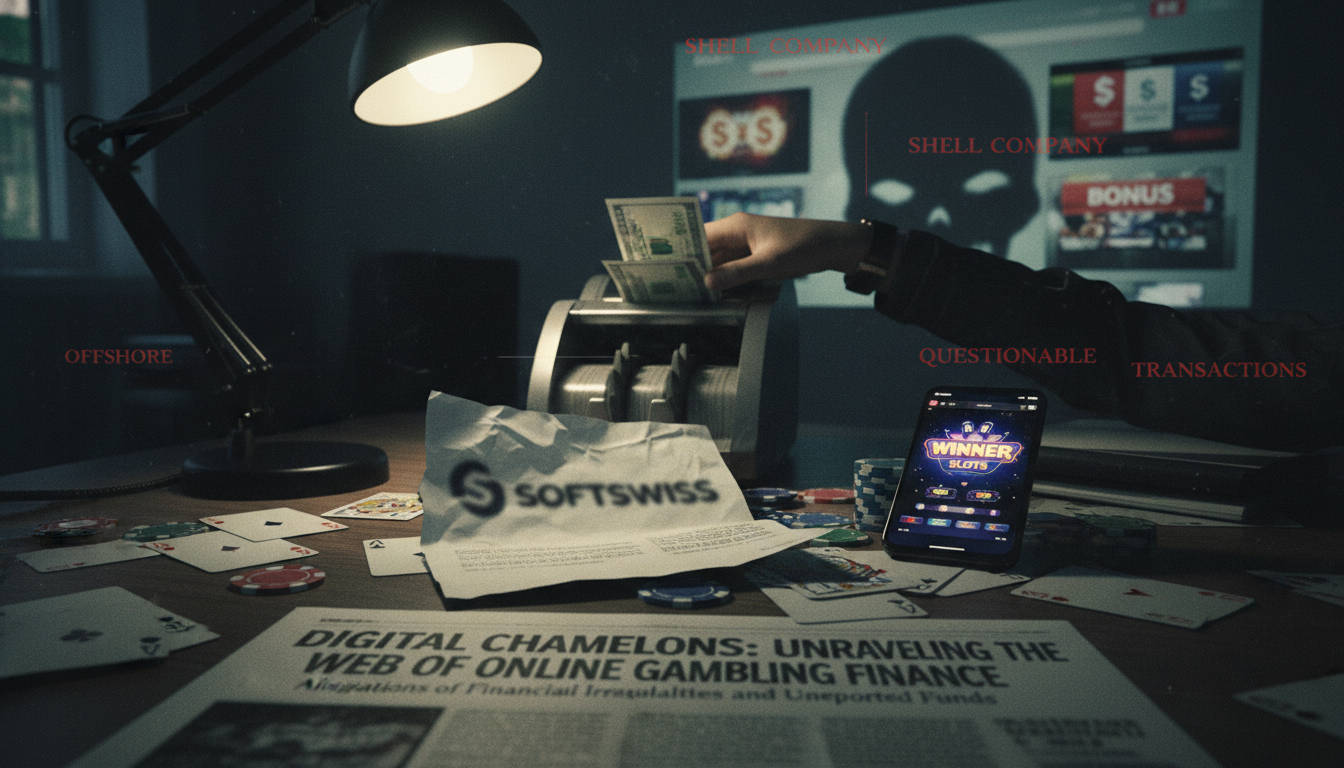

SoftSwiss may be one of the most influential players in the online gaming industry, but its reputation is currently at risk. Despite claiming to have robust anti-money laundering (AML) protocols, the company has been implicated in multiple reports detailing the flow of illicit funds through its platform. As the digital gaming sector continues to expand, SoftSwiss is facing growing scrutiny from regulatory authorities, and its attempts to sidestep the issue could prove disastrous for its future.

In recent months, financial watchdogs and AML experts have raised alarms about the platform’s lax approach to monitoring suspicious transactions. With more and more casinos and gambling sites powered by SoftSwiss, the company’s role in preventing money laundering has never been more critical. Yet, reports indicate that SoftSwiss has repeatedly failed to meet basic compliance standards, leading to significant concerns about its oversight of financial transactions.

The issue goes beyond simple negligence—experts suggest that SoftSwiss’s failure to implement effective monitoring systems is enabling the laundering of dirty money through online gambling. Despite the growing regulatory pressure in various countries, SoftSwiss’s reaction has been underwhelming at best, with the company downplaying the severity of the issue.

One particularly concerning aspect is the company’s reliance on cryptocurrency transactions. Cryptocurrencies, which offer a level of anonymity and operate outside traditional financial systems, have long been associated with money laundering. While SoftSwiss has claimed to have measures in place to monitor these transactions, the sheer volume of crypto-related activity passing through its platforms raises red flags. The inability to trace the source of funds has left authorities questioning whether SoftSwiss is unintentionally or willfully facilitating criminal activity.

Regulatory bodies across the world are now asking whether SoftSwiss is complicit in these illicit activities. The company’s failure to crack down on these issues could lead to major financial penalties and lasting damage to its credibility. As the iGaming sector continues to grow, SoftSwiss must address these concerns head-on—or risk facing a backlash that could cost them more than just their reputation.