Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

OX.FUN, a crypto derivatives exchange backed by Three Arrows Capital co-founder Su Zhu, is facing allegations and counterclaims over its financial stability and handling of user funds.

The controversy erupted after JefeDAO, an NFT artist collective, accused the platform of withholding a $1 million USDC deposit and engaging in extortion.

The dispute has drawn intense scrutiny from the crypto community, with concerns mounting over OX.FUN’s asset holdings and governance practices.

The Insolvency Allegations and OX.FUN’s Response

The controversy was ignited when a Twitter user claimed that several former employees of OX.FUN had reported the exchange was insolvent.

The tweet alleged that after a mass withdrawal of funds, OX.FUN’s liquidity had dwindled to approximately $180,000 as of 23:00 UTC, forcing the platform into “triage mode.”

OX.FUN swiftly responded, refuting the claims and insisting that “all withdrawals are processing normally.”

The platform accused JefeDAO of launching a social media smear campaign after its funds were frozen due to an alleged attempt to exploit OX.FUN’s trading infrastructure.

The exchange stated that no user funds were affected apart from those linked to JefeDAO, which were frozen following an Oracle manipulation attack.

In an official statement, OX.FUN elaborated on the attack, claiming that JefeDAO executed aggressive trades on the JAILSTOOL token by placing large limit orders below market price to drive it down artificially.

The platform asserted that JefeDAO’s actions directly violated its terms of service, leading to the freezing of its assets.

Furthermore, OX.FUN revealed that JefeDAO had been offered a resolution, but the collective rejected it, opting to escalate the issue on social media instead.

JefeDAO’s Accusations and Community Reactions

JefeDAO, on the other hand, has strongly denied any wrongdoing and framed OX.FUN’s actions as fraudulent.

The artist collective claimed that after depositing $1 million USDC into the exchange, their attempts to withdraw the funds were blocked without clear justification.

They alleged that OX.FUN refused to specify how they had violated the terms of service and instead cut off communication by blocking JefeDAO members on multiple platforms, including Telegram and X (formerly Twitter).

JefeDAO further accused OX.FUN’s founder, Nicolas Bayle, of attempting to negotiate a return of funds in exchange for five months of free promotional activity.

They labeled this demand as extortion and vowed to continue exposing the exchange’s alleged misconduct until the funds were fully returned.

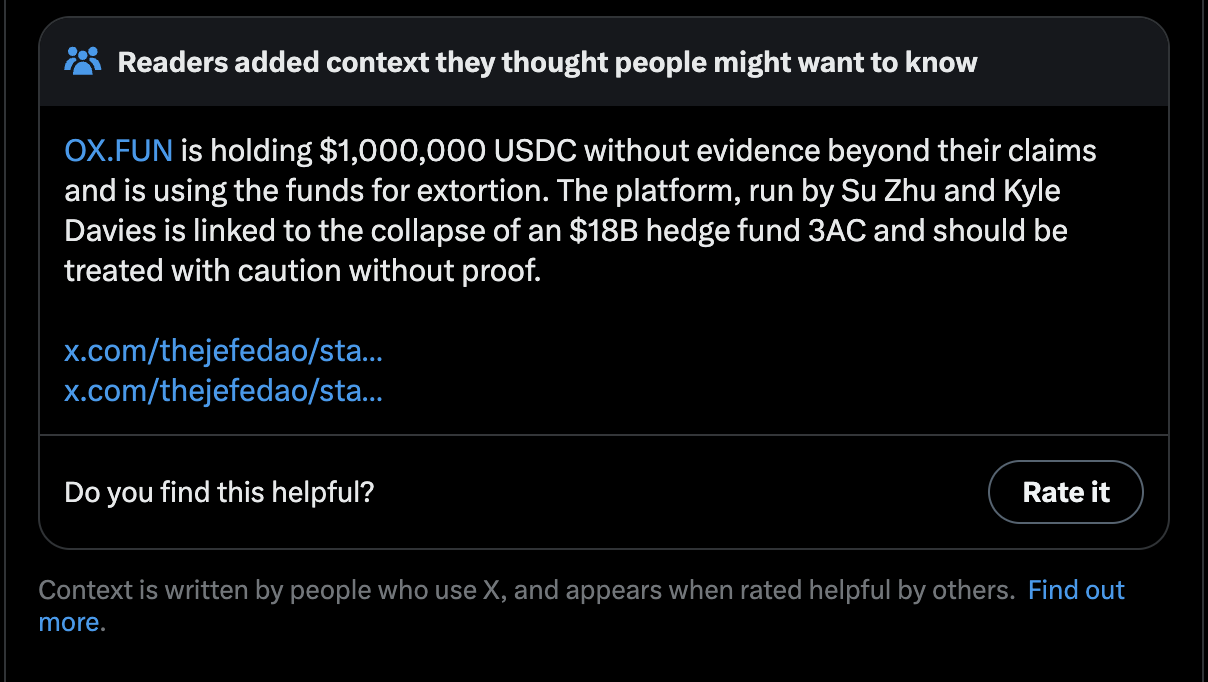

A community note attached to the original insolvency claim post on X bolstered JefeDAO’s argument, warning that OX.FUN’s leadership—including Su Zhu and Kyle Davies—was linked to the collapse of the $18 billion hedge fund Three Arrows Capital and urging users to exercise caution.

OX.Fun’s Asset Holdings and Broader Concerns

As the dispute escalated, questions about OX.FUN’s financial health became a focal point.

Coinbase’s head of product, Conor Grogan, raised concerns that OX.FUN’s wallets primarily hold its native OX tokens rather than stable assets.

He noted that if the platform were to process JefeDAO’s $1 million withdrawal, its USDC reserves would reportedly drop to just $1,000 — a potentially alarming sign of liquidity issues.

These revelations have led to mounting skepticism regarding OX.FUN’s solvency and operational integrity have been questioned, and the community is being urged to remove their funds from the exchange.

Looking forward, it remains to be seen whether the exchange can convincingly dispel doubts about its solvency in the future, but the allegations have already undermined its credibility.