Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Safe, a leading multi-signature wallet and digital assets platform, has unveiled Safenet, its ambitious blockchain transaction processor network. Safenet aims to transform the handling of on-chain and cross-chain transactions.

With a vision to move the world’s GDP on-chain, Safenet draws inspiration from VisaNet, the payment network that powers Visa.

Safenet is scheduled for an initial alpha release in early 2025 and is poised to become a cornerstone of decentralized finance (DeFi) by addressing critical liquidity, scalability, and interoperability inefficiencies.

Safenet Architecture: Will This Enable Cross-Chain Transactions?

Lukas Schor, co-founder of Safe, described Safenet as a groundbreaking solution designed to replicate the speed and efficiency of traditional payment systems within the crypto space.

Like VisaNet, which guarantees instant payments for merchants while settling funds days later, Safenet aims to enable similarly rapid transaction guarantees in the on-chain ecosystem.

Schor explained that this innovation will remove barriers posed by latency and fragmentation, which have historically limited blockchain adoption for global transactions.

At its core, Safenet operates as a decentralized transaction processor network rather than a blockchain.

It functions as a connecting layer for existing networks, enabling users to manage cross-chain transactions and interactions through a single account.

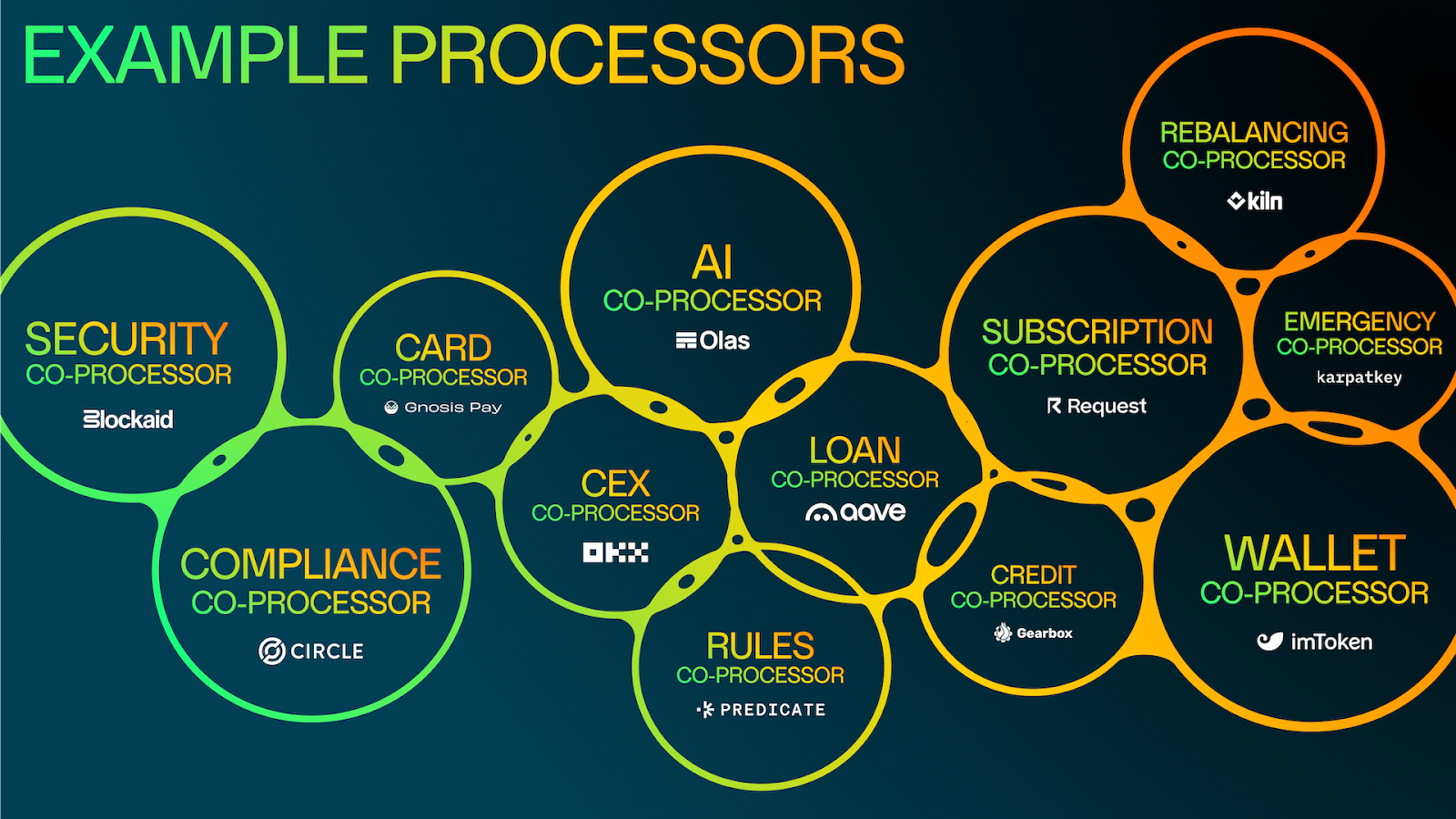

Safenet Processors handle transaction execution by temporarily reserving user assets through smart account resource locks.

These processors can issue execution guarantees and complete transactions using external liquidity sources, such as decentralized exchanges (DEXs) and lending platforms.

In essence, the processors separate transaction execution from settlement, mimicking VisaNet’s ability to guarantee payments instantly while completing settlement processes later.

The Liquidity Network, meanwhile, aggregates liquidity from a range of DeFi services to support seamless cross-chain operations.

By leveraging these liquidity pools, Safenet aims to eliminate the delays typically associated with bridging funds across Layer 1 (L1) and Layer 2 (L2) blockchains.

This architecture not only enhances transaction speeds—offering execution guarantees within 500 milliseconds—but also ensures scalability by unifying user balances across diverse ecosystems, including Ethereum, Solana, and non-EVM-compatible chains.

The network also enforces user-defined policies and advanced security checks to safeguard users against common risks like address poisoning.

Validators within the Safenet ecosystem monitor processor activities and can flag or challenge malicious transactions.

These validators are incentivized through rewards paid in the SAFE token.

Use Cases and Long-Term Vision

According to the announcement, Safenet will unlock many use cases, from simple cross-chain payments to complex financial arrangements.

For example, under-collateralized loans become possible through trusted processors, enabling users to finance purchases like NFTs with a small down payment while securing the remaining amount through the network.

This resembles traditional financial tools such as mortgages, offering crypto users greater flexibility without requiring full collateralization upfront.

Other use cases include off-exchange settlement, where Safenet could allow users to trade on centralized exchanges (CEXs) while maintaining full custody of their assets, subscription-based payments, etc.

Safenet’s introduction is part of Safe’s mission to move the world’s economy on-chain.

The platform already boasts over $100 billion in total value locked (TVL) and over 30 million accounts.

The SAFE token underpins the entire Safenet ecosystem, aligning incentives for processors, validators, and users.

Processors must stake SAFE tokens to participate, with staking requirements scaled to transaction volumes.

Validators ensure security and compliance, staking SAFE tokens and earning a share of transaction fees as rewards.

The Safenet is expected to release alpha in Q1 2025, focusing on basic cross-chain accounts and limited assets.