Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

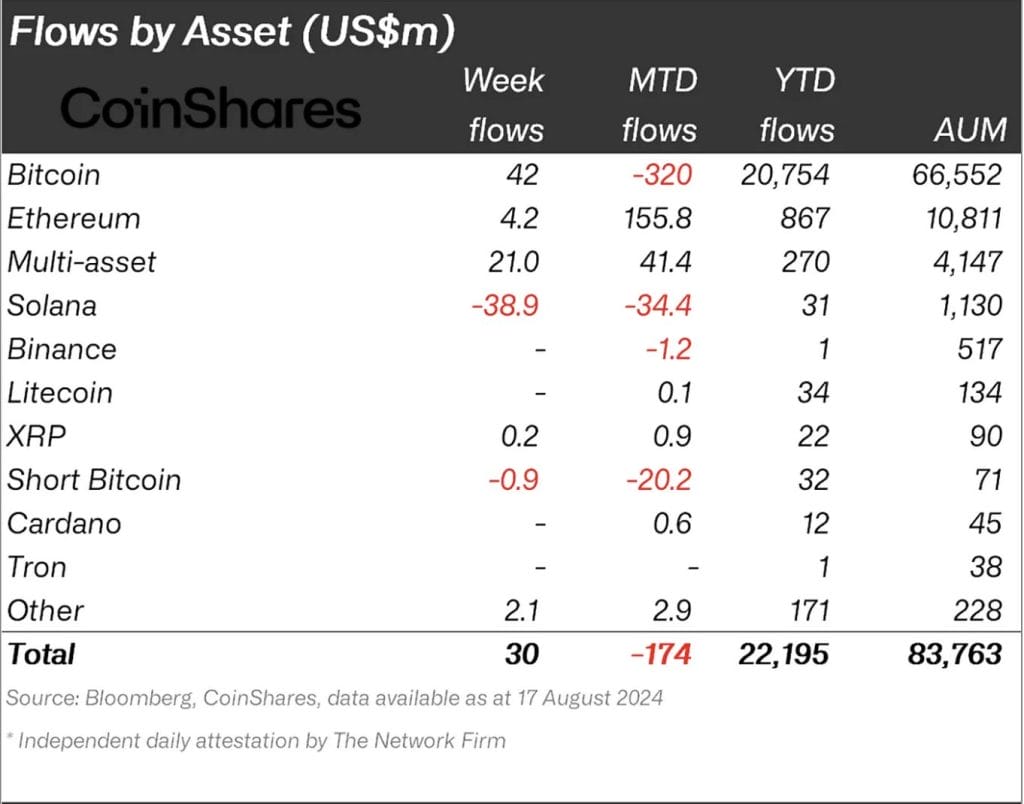

Solana has faced its largest outflow ever seen amid a broader but modest inflow of $30 million into digital asset investment products last week.

While Bitcoin and Ethereum managed to attract a large percentage of these new investments, Solana experienced its largest outflows on record, losing $39 million as it faced significant challenges, particularly a sharp decline in trading volumes.

As seen in the latest Digital Asset Fund Flows Weekly Report from CoinShares, this trend reflects broader macroeconomic influences, including recent data suggesting that the Federal Reserve is less likely to cut interest rates by 50 basis points in September.

This expectation has dampened investor enthusiasm, reducing global trading volumes and mixed inflows across different regions.

Solana Suffers $39 Million Outflow

Last week, the digital asset market recorded modest inflows of $30 million, which, although positive, but clearly uneven across different cryptocurrencies and regions.

Bitcoin emerged as the most favored asset, attracting $42 million in inflows, with continued interest and appeal to investors despite market irregularities.

However, the broader market saw mixed results, with notable outflows in certain regions, such as Switzerland and Hong Kong, where outflows reached $30 million and $14 million, respectively.

Ethereum, the second-largest cryptocurrency, recorded $4.2 million in inflows. However, this seemingly modest figure for Ethereum conceals significant underlying activity.

