Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Ripple, a blockchain-powered payment services provider, launched yesterday, on Dec. 17, its US dollar-pegged stablecoin, Ripple USD (RLUSD).

The launch, highly anticipated by the crypto community, follows approval from the New York Department of Financial Services (NYDFS).

Ripple USD (RLUSD) is now live on global exchanges.

An enterprise-grade stablecoin built for everyone, $RLUSD combines fiat stability with blockchain efficiency:

➡️ Instant global payments, 24/7

➡️ Seamless on/off ramps

➡️ Access value in real-world assets.… pic.twitter.com/lJ43GdoDGR— Ripple (@Ripple) December 17, 2024

RLUSD is a 1:1 USD-backed stablecoin fully collateralized by US dollar deposits, short-term US government treasuries and other cash equivalents.

Initially available on Ripple’s XRP Ledger (XRPL) and the Ethereum mainnet, Ripple plans to expand RLUSD’s availability to other blockchains and decentralized finance (DeFi) protocols over time.

Focus on Instant Cross-Border Payments

Introduced in June 2024, Ripple USD (RLUSD) began beta testing in early August.

Preview listings appeared on data providers like CoinGecko and CoinMarketCap prior to its official launch.

In October, Ripple announced the exchange partners that will drive the global distribution of its stablecoin. These include Uphold, Bitstamp, Bitso, MoonPay, CoinMENA, among others.

Today at #RippleSwell, we’re proud to announce our Ripple USD exchange partners.

Upon regulatory approval, $RLUSD will be globally available for institutions and users from @UpholdInc, @BitStamp, @Bitso, @Moonpay, @Indereserve, @CoinMENA, and @Bullish. https://t.co/iZ7L1MHpn3

— Ripple (@Ripple) October 15, 2024

According to Ripple, RLUSD is “designed to facilitate real-time global payments” by enabling instant payouts and simple on/off ramps for conversion between fiat currencies and the stablecoin.

RLUSD’s key features include full backing by US dollar reserves to minimize price volatility. This makes it suitable for cross-border payments, where fluctuating exchange rates can be a concern.

To ensure “responsible development and regulatory compliance”, Ripple has formed an advisory board for RLUSD, including former FDIC Chairman Sheila Bair and Ripple co-founder Chris Larsen.

B2C2 and Keyrock will support RLUSD liquidity. Additionally, Ripple will publish monthly, third-party audited attestations of reserve assets to ensure more transparency and trust.

RLUSD and Ripple’s native token XRP will complement each other within its cross-border payments solution. XRP will contribute to RLUSD’s liquidity, while the stablecoin will offer price stability for Ripple’s institutional clients.

