Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Publicly-listed German asset management firm Samara Asset Group revealed on Monday its intention to expand its Bitcoin portfolio using proceeds from a €30 million ($32.8 million) bond.

The firm has engaged Pareto Securities as the sole manager to arrange investor meetings for this potential multi-million euro bond to enhance its investment strategy.

Samara Asset Group Plans Bond Structure to Facilitate Bitcoin Investment

According to the announcement, the bond’s proceeds will facilitate “additional limited partnership stakes” and bolster investments in Bitcoin, which the firm identifies as its “primary treasury reserve asset.”

Samara CEO Patrick Lowry emphasized the company’s long-term commitment to holding Bitcoin, stating, “We are excited by the prospect of placing this Bond and look forward to using the proceeds to acquire more Bitcoin and continue to seed the world’s best-emerging managers.”

The bond, set to be issued by Samara Asset Group PLC, will be secured by a newly formed special purpose vehicle (SPV), Samara Asset Holdings Ltd.

This SPV will act as the bond’s guarantor. The bond is expected to be listed on the unregulated Oslo and Frankfurt Stock Exchanges, with a private placement that will have a minimum subscription amount of €100,000.

Lowry explained that the bond proceeds will enhance liquidity and diversify the firm’s investment in emerging technologies, reinforcing its already robust balance sheet.

Founded in 2018 by heavyweight investors, including Bitcoin advocate Mike Novogratz, Samara has a net asset value of €189 million ($20.6 million) as of June.

As of June 2024, the firm reported a net asset value of €18.9 million ($20.6 million).

Its diverse portfolio includes investments in leading companies such as Northern Data, a major player in the cryptocurrency mining space, and Deutsche Digital Assets, which offers a range of digital asset services.

Industry Context and Similar Public Investments in BTC

Samara’s latest investment initiative aligns with a broader trend among institutional investors increasingly embracing Bitcoin as a strategic asset.

For example, MicroStrategy, whose CEO Michael Saylor has been vocal about the benefits of Bitcoin as a long-term investment, currently holds 252,220 BTC.

In addition to Samara and MicroStrategy, Galaxy Digital, co-founded by Novogratz, is actively increasing its Bitcoin holdings.

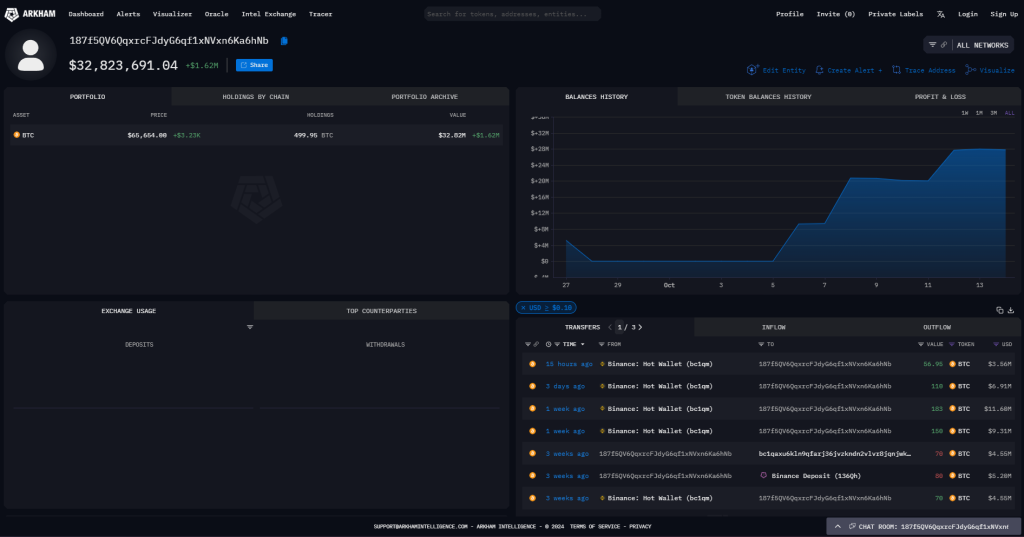

Data from Arkham Intelligence shows that Galaxy recently added nearly 500 BTC to its holdings, currently worth approximately $32.8 million

Similarly, Metaplanet Inc., a publicly listed investment and consulting firm in Japan, announced last week that it had added another 108.78 Bitcoin to its portfolio for ¥1 billion ($6.7 million).

The acquisition raises the firm’s total Bitcoin holdings to 639.5 BTC, valued at ¥5.96 billion (approximately $40 million).