Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Solana has fallen by 4% today, dropping to $168 as the crypto market loses steam and corrects by 4.5% in the past 24 hours.

SOL is also down by 3% in a week, yet the altcoin retains a healthy 9% increase in a fortnight and 15% gain in a month, while remaining up by 330% in a year.

Its monthly performance finds the token outperforming its biggest rival, Ethereum (ETH), with Solana benefitting from optimism that the pro-crypto Donald Trump will win Tuesday’s election.

Solana will most likely outperform ETH if Trump does indeed win next week’s vote, yet it has strong prospects regardless of who becomes the next President of the USA.

Solana Surges While Ethereum Stalls – Is a Breakout on the Horizon for SOL?

After dropping hard over most of this week, it seems that Solana has now hit a bottom and is ready to recover over the weekend.

Its 30-period moving average (orange) fell below the 200-period average (blue) overnight, entering an oversold position that should end with an intake of new buyers.

At the same time, SOL’s relative strength index (purple) has bounced from an oversold 30, and looks as though it will begin a climb towards 50, if not higher.

Given that the election is now very close, SOL is likelier to move upwards in the buildup to Tuesday.

And it will continue rising if Trump does indeed win the White House, with most cryptocurrency analysts and experts expecting a big push in such a scenario.

This is for various reasons, but mainly there’s an expectation that a Trump administration will result in a friendlier regulatory regime for crypto, with the SEC potentially dropping its opposition to a Solana ETF.

If so, SOL could witness a huge uptick in demand, combining with its strong fundamentals to make it a serious challenger to Ethereum.

Yet Solana is in a better position than most to weather any negative consequences of a Harris victory, given that it’s now the third-biggest layer-one network in the market in terms of total value locked in.

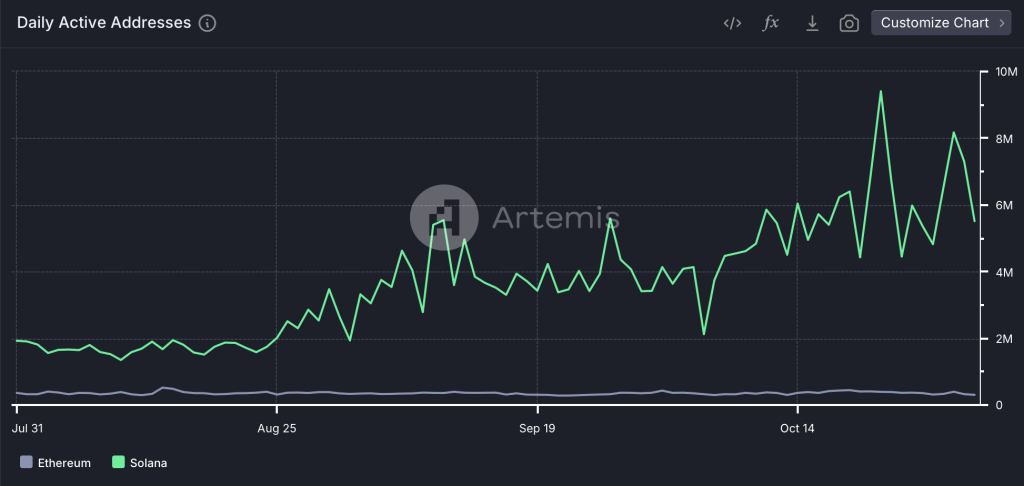

It has been growing more quickly than Ethereum, with its daily active addresses and daily transaction counts eclipsing those of its more valuable (for now) rival.

As such, we can see the Solana price reaching $200 by the end of November if Trump wins, or by the end of the year if he doesn’t.

Diversification with High-Potential Small-Cap Altcoins

Given Solana’s vulnerability to a Harris win, some traders may also opt to diversify into newer tokens, which aren’t as dependent on a crypto-friendly landscape in the US.

This could include presale coins, which in certain cases can rally hard when they list for the first time, particularly if they’ve had successful raises.

And one coin with a very successful raise is layer-two project Pepe Unchained (PEPU), which has now attracted more than $24 million in its soon-to-be-finishing sale.

Pepe Unchained will launch its L2 network for Ethereum once its presale ends, with its platform set to provide near-instant transactions and very low fees.

It’s aiming to become a leading ecosystem for meme tokens, attempting to eat into the market share Solana currently enjoys.

It will offer 100x the transaction speeds currently provided by Ethereum, with its speed also enabling it to provide double the staking rewards it would have offered as a normal layer-one token.

And because users will need PEPU to pay Pepe Unchained transaction fees, the token could experience strong demand once it launches, especially when coupled with staking.

It has a max supply of 8 billion PEPU, with its protocol allocating 30% to staking and 20% to its presale.

Read More: Pepe Unchained Price Prediction

It’s also very bullish that its official X account now boasts 47,000 followers, which is fantastic for such a young project.

Investors can join PEPU’s sale at the coin’s official website, where it’s now selling at $0.01199 per token.

This price will rise again in just under a day, while it could moon after PEPU lists in the next few weeks.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.