Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

U.S.-based spot Bitcoin ETFs have witnessed a sharp reversal in inflows, shedding more than $1.5 billion over a four-day outflow streak.

This marks the longest outflow streak since Donald Trump’s re-election, which provided a much-needed boost for the market.

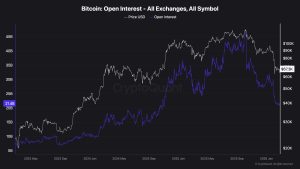

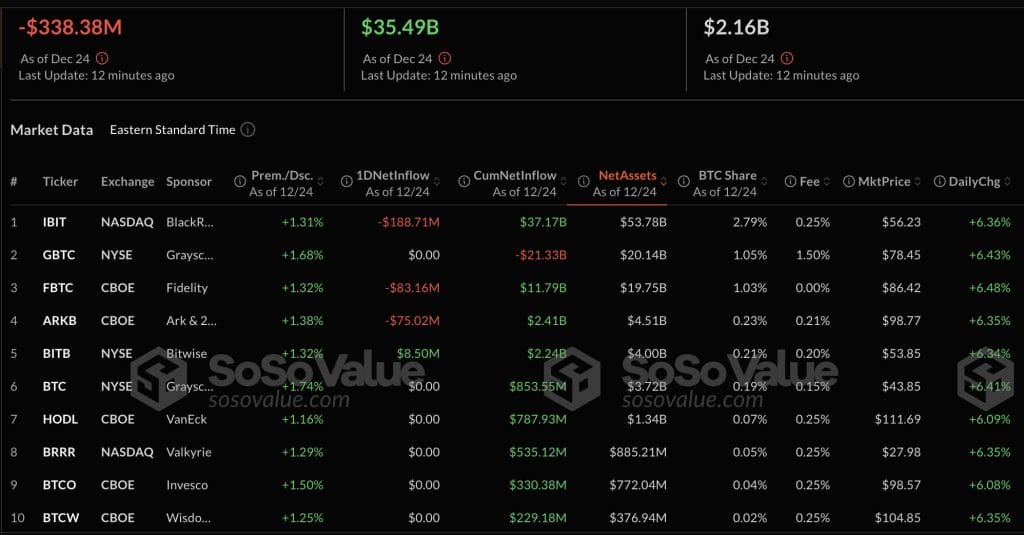

On December 24, spot Bitcoin ETFs recorded a total daily net outflow of $338 million, according to data from SoSoValue.

BlackRock’s IBIT Lead in Terms of Outflows

Among the 12 funds, BlackRock’s IBIT led the day’s losses at -$188 million, followed by Fidelity’s FBTC at -$83.16 million and ARK Invest’s ARKB at -$75.02 million.

Bitwise’s BITB was the sole fund to record a positive daily inflow of $8.50 million, while Grayscale’s GBTC, VanEck’s HODL, Valkyrie’s BRRR, and WisdomTree’s BTCW remained flat with no notable inflows or outflows.

Despite the net outflows, total assets held across all Bitcoin ETFs stood at $107.53 billion, supported by a day of strong price performance, with funds reporting daily gains of up to +6.48%.

The four-day streak has dragged cumulative net inflows down to $35.68 billion as of December 24.

The total net assets held by spot Bitcoin ETFs dropped to $107.53 billion, retreating from their December 16 peak of $121.7 billion.

Over this period, the funds saw their highest-ever single-day outflow of $680 million on December 19.

It is worth noting that spot Ethereum ETFs recorded a net inflow of $130.76 million on December 23, bringing the cumulative total net inflows to $2.46 billion.

Total net assets across Ethereum ETFs reached $12.05 billion, representing 2.94% of Ethereum’s market cap. The total value traded for the day stood at $494.25 million.

Among the notable performances, BlackRock’s ETHA led the market with a daily net inflow of $89.51 million, pushing its total net assets to $3.51 billion.

Fidelity’s FETH also recorded a strong inflow of $46.37 million, raising its total net assets to $1.46 billion.

Conversely, Grayscale’s ETH faced a daily outflow of $6.09 million, though its total net assets remained at $1.61 billion.

The data for spot Ethereum ETF flows on December 24 is not yet available.

Digital Asset Investment Products Saw $308M Inflows Last Week

Digital asset investment products experienced net inflows of $308 million last week, though this figure conceals a significant single-day outflow of $576 million on December 19.

The week ended with a total outflow of $1 billion over its final two days, triggered largely by market reactions to the Federal Reserve’s hawkish dot plot announcement.

These movements led to a $17.7 billion reduction in total assets under management (AuM) for digital asset ETPs, marking a 0.37% decline in AuM, according to a report from CoinShares.

While concerning, this outflow is modest compared to the largest single-day outflow of 2.3% in mid-2022, which followed an FOMC interest rate hike.

Bitcoin saw resilience with net inflows of $375 million for the week, while multi-asset investment products bore the brunt of the losses, shedding $121 million.

Ethereum continued its streak with $51 million in inflows, offset by Solana’s $8.7 million outflows.

Altcoins such as XRP, Horizen, and Polkadot saw smaller but notable inflows.