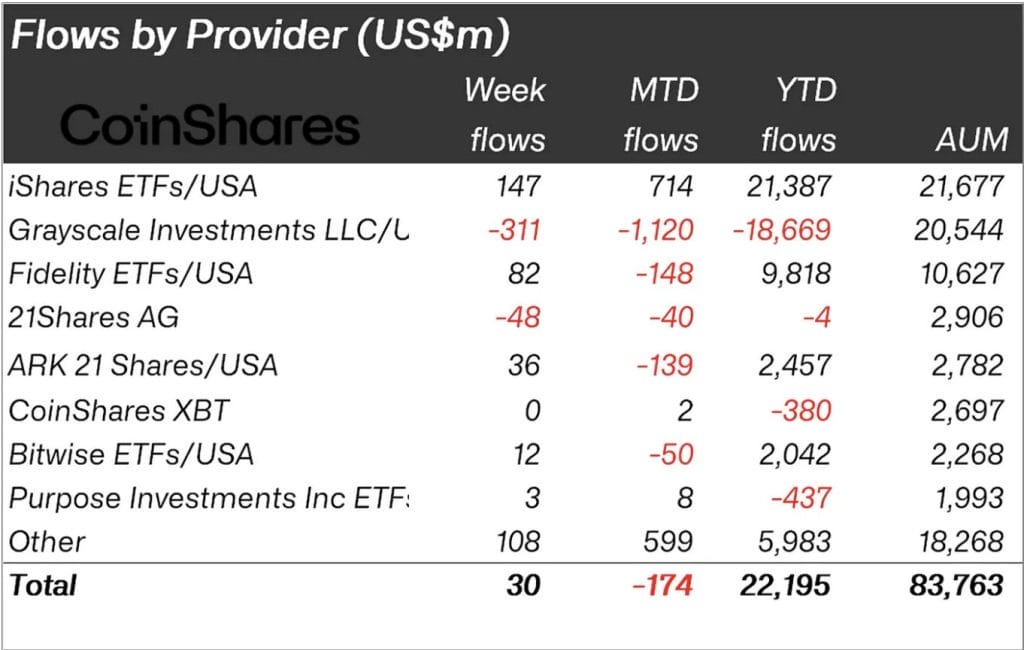

New providers of Ethereum investment products saw substantial inflows of $104 million, indicating a strong growing interest in alternative investment vehicles.

Conversely, Grayscale, one of the most established names in the crypto investment space, witnessed significant outflows totaling $118 million.

These Ethereum results suggest a potential shift in investor preferences towards newer options.

Despite the favorable time for other cryptos, Solana stood out for the wrong reasons, suffering a record outflow of $39 million.

This marks a significant setback for the coin, which had previously been seen as a strong competitor to Ethereum, especially in the decentralized finance (DeFi) space.

The outflows are largely attributed to a steep decline in trading volumes of memecoins, on which Solana has heavily relied for its market activity.

Therefore, as interest in these highly speculative assets waned, so did confidence in Solana, leading to its substantial outflows.

Solana Reacting Negatively to Microeconomics

Solana’s recent troubles can be traced back to its reliance on memecoins, a volatile segment of the cryptocurrency market.

Memecoins, often driven by social media trends and speculative trading, have seen a decline in activity due to the current market situation, which has severely impacted Solana’s trading volumes.

This decline in trading has directly affected Solana’s liquidity and investor confidence, leading to the record outflows observed last week.

This downturn is particularly notable given Solana’s rapid rise over the past year, during which it was hailed as an “Ethereum killer” due to its faster transaction speeds and lower costs.

However, the platform’s dependency on memecoins has exposed its vulnerability to market shifts, particularly those affecting speculative assets.

Notably, the broader market environment has also played a role in Solana’s challenges.

Recent macroeconomic data has suggested that the U.S. Federal Reserve is less likely to cut interest rates by 50 basis points in September.

This has led to reduced trading volumes in digital asset investment products, with weekly volumes falling to nearly 50% of the previous week’s total of $7.6 billion.

While Bitcoin continues to attract significant inflows, the overall market remains highly cautious, with investors carefully navigating the current “bear-lish” market.

As many have suggested, Solana may need to focus on building more robust and sustainable applications, particularly in decentralized finance, to fight times like this.