Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

The head of South Korea’s stock exchange says the nation should “institutionalize crypto” and “act quickly” or risk losing ground on its international rivals.

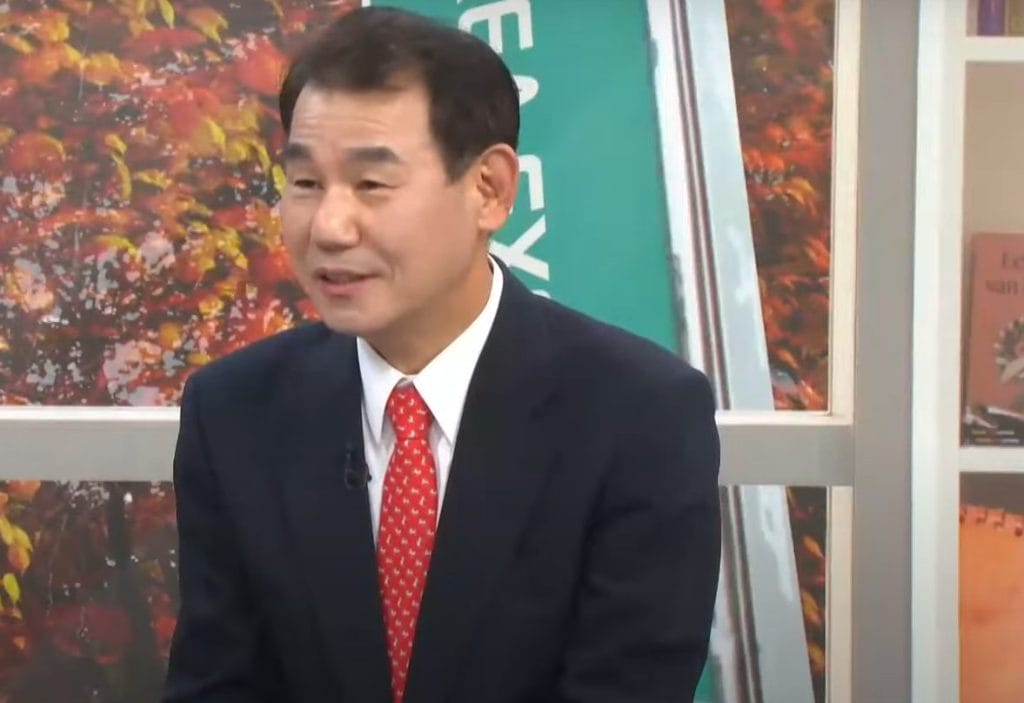

In an interview with the South Korean newspaper Maeil Kyungjae, Jeong Eun-bo, the head of the Korea Exchange, argued that the crypto market needs help to “overcome regulatory obstacles.”

“The cryptoasset market has grown in size and influence to the point where traditional markets cannot ignore it. South Korea should quickly make efforts to include cryptoasset in the financial sector.”

Jeong Eun-bo, Chairman, Korea Exchange

Institutionalize Crypto Now, Urges Exchange Chief

Jeong said attendees at a recent World Exchange Market (WFE) summit “seriously discussed” crypto-related matters.

And he said that exchange chiefs agreed that it “would be difficult” for stock exchanges to “maintain profitability” if they “ignored the virtual currency market.” He explained:

“The average daily trading volume of the domestic stock market is approximately 20 trillion won [around $14 billion]. But the virtual currency market has surpassed this since Donald Trump was elected as US President.”

Unique Market

“We must hurry to institutionalize the virtual currency market to create new added value. If we are vague with our treatment of virtual currency and treat it as a speculative asset […], we will fall behind in terms of international competitiveness.”

Jeong

The popularity of crypto in South Korea has skyrocketed in recent years. However, as experts have pointed out, the nation’s crypto market is uniquely dominated by private investors.

No crypto firms are listed on the Korea Exchange and companies cannot yet buy crypto with their balance sheets. And regulators are yet to approve the launch of Bitcoin spot ETFs.

A few firms with minority holdings in crypto exchanges are listed on the Korea Exchange.

Most of these companies experience price volatility when Bitcoin prices rise quickly or experience sudden drops.

Some domestic financial industry insiders say that allowing leveraged trading for conventional ETFs while maintaining a ban on Bitcoin spot ETF does not make sense from an “investor protection” standpoint.

Jeong is a graduate of Seoul National University. He holds a PhD in Economics from Ohio State University.

He became Korea Exchange chairman in February 2024.