Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

For the first time, official data has revealed a sharp increase in South Korea’s cryptocurrency investors, crossing 15 million in November. This surge coincides with heightened market activity following U.S. President-elect Donald Trump’s pro-crypto policy announcements.

According to figures submitted by the Bank of Korea to Rep. Lim Gwang-hyun of the Democratic Party, 15.59 million South Koreans held accounts on the nation’s top five cryptocurrency exchanges—Upbit, Bithumb, Coinone, Korbit, and GOPAX—by the end of November. This marks a significant increase of 610,000 new investors from October’s 14.98 million.

30% of South Korea’s Population Engages With Crypto

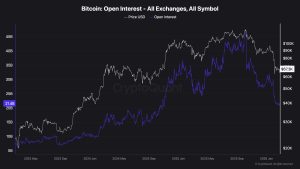

The Bank of Korea’s report, compiled under the Virtual Asset User Protection Act enacted in July, shows that cryptocurrency now engages over 30% of the country’s 51.23 million population. Market activity has surged, with Bitcoin prices rising from 105 million won at the end of October to 135.8 million won by November’s close.

Investor holdings also saw a dramatic increase. Total market valuation reached 102.6 trillion won (70.3B USD), in November, doubling from October’s 58 trillion won (39.7B USD). Meanwhile, the average holdings per person climbed from 3.87 million won (2655 USD) in October to 6.58 million won (4777 USD) in November.

Deposits in crypto exchanges also doubled, rising from 4.7 trillion won (3.2 billion USD) in October to 8.8 trillion won (6.03 billion USD) in November, signaling heightened investor interest.

The average daily trading volume in November hit 10.2 billion USD, rivaling the combined activity of the KOSPI (6.8 billion USD) and KOSDAQ (4.7 billion USD) markets. This is a notable jump from October’s 3.4 trillion won (2.3 billion USD) daily average.

“The rapid growth of virtual asset trading necessitates government-level measures to ensure market stability and safeguard investors,” said Rep. Lim.