Tag: Making Tax Digital

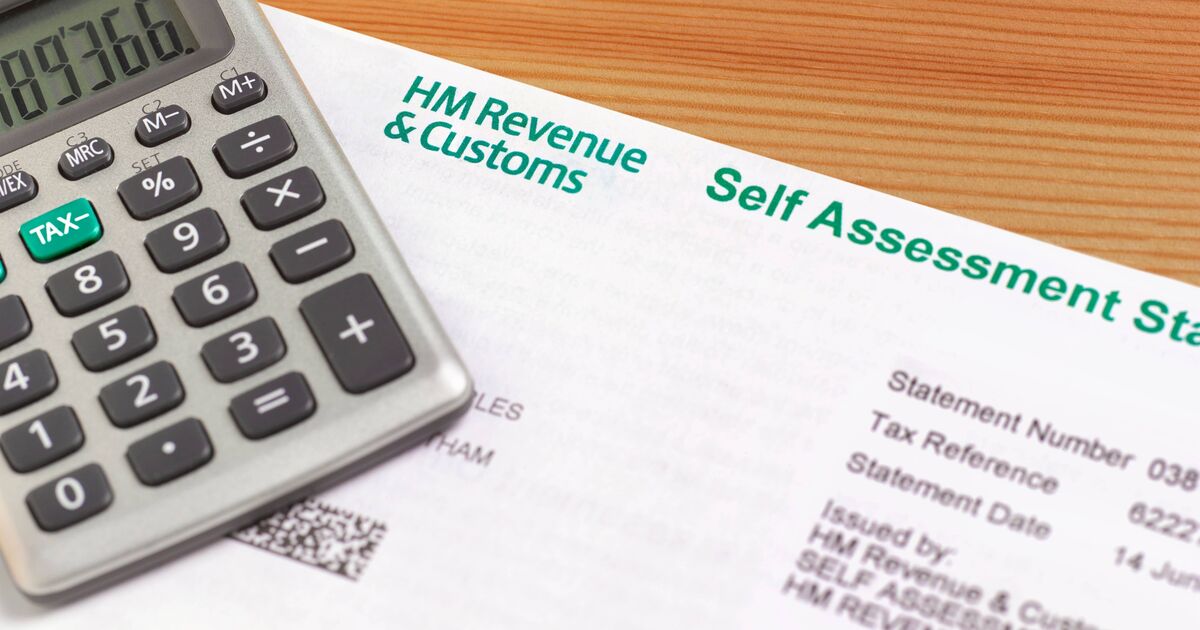

HMRC waives £200 fines for households under new 2026 tax rules

HMRC is rolling out a major tax reporting change this year and will be waiving fines. …

HMRC two-week warning over key date ahead of major tax change

A new tax requirement is gradually being expanded to more people …

Brits earning over £50,000 issued 4-month tax change warning

The latest phase of the Government’s scheme is set to go live in April. …

HMRC warning to workers as major tax change set for 2026

Qualifying workers will have to provide updates to HMRC as part of the change. …

HMRC issues Income Tax warning to people earning over £20,000

Those earning over £20,000 from certain income sources will have to make a change by the deadline, HMRC says. …

HMRC alert as £300 bill coming for sole traders and landlords

New tax reporting rules will come into effect in April 2026. …

HMRC issues 12 month tax warning set to impact 700,000 ordinary Brits

Four in five accountants view the tax change as the biggest challenge of the year ahead. …

HMRC sending instant £100 fines to taxpayers ‘four times a year’

Taxpayers who miss crucial deadlines will be hit with £100 fines up to four times a year. …

HMRC rule changes for thousands of drivers who earn more than £30,000

Drivers should start preparing now to avoid the risk of penalties. …

New HMRC rule is ‘biggest change to personal tax’ in 30 years

Making Tax Digital for Income Tax is set to affect millions of self-employed individuals and landlords – and experts warn it will be a ‘significant shift’ …