Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

K Bank, the South Korean neobank that partners with the market-leading crypto exchange Upbit, is inching toward a $3.7 billion initial public offering (IPO).

The media outlet Sejung Ilbo reported that the bank’s CEO has “expressed confidence” that “the IPO will be successful.”

South Korea: Upbit Providing Boost for Bank IPO Credentials?

The bank reportedly decided to boost capital by issuing 41 million new shares at a board meeting held earlier this month.

This move, K Bank executives hope, will help it raise some $265 million worth of capital.

Domestic securities industry insiders, the media outlet said, are calling K Bank’s move the “biggest IPO (initial public offering) in the second half of this year.”

However, the bank must first pass a “preliminary screening” process ahead of listing on the Korea Exchange (KRX).

The bank’s user base began to shoot up during the coronavirus pandemic, due largely to its Upbit banking deal.

Under South Korean law, all domestic crypto exchange customers must have real name-verified, social security number-linked bank accounts at a partner bank.

Upbit’s deal meant that its users could open platform-linked bank accounts online, rather than visiting bank branches in person.

This helped Upbit surpass its rivals and become the overwhelming market leader. And it also drew thousands of younger customers to K Bank’s platform.

The bank wants to use this wide user base as a springboard for its IPO bid, which it hopes to complete before the end of 2024.

Biggest South Korean IPO of the Year?

The media outlet pointed out that K Bank has the largest market capitalization and public offering amount among all the companies attempting domestic IPOs this year.

The firm debuted in April 2017, becoming the first neobank in South Korea.

After passing a KEX screening application in 2022, it eventually shelved its plans citing a worsening IPO market.

This year, it posted KRW 85.4 billion ($64 million) in net income in H1 of FY204. That figure is “higher than any other year since its launch,” the media outlet noted.

“Based on our growth potential and profitability, we will successfully complete the IPO and further expand our customer base.”

Choi Woo-hyung, CEO of K Bank

The bank has also posted rapid increases in new users, with 1.14 million customers opening accounts in the second quarter of the financial year.

However, the bank’s IPO bid faces no shortage of obstacles. Some critics have pointed out that K Bank’s performance may be “inflated.”

They claimed that the performance of Upbit, “the number one virtual asset exchange” in South Korea may be a factor “behind” K Bank’s record-breaking performance.

Bitcoin Price Drop a Problem?

Critics also pointed to “rapid increases in short-term housing mortgage loans as another “inflationary” factor.

The outlet also claimed that “concerns about a slump in stock market” prices may yet derail the bid.

And it said that “a decline in the price of cryptocurrencies such as Bitcoin (BTC)” could also present a problem for the bid.

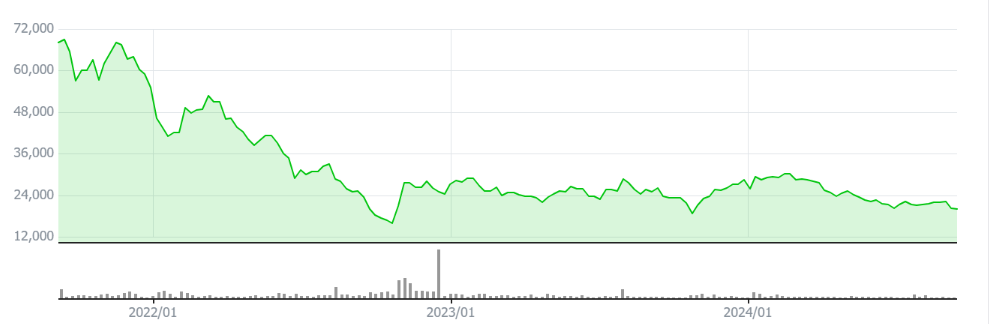

Experts also claim that the case of Kakao Bank, a rival neobank, presents a cautionary tale.

Shares in Kakao Bank ballooned by nearly 80% as the firm made its Korea Exchange market debut in August 2021.

Investor enthusiasm was high as Kakao Bank became South Korea’s first digital bank to go public.

But share prices have since slumped, despite the fact that Kakao Bank has since launched a similar banking service deal with the Upbit rival Coinone.