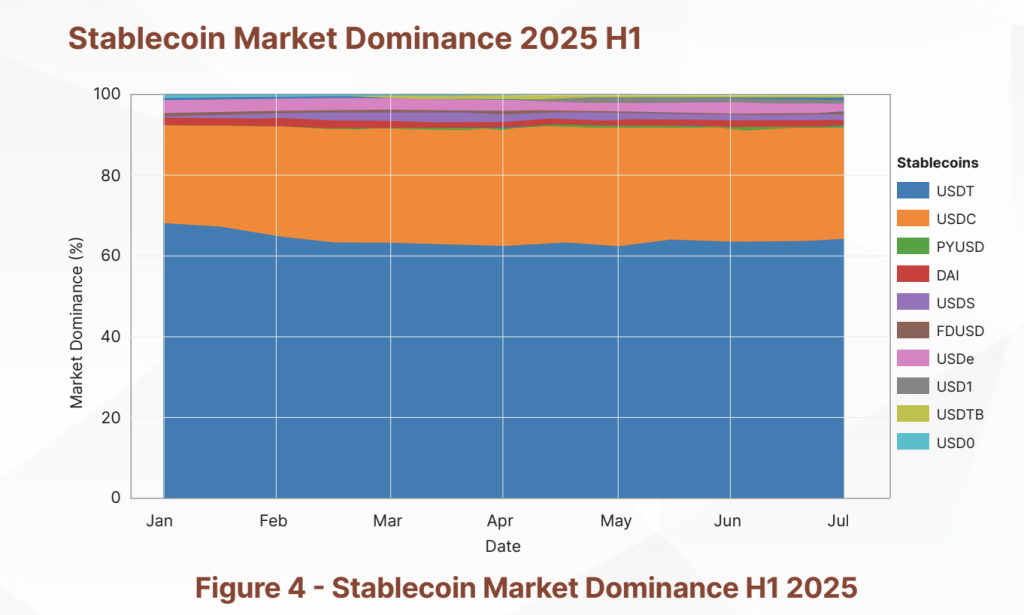

The first half of 2025 marked a new phase for stablecoins, as their total market supply surged from $204 billion to $252 billion, with monthly settlement volumes reaching $1.39 trillion, CertiK reports.

Despite this, CertiK’s 2025 Stablecoin Report urges caution, revealing that this growth has exposed uneven security practices and regulatory preparedness across the sector.

Using its Skynet Stablecoin Framework—a six-factor methodology designed to assess compliance, transparency, and operational risk—CertiK found that while stablecoins have matured in adoption, their resilience remains uneven.

Top-Performing Stablecoins and Security Weak Spots

USDT continues to lead the market in liquidity, particularly on the Tron network, while USDC has narrowed the gap by securing a MiCA license, completing an IPO, and expanding its supply to $61 billion.

PYUSD also made strides, doubling its float through a Solana integration and launching a yield program that pays users 3.7 percent. Other well-rated stablecoins include RLUSD, USDG, and FDUSD, which all earned favorable scores under CertiK’s risk framework.

Still, the growth narrative was clouded by a troubling pattern: security losses in the first half of the year totaled $2.47 billion, with 344 recorded incidents. Rather than contract vulnerabilities, most losses stemmed from poor key management and flawed logic in liquidity pool operations.

A major breach of the Bybit wallet accounted for more than half the total losses, while FDUSD’s brief depeg to $0.76 tested its ability to maintain stability—ultimately recovering thanks to transparent reserves.

