Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Robinhood announced its plans to support Bitcoin and Ether futures, alongside traditional commodities like oil and the S&P 500, as part of a larger rollout of derivatives products.

This initiative is designed to attract a broader range of investors, particularly those interested in advanced trading options.

Robinhood Bitcoin and Ether Futures Will Debut on Trading App

In an announcement during its HOOD summit conference on October 16, Robinhood revealed that Bitcoin and Ether futures trading will now be available directly within the Robinhood app.

This new development came after the crypto trading platform’s reported plans to list crypto futures in the U.S. and Europe.

JB Mackenzie, the Vice President and General Manager of Futures and International at Robinhood, highlighted the platform’s unique approach to futures trading.

He emphasized the company’s low fees and user-friendly design, noting that the new features will make trading more straightforward, quick, and efficient.

In addition to competitive fees, users can take advantage of the 60/40 tax rule, allowing 60% of gains to be taxed as long-term capital gains and enjoy nearly 24-hour trading access.

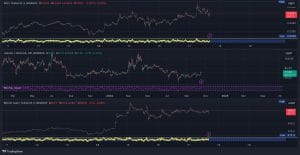

Robinhood also introduced its desktop platform, Legend, which is tailored to active traders.

This customizable, browser-based platform will feature eight charts in a single window, diverse chart settings, and various chart types like candle and line charts at no extra cost.

Users can incorporate technical indicators such as moving averages and Bollinger Bands, as well as utilize drawing tools like trend lines and Fibonacci tools.

Beyond charting capabilities, Robinhood Legend provides in-depth analysis tools, allowing traders to monitor and evaluate their assets, open orders, positions, and options contracts effectively.

Robinhood Legend is now rolling out and will be available to all eligible customers in the coming months, while the Futures and index options will also launch during this period.

With these advancements, Robinhood is not just expanding its offerings; it’s positioning itself as a go-to platform for both new and experienced traders seeking comprehensive tools and resources.

Recall that Robinhood recently launched crypto transfers in Europe to allow users to deposit and withdraw over 20 cryptocurrencies in a move to expand its global crypto services.

Robinhood Will Also Support Index Options

Robinhood is not just stopping at futures; the platform is set to introduce support for index options, responding to requests from experienced traders.

According to the exchange, the Index options come with attractive tax advantages, similar to futures.

Under the 60/40 tax rule, 60% of gains are taxed as long-term capital gains, making them a financially savvy choice.

These options are cash-settled and follow a European-style approach, meaning they carry no early assignment risk.

Traders can engage in transactions right up to expiration, adding flexibility to their strategies.

Additionally, Robinhood is committed to keeping costs low; the contract fee for index options is set at just $0.35 for Gold members and $0.50 for non-Gold members, excluding any regulatory and exchange fees.

This competitive pricing positions Robinhood as a compelling choice for those looking to dive into index options.