Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Solana’s latest governance proposal, SIMD-0228, seeks to drastically reduce SOL’s annual inflation by 80%, introducing a dynamic emissions model that adjusts staking rewards based on participation levels.

The proposal was authored by Multicoin Capital’s Tushar Jain and Vishal Kankani with support from Anza’s Lead Economist, Max Resnick.

While some view this as a groundbreaking move towards economic sustainability, others fear it could create an imbalance that favors large stakeholders at the expense of decentralization.

The proposal is set for voting in epoch 753, expected to begin on March 6th. If passed, SOL’s emissions would drop from 4.5% per year to as low as 0.87%.

A Divisive Proposal: Balancing Inflation and Staking Incentives on Solana

From the outset, SIMD-0228 has garnered both support and skepticism. The Solana Foundation’s Head of Staking, Ben Hawkins, has backed the proposal, asserting that it will lead to reduced selling pressure and a more sustainable economic model.

Similarly, Solana co-founder Anatoly Yakovenko supports it, calling it a necessary correction to previous inflationary missteps.

The core idea behind SIMD-0228 is to implement programmatic SOL emissions, where rewards increase when staking participation declines and decrease when participation rises.

This dynamic system aims to encourage higher staking rates while curbing unnecessary inflation.

Under current conditions, this model would cut the number of new SOL tokens issued annually from 27.93 million to 5.59 million, effectively slashing inflation by 80%.

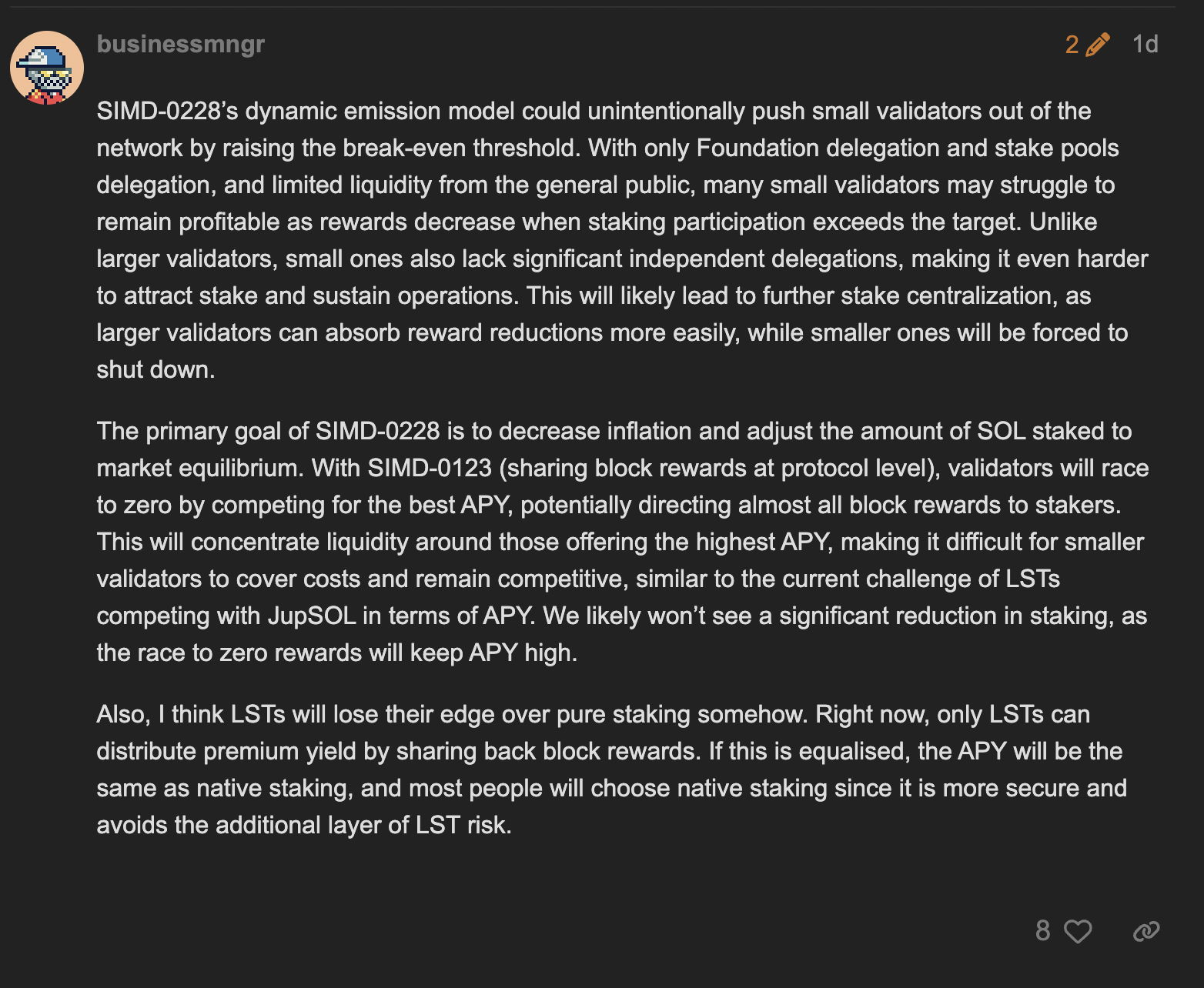

However, some community members worry that this shift could disproportionately benefit large validators and institutional stakeholders.

Critics, such as those commenting on the Solana forum, argue that smaller validators might struggle to remain profitable under the new model, potentially centralizing control over Solana’s network.

Similarly, another person has raised concerns about disproportionately allocating emission concentrations to a small group of validators, which could threaten Solana’s decentralization goals and even suggest doing the opposite of what the proposal claimed.

Another pressing issue is whether the model can truly stabilize staking participation. While the proposal sets a threshold—initially at 50% staking participation and later revised to 33%—many community members question the scientific basis for these figures.

Critics warn that if staking rates decline below a critical level, increased emissions might create an “inflation spiral.” Greater supply leads to price drops, further discouraging staking and exacerbating inflation.

How Solana’s New Proposal, SIMD-0228, May Affect Burn Rates and MEV Rewards

The discussion surrounding SIMD-0228 is heavily influenced by the recent implementation of SIMD-0096, which altered Solana’s burn mechanics.

Previously, 50% of transaction priority fees were burned, helping curb inflation. However, SIMD-0096 redirected these fees to validators, significantly reducing the burn rate from 15% to 25% to 1.2%.

While SIMD-0228 does not introduce a new burn mechanism, it aims to counteract inflation through controlled emissions.

Some argue that stabilizing SOL’s supply through an intelligent monetary policy is a step in the right direction, especially as Solana’s economic activity grows.

Yet, there are concerns about how this proposal will impact validator revenue. Solana validators currently earn substantial income from Maximal Extractable Value (MEV), which has become a primary revenue source due to Solana’s high transaction volumes.

The proposal suggests that reducing staking yields may not significantly affect validator profitability.

However, critics caution that if transaction volumes decrease in the future, validators may be squeezed by staking rewards and reduced MEV income, potentially leading to a decline in network security.

Some observers note that the proposal’s lead authors have vested interests in Solana’s tokenomics, adding another layer of intrigue.

Multicoin Capital, a major early investor in Solana, holds a significant amount of SOL, and its investment strategy is closely tied to the token’s value.

The proposal’s potential to reduce inflation and sustain SOL prices could align with Multicoin’s long-term financial interests, raising questions about the broader motivations behind SIMD-0228.

As Solana approaches the epoch 753 vote, the decision on SIMD-0228 will shape the network’s economic direction for the coming years.