Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

State Street, a major U.S. financial services provider, has partnered with Swiss-based crypto firm Taurus to expand its offerings in the digital asset space.

The collaboration aims to meet the growing institutional demand for digital asset services by introducing new capabilities, including the tokenization of real-world assets, which allows these assets to be traded as digital tokens.

State Street, which already provides fund administration and accounting services for crypto investments, will now extend its services to include the custody of crypto assets and the facilitation of tokenized assets, according to a report from Reuters.

State Street to Offer Tokenization Services

State Street’s partnership with Taurus positions the company to assist clients in creating and managing tokenized funds and other securities, further integrating traditional finance with the burgeoning digital asset market.

Tokenization is a process that involves converting ownership rights of traditional assets into digital tokens that are recorded on a blockchain.

This decentralized ledger, maintained by a consensus of its users, offers enhanced transparency and security, making the trading of these assets more efficient and accessible.

“Our clients need the ability to navigate both traditional finance and digital assets side by side,” Donna Milrod, State Street’s Chief Product Officer and Head of Digital Asset Solutions, said.

The launch of this service is expected soon, although specific details were not disclosed.

State Street’s move into digital asset custody also addresses a critical need among institutions for reliable partners to secure their crypto holdings.

Traditionally, institutions have been cautious about using crypto exchanges or wallet providers due to concerns over security.

By offering custody services, State Street aims to provide a more secure and trustworthy alternative for institutions.

Institutional Investors Shown Increased Interest in Digital Assets

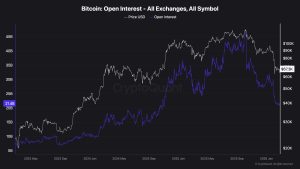

The partnership comes at a time when institutional interest in digital assets is surging.

Many institutions view them as a hedge against inflation and a means to diversify their portfolios.

The launch of several spot bitcoin and ether ETFs this year has attracted significant investments from major financial players, including Goldman Sachs and Morgan Stanley, who collectively invested over $600 million in these products during the second quarter.

Additionally, State Street Global Advisors, a division of the bank, has filed with the Securities and Exchange Commission to register a crypto fund managed by Galaxy Asset Management, which would include exposure to crypto companies and crypto-based ETFs.

Taurus, supported by Credit Suisse (now owned by UBS), has been actively forming similar partnerships, including a notable collaboration with Deutsche Bank for crypto custody and tokenization services.

As reported, a growing number of institutional investors are bolstering their Bitcoin holdings through spot ETFs, according to recent data from Bitwise.

In the second quarter of 2024, approximately 66% of these investors either maintained or increased their Bitcoin ETF positions.

Meanwhile, only 21% of institutional investors reduced their positions, and a smaller 13% decided to exit entirely.