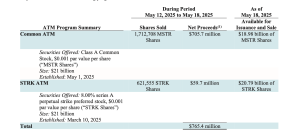

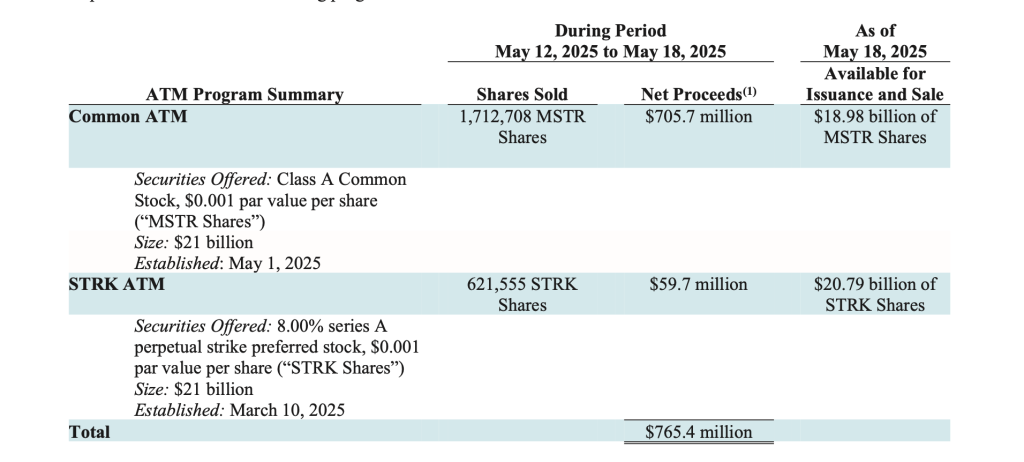

Strategy Inc. (NASDAQ: MSTR) has deepened its already commanding position in the Bitcoin market, acquiring an additional 7,390 BTC for $764.9 million during the week of May 12–18.

The company disclosed that the average purchase price was $103,498 per bitcoin, a major jump from its historical average cost basis.

This latest acquisition comes just a week after Strategy purchased 13,390 BTC for $1.34 billion. The firm remains committed to its Bitcoin-centric treasury strategy.

Strategy Now Holds 576,230 BTC in Total

As of May 18, 2025, Strategy now holds 576,230 BTC, acquired for a total of $40.18 billion at an average price of $69,726 per bitcoin. The company’s Bitcoin holdings have delivered a year-to-date yield of 16.3%, driven by the digital asset’s surge past $104,000.

The move reinforces Strategy’s status as the largest corporate holder of Bitcoin—a position it has cemented through relentless accumulation since pivoting to a Bitcoin-first capital allocation strategy under Executive Chairman Michael Saylor.

Saylor’s Bitcoin Bet Could Make Strategy the Top Public Stock

A recent Financial Times documentary, Michael Saylor’s $40 Billion Bitcoin Bet, explores the bold vision behind Strategy’s approach. In the film, Jeff Walton, an analyst at Strategy, claims the company could eventually become the top publicly traded firm in the world, propelled by its singular focus on Bitcoin.

“Strategy holds more of the best asset and most pristine collateral on the planet than any other company, by multiples,” Walton said. He argues that the firm’s massive exposure to Bitcoin—viewed by many as digital gold—gives it an unmatched strategic edge in a volatile macroeconomic environment.

Bitcoin has rallied steadily in 2025, attracting renewed interest from institutional investors amid ongoing inflation concerns and geopolitical instability. Strategy’s aggressive buying spree suggests high confidence in the long-term value proposition of Bitcoin.

As Bitcoin continues to break new ground, Strategy’s bet may turn into one of the most successful financial plays in corporate history—or one of the riskiest. Either way, Michael Saylor and his team have made it clear: they’re not just in it to win—they’re in it to redefine the game.

Bitcoin Price Action

Bitcoin has surged past the $106,800 mark, gaining an impressive $12,000 in May alone and notching up six consecutive weeks of growth. This upward momentum has revived the market, raising questions about whether the cryptocurrency is now on track to hit a new all-time high.

Despite a brief pullback, BTC is consolidating within a tight range, with strong support at $102,000 and resistance at $106,000—indicating a market gearing up for its next big move.

Arthur Azizov, founder and investor at B2 Ventures, believes this breakout reflects not just bullish enthusiasm but a maturing market underpinned by increasing institutional interest.

“The return of the Coinbase premium is a key sign of renewed U.S. demand,” he notes, adding that if buyers can push through the current range, Bitcoin could break $108,000 and even test $110,000. That level would likely act as a strong psychological resistance, which could be overcome if momentum continues building at this pace.

Technical indicators are aligning with the bullish narrative. Moving averages (EMA and SMA across 10, 20, 30, and 50-day periods) and the MACD (12, 26) support a continued upward trajectory. Azizov emphasizes that macro fundamentals are also favorable: last year’s halving has restricted supply, while ETF inflows are outpacing mining output. With fewer Bitcoin sitting on exchanges, supply pressure remains low.

“The flat now is definitely not the top,” Azizov says. “It’s a pause before a surge—unless something unexpected knocks the market off course.”