Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The Bank for International Settlements (BIS) released a report on October 21 highlighting both the potential and the pitfalls of tokenization in traditional finance.

While tokenization offers benefits like faster and cheaper transactions, BIS warns in its report of potential risks to governance, legal frameworks, and financial stability.

Tokenization Benefits Attract Institutions

According to the BIS, tokenization can be seen as a natural evolution in market structures. Token arrangements, which provide platform-based intermediation for financial transactions, can lead to changes in market structure. This can result in reduced transaction costs, increased efficiency, and broader market access.

The BIS also noted that tokenization offers opportunities for improved safety and efficiency in pre- and post-trade functions. For example, using PvP and DvP settlement can reduce principal risks, while programmability and automation can streamline processes.

New Risks Require Attention

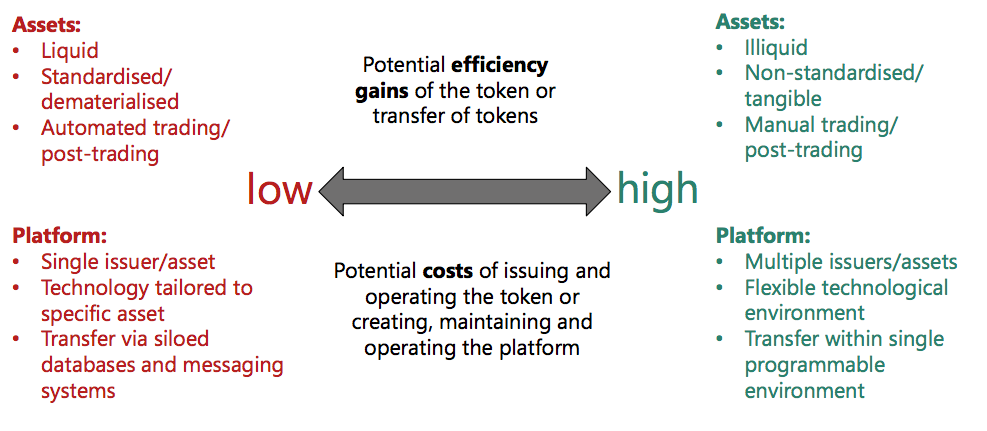

While the BIS acknowledges the potential benefits of tokenization, it also emphasizes the associated costs and risks. Investment costs are likely to be higher for initiatives with greater expected benefits. Additionally, the regulatory framework is still evolving, and network effects may take time to materialize.

According to the BIS, token arrangements face risks similar to traditional market infrastructures regarding governance, legal, credit, liquidity, and operational risks. However, these risks may manifest differently due to tokenization’s unique characteristics.

The BIS believes that tokenization may affect central banks’ roles in payments, monetary policy, and financial stability. Central banks must consider how to respond to private sector tokenization initiatives, foster interoperability, assess the trade-offs between different settlement assets, and identify token arrangements requiring regulation and oversight.

The BIS report also goes beyond technical concerns. It identifies legal risks arising from unclear application of existing laws to tokenized assets.

For instance, the report cites the example of repurchase agreements (repos) in the United States, where traditional repo transactions benefit from automatic bankruptcy protection. It’s unclear if this protection would extend to tokenized versions of the same transaction.

RWA Tokenization: A Booming Sector

Major financial institutions like Barclays, Citi, and HSBC are actively exploring tokenization.

Trials like the UK’s Regulated Liability Network (RLN) are testing the viability of tokenized deposits and programmable payments.

In particular, the real-world asset (RWA) tokenization sector is poised for a breakout year in 2024, with predictions pointing to massive growth by the decade’s end.

According to Tren Finance’s latest research report, predictions for the size of the RWA tokenization market vary widely, with most estimates ranging from $4 trillion to $30 trillion. Even at the median prediction of $10 trillion, this would represent a 54x increase from the current market value of $185 billion (including stablecoins).