Security Incidents in H1 2025

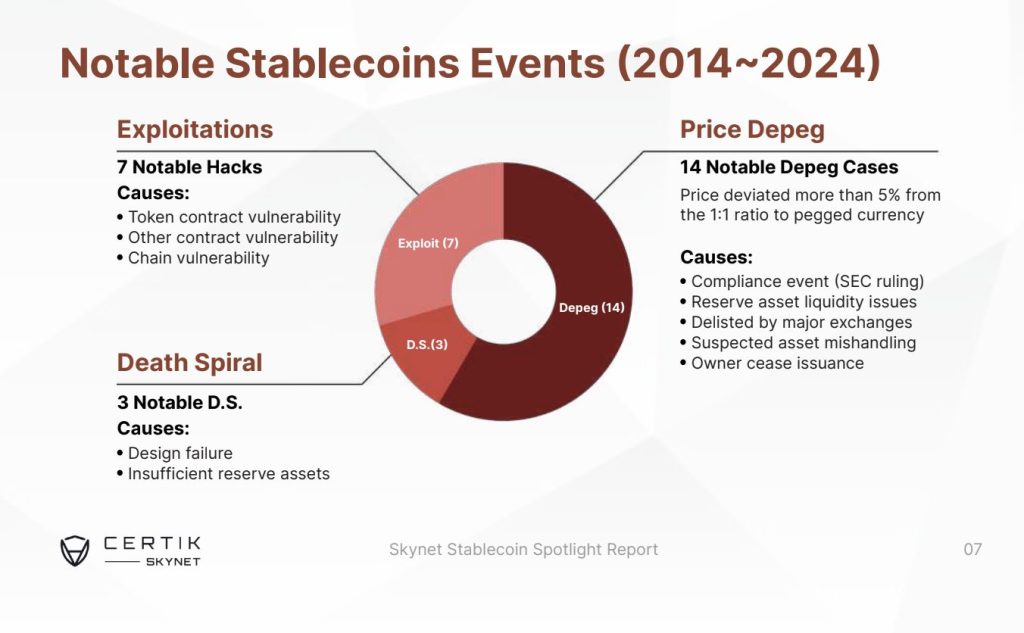

The first half of 2025 revealed serious vulnerabilities across both stablecoin issuers and the broader digital asset ecosystem. One of the most visible shocks occurred in March, when First Digital USD (FDUSD) briefly depegged to $0.76.

The event was triggered by market speculation over the quality of the stablecoin’s reserves, prompting a liquidity run. The issuer’s quick release of audited reserve reports and secondary-market interventions helped the coin recover to above $0.995 within twelve hours.

This episode shows both the fragility of fiat-backed stablecoins in the face of confidence shocks and the importance of real-time transparency and liquidity in restoring trust.

Beyond the stablecoins themselves, centralized exchanges (CEX) and decentralized finance (DeFi) platforms became prime targets for attackers. In February, a major breach at Bybit resulted in a $1.5 billion loss, making it the costliest security event of the reporting period.

Unlike traditional smart contract failures, the Bybit attack stemmed from a compromised private key, revealing the increasing tendency of attackers to exploit the operational infrastructure of centralized platforms. This shift shows the growing exposure of stablecoin holders to third-party risk.

The DeFi space also faced considerable losses, with stablecoins at the center of the damage. The Infini platform exploit led to the disappearance of $49.5 million in stablecoin deposits, while the more complex attack on the Cetus Protocol drained $225 million.

These breaches demonstrate how interconnected vulnerabilities can amplify financial risk, especially when stablecoins are deeply embedded in decentralized applications, reports CertiK.

Regulatory Divide Deepens as Traditional Finance Embraces Stablecoins

The global regulatory environment is now actively reshaping the stablecoin market. In the United States, the passing of the STABLE and GENIUS Acts, combined with the EU’s enforcement of MiCA, is beginning to separate licensed, institution-ready issuers from those unable to meet new compliance standards.

Institutions such as Société Générale, Santander, Visa, and Stripe have all initiated stablecoin pilots, pointing to an increasing merger of blockchain-based assets with traditional finance rails.

The report also notes that real-world asset-backed and yield-bearing stablecoins are set to expand their market share, potentially reaching 10 percent of a projected $300 billion market by year-end.

Still, these newer models introduce heightened risks related to off-chain custody, strategy execution, and composability, requiring a new level of discipline and risk management from issuers.

CertiK’s report concludes that as adoption grows, stablecoin issuers must evolve quickly—or risk falling behind in a newly regulated, high-stakes environment.