Stamp Duty increases are set to hit home buyers with extra taxes from April (or from right now if you’re buying a second home) following an announcement by Chancellor Rachel Reeves.

But the changes to Stamp Duty thresholds due to take effect from the next tax year will see more people paying more tax on the purchase of a property on average – apart from those living in one area of England.

Right now, Stamp Duty begins to be paid on any property worth £250,000 or more.

From April 2025, those looking to buy a home will start paying the tax on homes worth £125,000 or more as the thresholds are dropped by £125,000.

That also means that those buying more expensive homes will pay more tax, too, because Stamp Duty is charged on each slice of a property’s value – so 0 percent on the first £125,000, then 2 percent on the second £125,000, then 5 percent on the next amount up to £675,000, then 10 percent on the next £575,000, and finally 12 percent on any further amount over £1.5M.

Property experts Regency Living say this means that 99 percent of buyers will face paying more in tax – apart from in one area which falls into that 1 percent.

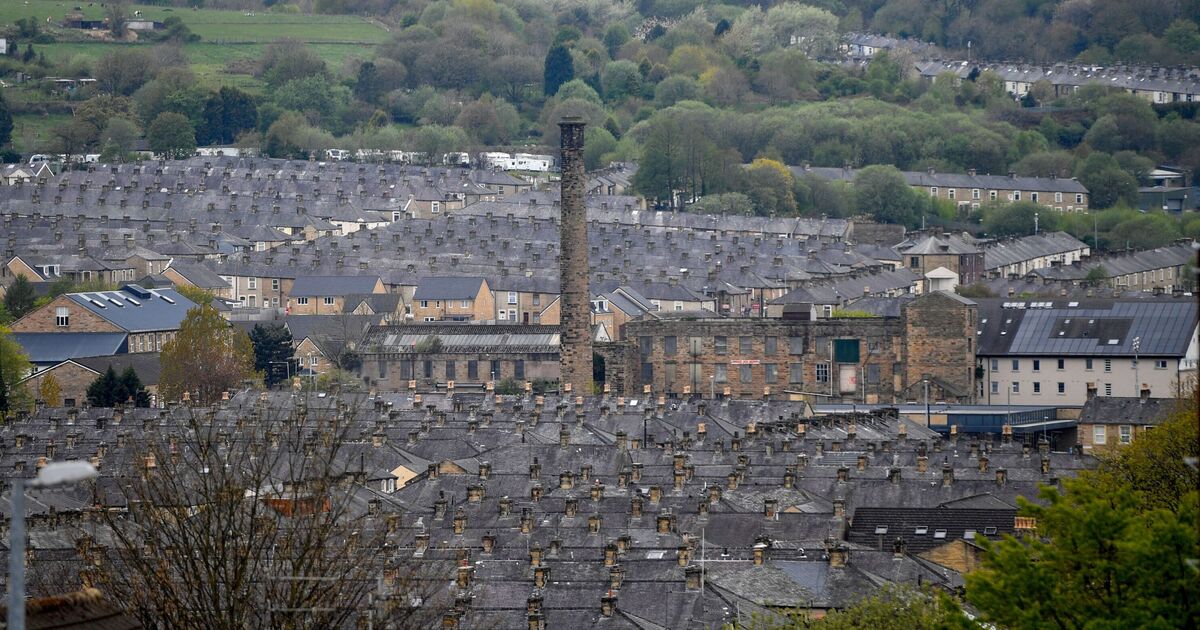

They said that in Burnley, the average house is valued a £112,640, ‘well below’ the £125,000 threshold. It means those buying an average home in the Lancashire town will still not pay any Stamp Duty even after the rates change in April.

The spokesman said: “32% of local authorities in England are home to an average house price of between £125,000 and £250,000, meaning they will see increases ranging from £37 in Hyndburn where the average home costs £126,861, to £2,483 in Torbay, where the average home is currently valued at £249,135.

“In fact, just one area of the market will currently see existing home buyers remain exempt from paying Stamp Duty from April of next year and that’s Burnley, where the average home is currently valued at £112,640 – well below the £125,000 threshold.”

Sales & Marketing Director at Regency Living, Tim Simmons commented: “Homebuyers across the nation will be understandably disappointed to see that no extension to current stamp duty relief thresholds was granted in this week’s Autumn Statement.

“The good news is that, for first-time buyers, purchasing a home at £300,000 or less will still see them pay no stamp duty, however, it’s existing homebuyers who are likely to be hit with the largest increase in costs when it comes to purchasing.

“For many, this increase will be £2,500 and will see the average existing homebuyer across England paying £5,500 in stamp duty. However, this climbs north of £10,000 in 55 local authorities and as high as £58,000 in the most expensive areas of the market.

“Whilst having a foot on the ladder does put them at an advantage to some extent, stamp duty remains a substantial financial barrier that delays homebuyers at all rungs of the ladder.”