Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Bitcoin has dropped by 1.5% in the past 24 hours, slipping to $95,287 as the cryptocurrency market loses 2.5% today.

BTC is now down by 3% in a week, with the market having spent the previous seven days struggling to clear new highs.

The original cryptocurrency holds on to a 37% increase in a month and a 146% gain in a year, with its move to $100,000 seemingly only a matter of time.

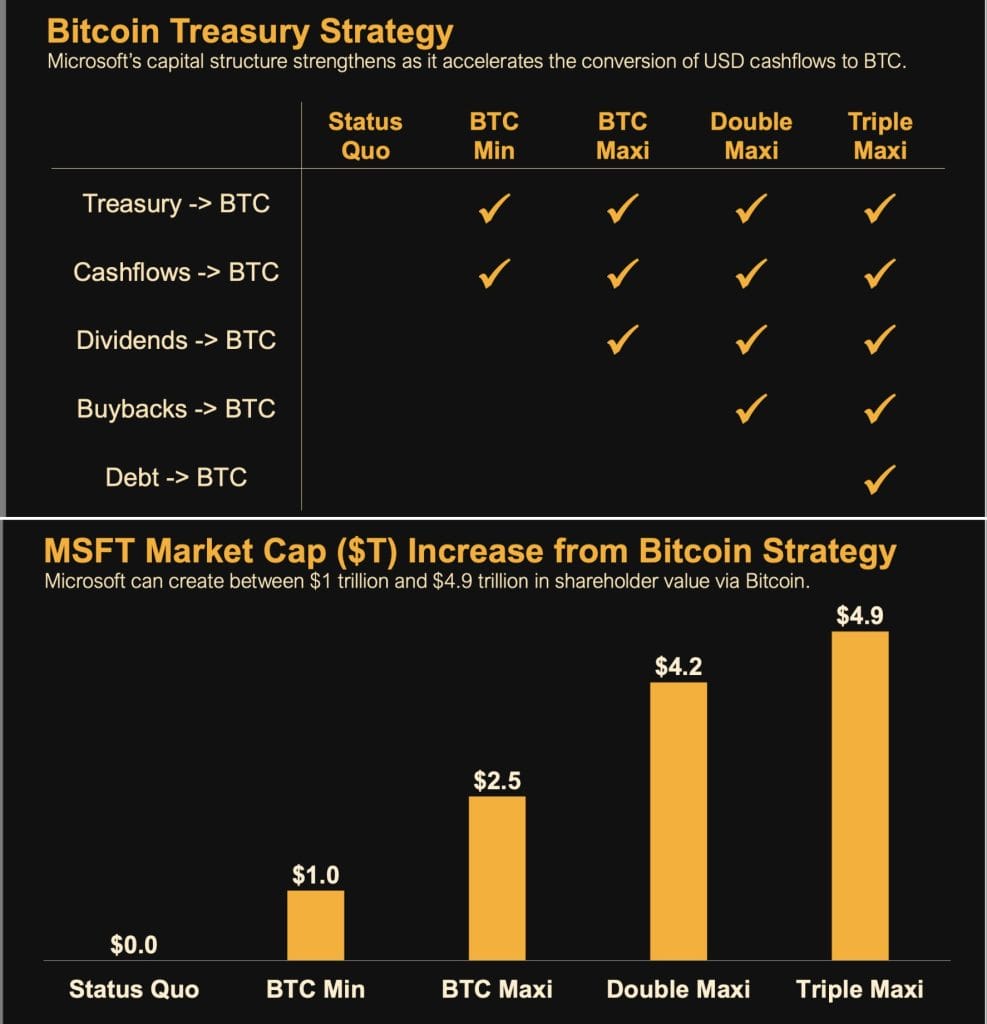

Yet it could rise even higher than this target, with Michael Saylor’s recent pitch to Microsoft raising the possibility of a scenario where the tech giant adds as much as $4.9 trillion to its market cap by investing heavily in Bitcoin.

Strong Buy Signals Emerge as Saylor Predicts Microsoft Could Add $4.9T with Bitcoin – Will BTC Hit $150K?

Attending a recent meeting of Microsoft’s shareholders, the CEO of MicroStrategy shared a three-minute presentation on why the multinational tech firm should add Bitcoin to its balance sheet.

The foundation of Saylor’s argument revolved around the claim that Bitcoin represents the next wave of major technological progress, providing far superior “capital preservation” than previous stores of value.

Saylor also forecasts that BTC’s market cap will rise from $2 trillion to $200 trillion in the next 21 years, based on previous performance.

He therefore urged the company’s shareholders to seriously consider investing in Bitcoin, something which could add $4.9 trillion to Microsoft’s market cap over the next ten years.

While there’s no real indication that Microsoft will end up doing this, the mere fact that the company invited Saylor to present on Bitcoin is significant.

Combined with the arrival of a more crypto-friendly US government, it raises the possibility that Microsoft or other major corporations will begin buying up Bitcoin.

This is a big part of the reason why BTC has been doing so well since last month’s election, but if we do see a major firm invest in the cryptocurrency, it could explode.

Today, its chart suggests that it’s close to bouncing back up from its dive overnight.

Its RSI (purple) has just recently touched an oversold 30, while its 30-period average (orange) is close to dropping below the 200-period (blue).

Once this happens, BTC will be in a stronger position to make more consistent gains, with the token currently struggling to break through the $100,000 barrier.

Yet it certainly has the medium- and long-term momentum to break through this level sooner or later, with the coin on course to reach new highs by the end of the year.

New Presale Coins Could Lift Off Next Year

Bitcoin is virtually always going to perform well whenever the market performs, yet traders who want to spread their exposure to potential upside should also consider smaller cap alts.

Such alts can enjoy outsized growth, given their low starting base, and this can particularly be the case with presale tokens.

One of the most exciting presales coins available today is Crypto All-Stars (STARS), a new Ethereum-based coin that has raised a very impressive $7.6 million in its sale.

Crypto All-Stars is the first token in crypto to provide a ‘MemeVault’, enabling holders of any meme token can stake their funds.

By harnessing the ERC-1155 multi-token standard, Crypto All-Stars’ contract is able to tokenize any cryptocurrency, including coins not running on the Ethereum blockchain.

This could result in massive adoption and usage for the token, especially when users who stake meme coins with its protocol will receive greater rewards if they hold more STARS tokens.

Investors should act quickly, since the STARS presale ends in only 18 days.

They can join the offering by going to the official Crypto All-Stars website, where the coin costs $0.0016582.

This is its final presale price, but given the coin’s early popularity it certainly won’t be the highest price it ever reaches.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.