Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

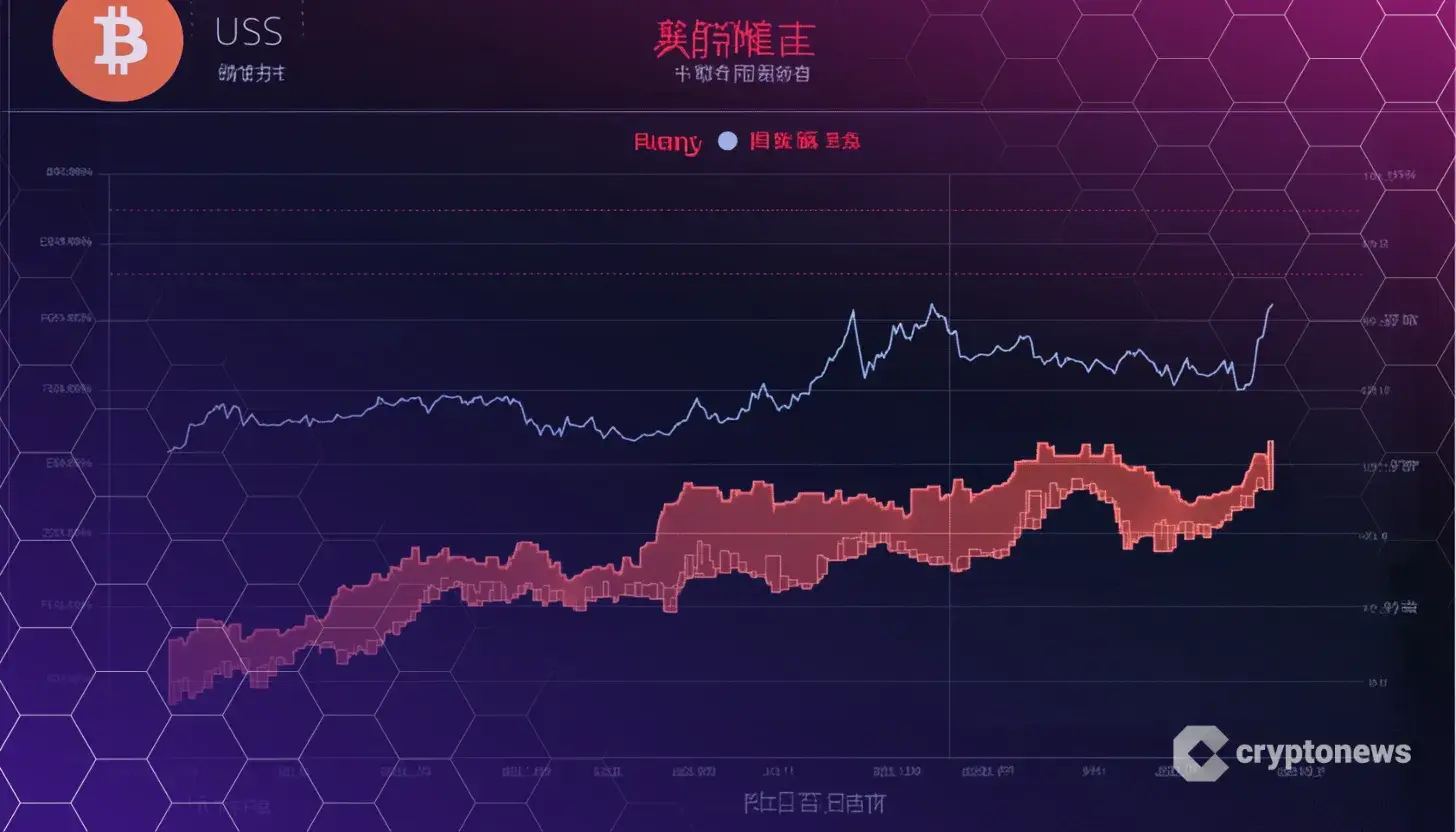

The Asia-Pacific (APAC) region has taken the lead in retail Bitcoin trading, surpassing the U.S. and Europe, according to research published by Gemini and Glassnode in February 2024.

Excluding exchange-traded funds (ETFs) and exchange flows, APAC has shown faster growth in retail activity than Western regions.

APAC Leads Growth in Retail Bitcoin Market

Glassnode researchers examined transaction timestamps and linked Bitcoin trades to regional working hours.

The study revealed that “retail activity in the APAC region has grown at a faster rate than other geographies.”

Since Bitcoin hit its cycle low in December 2022, APAC has recorded a year-over-year supply growth of 6.4%.

In contrast, the U.S. experienced a 5.7% drop, while Europe declined by 0.7% during the same period.

Multiple factors drive APAC’s leadership in retail Bitcoin trading. The region’s expanding digital economy and growing awareness of cryptocurrencies have encouraged non-institutional investors to engage in the market. Supportive technology advancements have further strengthened this trend.

Regulatory frameworks in certain APAC countries have adjusted, creating conditions that support Bitcoin adoption.

Indonesia has emerged as a key market, with cryptocurrency transactions exceeding $30 billion in 2024 and an estimated 21 million active traders.

This places Indonesia among the top 20 countries in global crypto adoption.

APAC’s Growing Role in the Global Market

Recent data indicates that APAC accounts for 29% of the total digital currency value received globally.

This surpasses North America’s 19% and Western Europe’s 22%, highlighting the region’s expanding role in digital asset trading.

The U.S. market has increasingly leaned toward institutional participation, particularly after the introduction of spot ETFs.

Analysts believe the launch of these ETFs in January 2024 created new opportunities for both retail and institutional investors.

Glassnode emphasized that this dynamic “reflects an inversion in behavioral activity between the U.S. and APAC, suggesting a shifting dominance in retail activity between the two regions.”

APAC’s Bitcoin trading sector reflects a growing investor base with a stronger grasp of digital assets.

Meanwhile, crypto exchange Gemini is expanding its operations in Europe, with former Kraken executive Mark Jennings leading the region’s unit.

This development follows the implementation of the European Union’s MiCA regulations, which mandate proper licensing for crypto firms.

The exchange, which launched its operations in France, is positioning itself to enter Europe’s expanding digital currency market.

As market dynamics evolve, APAC’s role in the global Bitcoin sector is expected to expand.