XRP Surges to New Heights Amidst RLUSD Launch

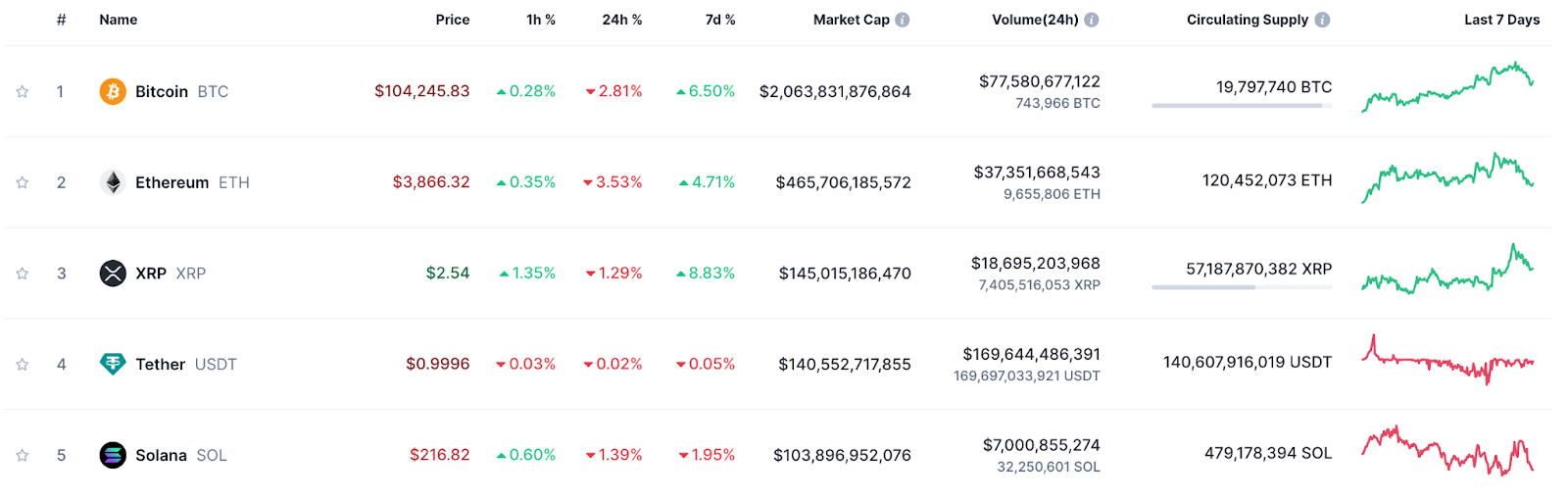

The launch of RLUSD comes amidst a surge in XRP’s price, with the token recently re-emerging as the third-largest cryptocurrency by market capitalization.

XRP has surged over 121% in the last 30 days, reaching a seven-year high of $2.89 on Dec. 12. Active accounts on the network increased by 278% from Nov. 1 to Dec. 17, according to XRPScan, peaking at 105,956 accounts on Dec. 2.

This rally has pushed XRP’s market cap to over $144.8 billion at the time of writing, surpassing both Tether’s $140.5 billion and Solana’s $103.8 billion, according to CoinMarketCap.

Currently, XRP is trading at $2.6 per coin.

XRP’s Bull Run: Can it Double its Previous High?

Several factors are contributing to XRP’s price performance. These include partnerships and new product developments from Ripple Labs, such as the launch of the first tokenized money market fund on the XRP Ledger and the RLUSD stablecoin.

RLUSD is positioning itself as a direct competitor to major stablecoins such as USD Coin (USDC) and Tether (USDT).

Rumours also suggest that Ripple could use its substantial XRP escrow holdings to back RLUSD. This could increase confidence in the value of the stablecoin, potentially reduce the supply of XRP in circulation and increase the liquidity of the XRP Ledger.

🚨 911 Alert: $XRP

Rumors are swirling thru the cryptosphere that @Ripple might custody its entire $XRP escrow and use it to establish the initial reserve for $RLUSD.

If true, this move would enable @Ripple to mint $RLUSD, sell it to ODL partners, and unlock substantial working…

— Del Crxpto (@DelCrxpto) December 2, 2024

Possible approval of XRP exchange-traded funds (ETFs) in the US can further fuel XRP’s rise. Major asset management firms, including WisdomTree, 21Shares, Canary Capital, and Bitwise, have recently filed applications with the Securities and Exchange Commission (SEC) to launch spot XRP ETFs.

These ETFs would provide a more accessible way for institutional investors to gain direct exposure to XRP, and the SEC’s approval of these ETFs could significantly increase liquidity within the XRP ecosystem and boost XRP price.

According to Jacob Canfield, an independent cryptocurrency trader, XRP’s current price surge is similar to past rallies, but with Bitcoin’s (BTC) price now 5x higher, XRP could potentially reach $6.60, double its previous high.

This prediction is based on Fibonacci extensions and represents an “ideal FOMO target.” However, XRP might face resistance around $2.75-$3.00 before breaking all-time highs or experiencing a pullback.

The only difference between this $XRP move and those in the past is the price of Bitcoin is 5X higher than it was in 2017.

If we use Canfield Fibonacci extensions to give us an idea of where this move may take us, it would be at the 11.09 fib exension.

This would put the price… pic.twitter.com/fNYay1eFLF

— Jacob Canfield (@JacobCanfield) December 2, 2024