Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

According to veteran trader Peter Brandt, Bitcoin needs to avoid a trip below $48,000 to preserve its chances of a six-figure all-time high next year.

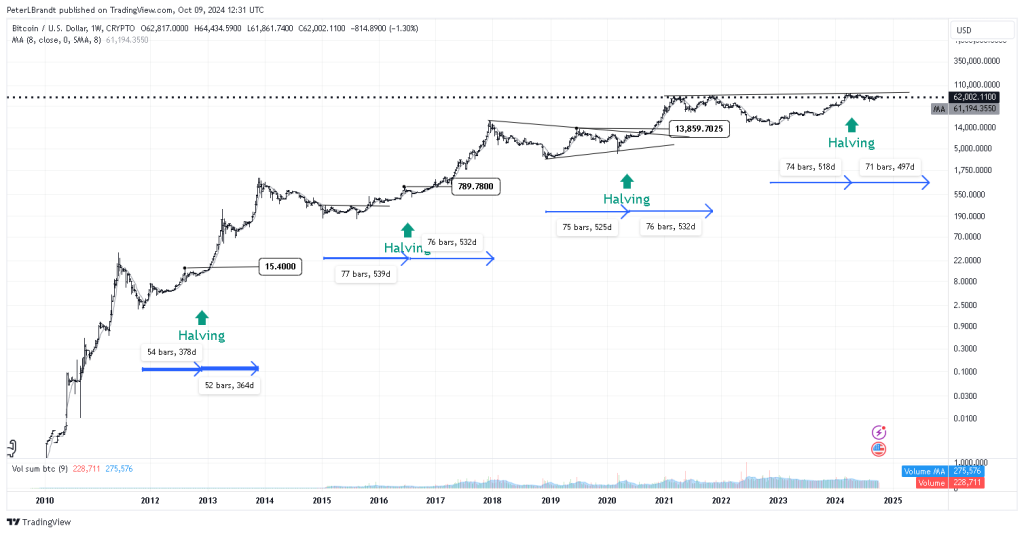

In an October 9 X post, Brandt delivered his expectations for Bitcoin through 2025, citing the market’s consolidation since March as a “brief pause,” with the bulk of the bull market still ahead.

This forecast draws from past halving cycles. Historical data shows that the latter half of Bitcoin’s four-year halving cycles always produces the sharpest price upside. With this macro stance, Brandt sets a Bitcoin price target of $135,000 by August to September 2025.

However, there is a caveat: if the bears gain control soon and Bitcoin experiences a big downside, $48,000 becomes the prediction’s make-or-break level.

“Close below $48K negates my chart analysis,” Brandt confirmed.

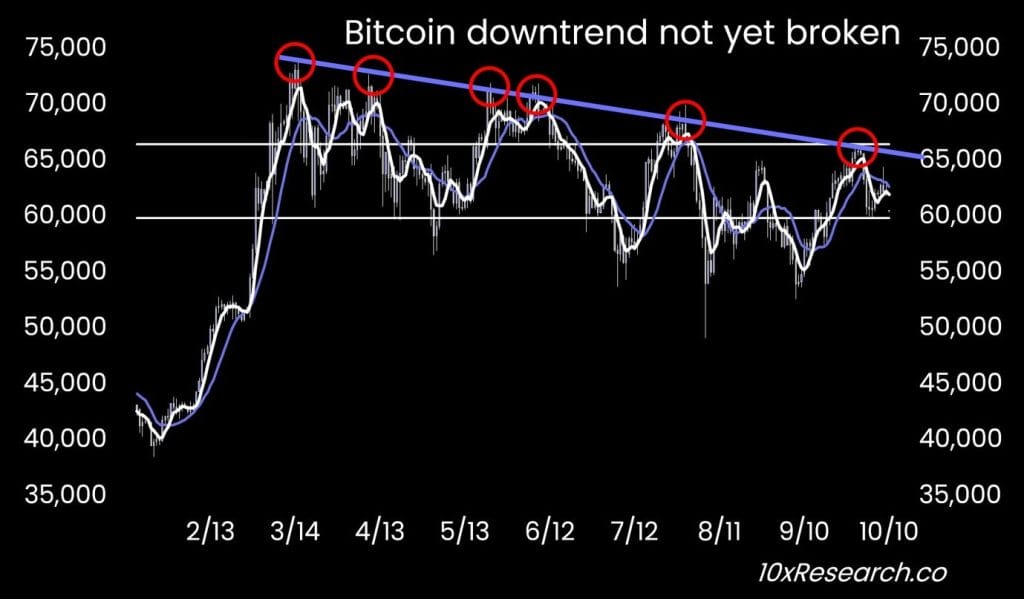

10x Research Cautions Bitcoin Maxis

Although macro trends can be insightful, 10x Research CEO Markus Theilin cautioned in an October 9 report that they are an “overly simplistic and insufficient” basis for predicting market direction.

He noted common expectations among Bitcoin maximalists that Bitcoin’s price “will increase tenfold indefinitely” post-halving and will rally exponentially with the “bottoming out of the liquidity cycle, marked by Fed rate cuts and rising money supply.”

While these factors undeniably provide tailwinds, Theilin emphasizes that strong fundamentals must back these macro factors.

This necessity is evident as Bitcoin continues to affirm its downtrend months after its last halving. Meanwhile, the narrative suggesting a soft landing for the US economy seems increasingly plausible following September’s aggressive Fed rate cut.

The report argues that the current market suffers from a lack of compelling momentum. While “macro factors can set the direction, the ship won’t stay on course without enough wind.”

US Election to Play Pivotal Role

Among the potential catalysts that could provide Bitcoin with the “wind” it needs for a breakthrough, Theilin cited the upcoming November 5th U.S. presidential election to play a “critical role.”

A Trump victory is generally viewed as favorable for cryptocurrencies, particularly given his involvement in Bitcoin 2024 and his announcements regarding a decentralized finance (DeFi) project called World Liberty Financial.

Analysts anticipate that a Trump administration would expedite the development of pro-crypto policies. Past Standard Chartered reports project a less conservative Bitcoin price target of $220K under a Trump presidency.

Conversely, the report highlighted the potential for a Harris presidency to push Bitcoin to new heights, setting a target of $75,000, especially following her recent public endorsement of digital assets.

However, it cautioned that her election might trigger an initial price decline. Investors are expected to buy the dips as the market recognizes that progress on the regulatory front will continue.

In summary, Theilin expressed optimism, stating it is “too early” to abandon hopes for a Q4 rally. However, he emphasized that effective risk management is “crucial.”

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.