“Costs, costs, costs” are what Oliver Blume, the boss of Volkswagen (vw), recently said the car giant must address most urgently. His diagnosis of vw’s longstanding problem is nothing new, but his approach to dealing with it undoubtedly is. On September 3rd Mr Blume announced that, for the first time, vw was considering closing factories in Germany to tackle the “demanding and serious situation” confronting Europe’s carmakers. Even if he succeeds in doing so, however, shutting factories will not be sufficient to reverse VW’s dwindling sales and stay ahead of the looming onslaught of cheap Chinese electric vehicles (EVs).

The difficulty Mr Blume will face closing factories in Germany became apparent soon after his announcement. The firm’s governance structure hands significant power to workers and the state of Lower Saxony, which has a 20% stake in the business and is home to around a third of its 300,000 employees in Germany. Daniela Cavallo, the main official representing VW’s workers, promised “fierce resistance”. Stephan Weil, premier of Lower Saxony, says he supports cutting costs but favours alternatives to factory closures.

Wish Mr Blume luck taking on vw’s entrenched interests, which ensure that it relies heavily on expensive German workers even as rival carmakers have shifted production to lower-cost countries. Herbert Diess, his abrasive predecessor, departed in 2022 after several clashes with the unions. It is unlikely that Mr Blume’s more consensual style will have better results.

Even if it does, cutting labour costs will not be sufficient to rescue VW from its parlous state. The carmaker has spent heavily but unwisely in its effort to transform itself into an EV powerhouse capable of making vehicles that run on clever software. The company’s shares have continued to slide since Mr Diess’s departure, even though Mr Blume has cancelled plans for a new ev factory in Germany and has pushed back ev launches. Investors are wary of the carmaker’s plans to invest €165bn ($183bn) between 2025 and 2029, even after Mr Blume trimmed the amount by €5bn, given its reputation for profligacy and underwhelming sales for its ID range of evs.

Developing software in particular has flummoxed vw. Cariad, its in-house division, has been a disaster, delivering clunky programs well behind schedule. Reversing a decision to develop most of its own software, it invested $5bn in Rivian, an American ev startup, in June to gain access to its programming expertise. Earlier this year it struck a similar deal with Xpeng, a Chinese ev startup, to up its game on the mainland. Stephan Reitman of Bernstein, a broker, calls the move merely a “band-aid” that adds costs and complexity.

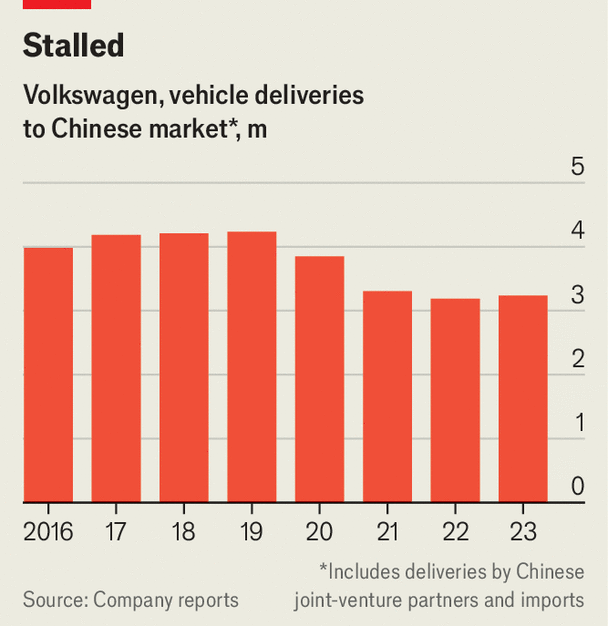

vw’s business in China, the carmaker’s biggest market, is suffering. It sold 3.2m vehicles in the country last year, down from a peak of 4.2m in 2019 (see chart). As local competitors such as BYD have surged, its market share there has fallen by five percentage points since 2020, to 14.5% last year. VW is still the biggest seller of petrol-powered cars but is in seventh place for evs, which now account for nearly half of all sales in the country.

vw hopes to use Xpeng’s know-how to get up to “China speed”, cutting by 30% the time it takes to get new models to market, and to slash production costs by 40%. Even if it can do so by 2026, when the first new cars from the partnership hit the road, nimble Chinese competitors will be even farther ahead.

On September 4th 16,000 German workers gathered to hear from management about the cuts. “We still have a year, maybe two years, to turn things around,” said Arno Antlitz, VW’s chief financial officer. If the carmaker is to truly get back in the race, Mr Blume will need to move at China speed. ■

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.