Tag: HMRC

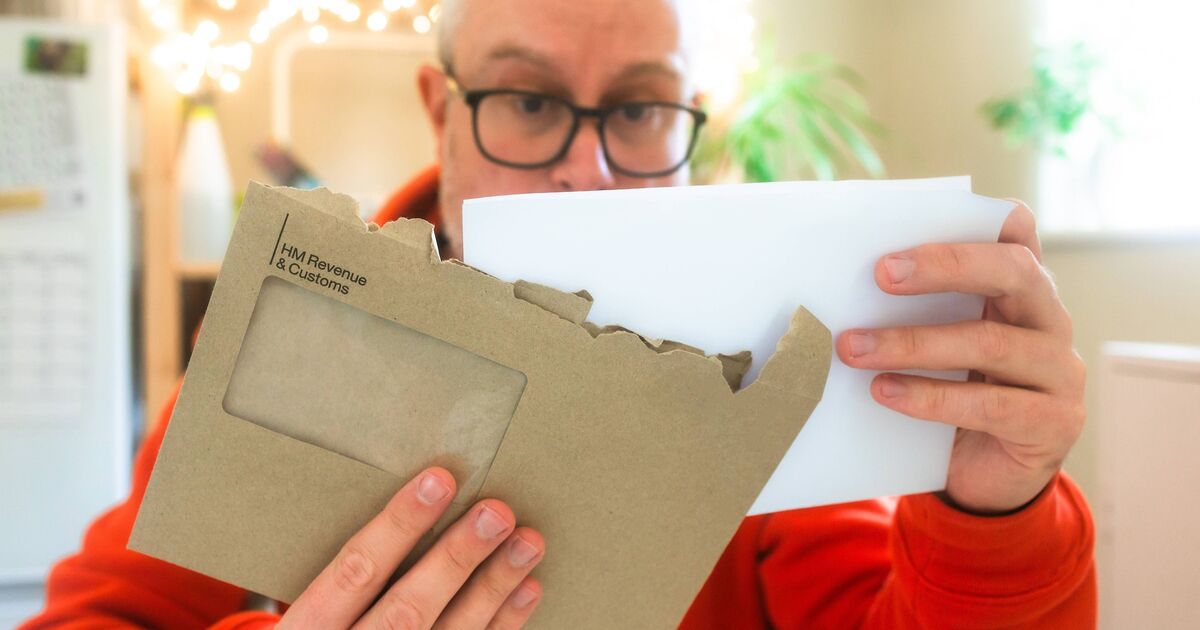

HMRC issues update and says ‘sorry’ with 5.65million facing £100 fines

HMRC has apologised after its helplines were down for part of Thursday, with the self-assessment deadline looming at the end of this month …

People of pension age could be due extra cash support from DWP

You may not realise that you no longer need to keep paying National Insurance even if you keep working. …

HMRC reminds all taxpayers ‘it’s your responsibility to check this’

You could be charged the wrong amount of tax if your details are incorrect …

HMRC admits huge errors as thousands wrongly had benefit payments stopped

HMRC has completed a review of around 24,000 cases after a row broke out over errors made in an attempt to crack down on fraud. …

Personal tax threshold £12.570 update as ‘1.3m extra’ get HMRC letters

Tax freeze has seen dramatic increase in numbers of people paying more including pensioners and savers, say experts …

Tax-free Personal Allowance increased to £16,320 for HMRC self-assessment households

HMRC will give you a £16,320 allowance tax-free legally if you submit a self-assessment tax return this January, shared with a partner. …

Brits earning £50,000 urged to make ‘overlooked’ pension move – ‘need to claim it’

Hundreds of thousands of higher and additional rate taxpayers miss out every year. …

DWP and HMRC benefits and handouts frozen with no increase in 2026

Some benefits and allowances won’t be going up this year with rates to remain frozen. …

HMRC issues important Winter Fuel Payment update for pensioners

HMRC has issued an important update for pensioners who received the Winter Fuel Payment …

Martin Lewis issues £100 HMRC fine warning with January deadline

The Money Saving Expert has warned that as many as 5.6 million people could be at risk of the fine. …