropped below 300 as of early March.

In a statement, Pump.fun co-founder Alon Cohen attributed the slowdown to the broader market downturn, explaining that “when the market trades down, altcoins as well as meme coins trade down, and activity across crypto—including on Pump.fun—slows down.”

Investor Confidence Shaken by High-Profile Meme Coin Scandals

Meme coin trading, once a defining trend of this crypto bull run, has lost momentum amid fears of insider trading, rug pulls, and fraud.

The collapse in confidence was exacerbated by several high-profile incidents, the most infamous of which was the so-called “Libragate” scandal.

LIBRA, a token launched by a group that included the controversial Hayden Davis, saw its price skyrocket after receiving an endorsement from Argentine President Javier Milei.

However, what initially seemed like a bullish moment quickly turned disastrous when LIBRA crashed, wiping out over $120 million in market value.

Around 86% of investors suffered realized losses exceeding $1,000, prompting accusations of a massive rug pull. The scandal became a turning point for meme coins, fueling fears of manipulation and market exploitation.

In response to these concerns, the U.S. Securities and Exchange Commission (SEC) stated on February 27 clarifying that meme coins are not considered securities.

However, the regulatory body emphasized that fraudulent activities associated with these assets would still face strict enforcement.

Pump.Fun’s Efforts to Adapt

Pump.fun has been working to address the challenges plaguing the meme coin space by enhancing its platform’s features and liquidity mechanisms.

Recently, the company launched a mobile app and teased plans for a native automated market maker (AMM).

Despite the slump, Pump.fun remains a key player in the on-chain token launch sector, generating $74 million in revenue over the past 30 days.

According to DeFiLlama data, Solana topped DEX trading volume for the fifth consecutive month, surpassing Ethereum by 24% with a total of $109 billion in trades.

The platform’s total fees have reached $580 million, and over 8.2 million tokens have been launched to date.

Platforms like Raydium, Meteora, and Orca have maintained strong liquidity, providing some resilience to the struggles of the meme coin sector.

However, the sustained decline in trading volume for graduated Pump.fun tokens points to broader market issues.

Daily trading volume for these tokens has plummeted from January peaks of $3 billion to approximately $170 million at the time of writing—a 94% reduction.

Furthermore, the platform’s token graduation rate has dropped from 1.85% to 0.83% per week, indicating that fewer new coins are achieving the $100,000 market cap threshold necessary to graduate to Raydium.

The overall contraction suggests that trader fatigue is setting in. After months of intense speculative fervor, many participants are growing wary of meme coin-related risks.

Over the past year, crypto enthusiasts have cycled through presidential coins, influencer coins, TikTok coins, AI-driven coins, and various animal-themed tokens, with each wave of speculation followed by disappointment and losses.

It remains to be seen whether Pump.Fun can navigate the evolving market conditions or depend on peak speculative mania.

As the meme coin sector grapples with credibility issues, investor sentiment remains fragile. Pump.fun may regain traction if it successfully implements its planned AMM and continues innovating.

However, with regulatory scrutiny increasing and traders growing cautious, the platform’s future remains uncertain.