Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Tether Investments SA de CV (“Tether”), the company behind the largest USDT stablecoin, has made an unexpected offer to buy a controlling share of Adecoagro SA, a major agricultural company in South America.

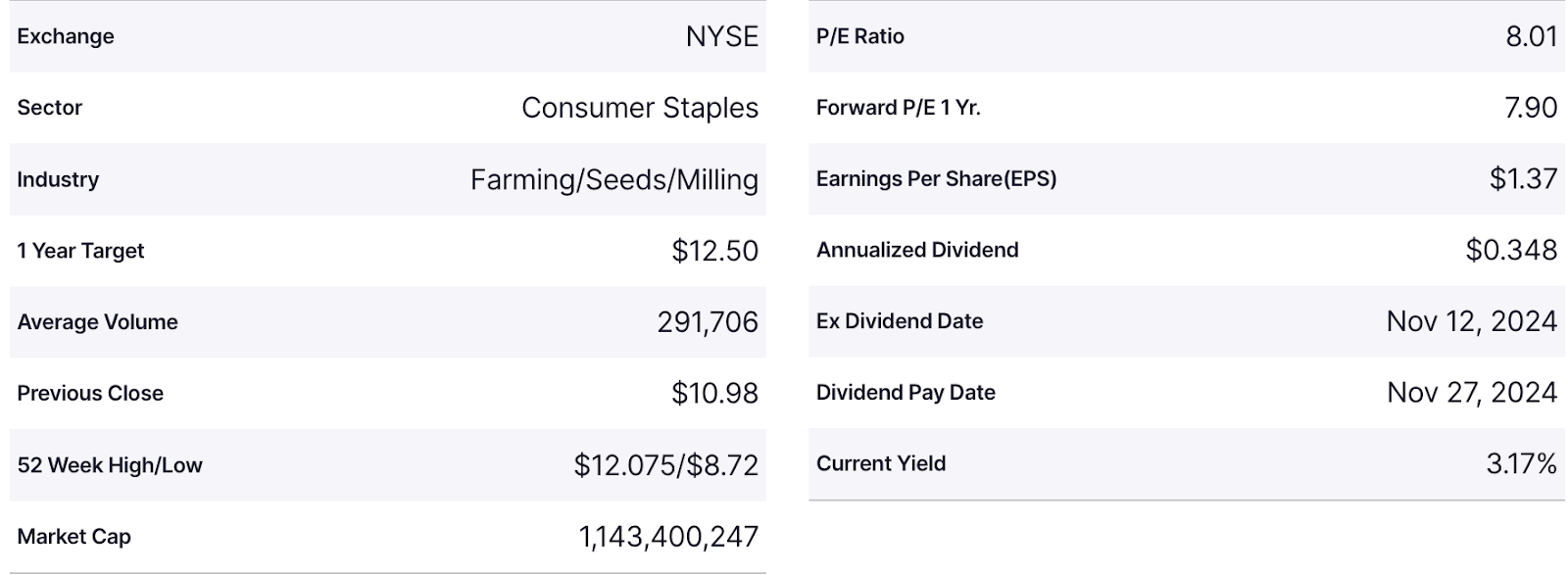

Adecoagro confirmed in a Feb. 18 press release that its board of directors received an offer from Tether to purchase outstanding common shares at $12.41 per share.

If approved, this deal would raise Tether’s ownership from its existing 19.4% stake, as outlined in a public filing dated Nov. 14, 2024, to a majority 51% stake.

Adecoagro’s board met to assess the offer and decided to bring in legal and financial advisors to analyze its potential impact. The company said that shareholders do not need to take any immediate action while the evaluation is underway.

Key Crops and Production Across South America

Adecoagro, recognized as Argentina’s largest producer of milk and rice, is also engaged in sugarcane farming and renewable energy production in Brazil. Additionally, it cultivates key crops like soybeans and corn in Argentina and Uruguay.

Tether has been actively diversifying its portfolio, having initially entered Adecoagro’s ownership structure in September 2024 with a $100 million investment for a 9.8% stake.

Since that investment, Adecoagro’s share price has fallen about 17% to $9.32, but after the news of the new Tether proposal, it has risen almost 18% and is currently at $10.98. Adecoagro’s market capitalization is currently above $1.14 billion, based on Nasdaq data.

If the new deal goes through, it would mark another strategic move by Tether, following its acquisition of a minority stake in Juventus Football Club on Feb. 14.

Tether Investments Announces Strategic Minority Stake in Juventus Football Club @juventusfc 🦓

Read more: https://t.co/4qqeT5zLQy

— Tether (@Tether_to) February 14, 2025

Regulatory Scrutiny Over Tether’s Financial Reserves

The bid also comes amid growing scrutiny of Tether’s financial reserves, particularly in light of JPMorgan analysts’ recent claims that the firm might need to liquidate its Bitcoin (BTC) holdings to comply with possible US stablecoin regulations.

According to JP Morgan analysts led by Nikolaos Panigirtzoglou, only 66% of Tether’s reserves meet compliance standards under the STABLE Act, whereas under the GENIUS Act, the figure rises to 83%.

Tether CEO Paolo Ardoino rejected such concerns, stating that it holds over $20 billion in liquid assets, while Tether’s US Treasury portfolio is now worth approximately $113 billion.

JPM analysts are salty because they don’t own Bitcoin.

— Paolo Ardoino 🤖 (@paoloardoino) February 13, 2025

Tether currently holds about 83,758 Bitcoin, worth over $8 billion at current prices, as part of its reserves.

Tether’s Strategic Expansion Beyond Crypto

Tether underwent a major restructuring in 2024, splitting into four divisions: Tether Finance, which oversees the USDT stablecoin; Tether Data, focused on Bitcoin mining investments; Tether Tech, managing strategic technology investments; and Tether Edu, leading educational projects.

It remains unclear which division is spearheading the Adecoagro acquisition.

Expanding beyond its core crypto business, Tether has also invested in other companies, including the $18.75 million investment in Taiwan-based crypto exchange XREX and the $150 million investment in Nasdaq-listed bitcoin mining company Bitdeer.

Earlier this February, Tether also signed a memorandum of understanding with the government of Guinea to explore blockchain technology and support the country’s digital transformation. The company has also launched similar initiatives in Turkey, Uzbekistan and the United Arab Emirates (UAE) to promote digital literacy and economic empowerment.