Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

In 2024, international sanctions reshaped the landscape of cryptocurrency transactions, as both Russia and Iran increasingly turned to digital assets to bypass financial restrictions.

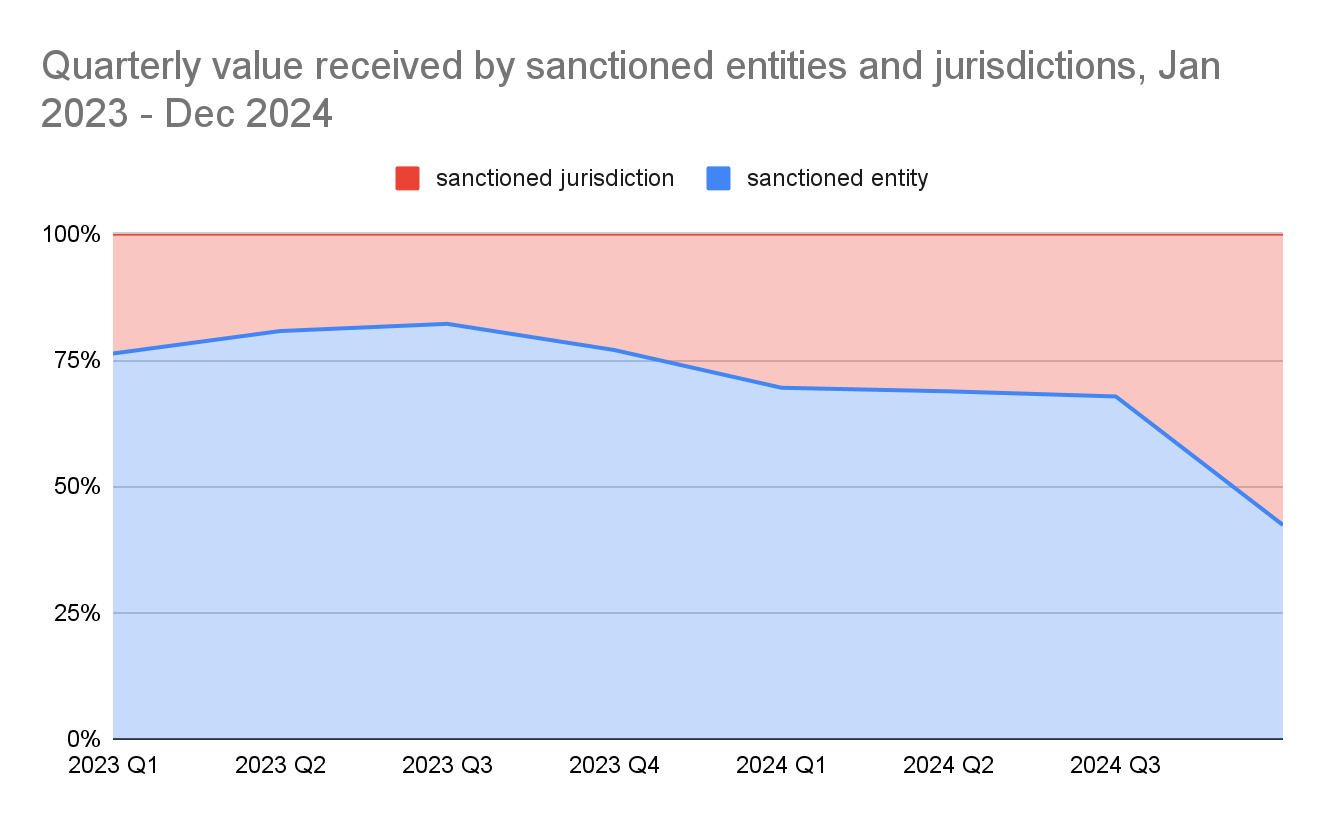

A recent report by Chainalysis, shared with Cryptonews, shows that sanctioned entities received $15.8 billion in cryptocurrency in 2024, accounting for nearly 39% of all illicit crypto transactions.

Sanctioned jurisdictions accounted for a record share of total sanctions-related activity compared to individual entities, commanding nearly 60% of value by the end of 2024.

Sanctions Target Russia’s Financial Networks

While Western enforcement agencies intensified crackdowns, individuals and state-backed networks in Iran and Russia are seeking alternative financial systems to bypass Western restrictions.

In 2024, both countries adapted their financial strategies by using decentralized finance (DeFi) and no-KYC exchanges to sustain financial operations, according to Chainalysis.

Iran and Russia have strengthened financial ties with BRICS countries, with Russia pushing for trade settlements using stablecoins and central bank digital currencies instead of the US dollar.

Russia also legalized cryptocurrency mining and international payments in 2024, marking a significant policy shift to counter financial sanctions.

🇷🇺 Russia’s Bitcoin mining hotspots are consuming more energy than ever, a new study has revealed, with crypto adoption continuing to soar nationwide.#BitcoinMining https://t.co/JK6o5psPr5

— Cryptonews.com (@cryptonews) February 13, 2025

However, several major crackdowns in 2024 disrupted Russian financial networks.

In August, 2024, the US Treasury’s Office of Foreign Assets Control (OFAC) sanctioned KB Vostok OOO, a Russian drone manufacturer supplying military equipment to Russian forces. The company solicited cryptocurrency donations, with one counterparty handling $40 million in transfers through sanctioned exchange Garantex, which processed over $100 million in illicit transactions.

In September, German authorities seized the infrastructure of 47 Russian-language no-KYC exchanges in “Operation Final Exchange.” These platforms facilitated ransomware payments, darknet transactions, and sanctions evasion by offering crypto-fiat conversion services linked to sanctioned Russian banks such as Sberbank.

Later that month, OFAC sanctioned Cryptex, a Russia-based crypto exchange, and its operator Sergey Ivanov, for laundering over $5.88 billion in transactions tied to fraud, ransomware, and darknet markets. FinCEN also designated PM2BTC, a no-KYC exchange that processed over $1 billion, as a primary money laundering concern.

In December, the UK’s National Crime Agency dismantled a multi-billion-dollar Russian-speaking money laundering network in “Operation Destabilise,” arresting 84 individuals and seizing over €20 million in cash and cryptocurrency. The network, spanning 30 countries, was linked to Russian elites, organized crime syndicates, and ransomware groups like Ryuk.

Despite these enforcement actions, Russian-language no-KYC exchanges continue to emerge, often as rebranded versions of previously dismantled platforms, though overall inflows to these exchanges have declined.

Global Exchanges Tighten Restrictions on Iran

Iran, facing severe financial isolation, has also turned to crypto as an economic stabilizer.

However, as per the report, global exchanges are increasingly cutting off access to Iranian services due to compliance pressures. Between 2022 and 2024, exchange interactions with Iranian entities dropped by 23%, with small transactions under $1,000 seeing the sharpest decline at 33%.

The country also saw a dramatic increase in crypto outflows, which totaled $4.18 billion in 2024, up 70% from the previous year, according to Chainalysis data. This shift is driven by economic instability, rising inflation hovering around 40-50%, and the continued devaluation of the Iranian rial, which has lost approximately 90% of its value since 2018.

The Iranian government exerts tight control over financial systems, restricting access to foreign currencies and imposing limits on withdrawals from local crypto exchanges, the report said. In December 2024, authorities abruptly halted withdrawals as the rial reached record lows, prompting an exodus of funds into Bitcoin (BTC) and stablecoins.

Many Iranian citizens view cryptocurrency as a financial lifeline, using it to protect assets and facilitate international transactions in a highly restricted banking environment.