Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Over the past week, stablecoin activity across major blockchain networks has shown significant changes in liquidity.

According to data from Lookonchain on Feb. 24, Tron (TRX) significantly outperformed other blockchains in stablecoin inflows over the past seven days, recording an increase of $824.51 million in Tether (USDT) and USD Coin (USDC) holdings.

In the past 7 days, stablecoins(USDT&USDC) on #Tron increased by $824.51M, and stablecoins(USDT&USDC) on #Avalanche decreased by $506M.https://t.co/SxD9j6MIPu pic.twitter.com/Lc74rnyIrJ

— Lookonchain (@lookonchain) February 24, 2025

The blockchain’s low transaction fees, fast transfers, and strong presence in emerging markets made Tron the go-to network for stablecoin transactions, particularly USDT, which is widely used for payments and trading.

Base, Polygon, and Optimism Also Expand Stablecoin Holdings

Similarly, Base, as well as an Ethereum-compatible Layer-2s Polygon (POL) and Optimism (OP), also saw stablecoin inflows, strengthening their positions as competitive alternatives.

Base saw an increase of $115 million, while Polygon and Optimism gained $39.81 million and $22.61 million in stablecoins, respectively, demonstrating its growing appeal as Layer-2 solutions that improve Ethereum’s usability while offering lower costs.

In contrast to these larger gains, Solana (SOL) saw a modest $4 million increase in stablecoin reserves. While relatively small, this growth shows resilience amidst market volatility and suggests that Solana remains a viable option for stablecoin transactions despite broader volatility.

Avalanche and TON Suffer Major Stablecoin Losses

On the other end of the spectrum, Avalanche (AVAX) saw the largest decline, losing $506 million in stablecoin reserves.

Similarly, TON (TON) experienced a $280 million decline in stablecoins, possibly due to market corrections or shifts in user preferences.

While Ethereum (ETH) remains one of the leading networks for decentralized finance applications (DApps) and institutional crypto transactions, it also experienced a net outflow of $208 million in stablecoins last week.

These changes could suggest a temporary reallocation of liquidity to more cost-effective blockchain solutions like Tron and Layer-2 networks.

Stablecoin Adoption Surpasses Bitcoin in Key Regions

Stablecoins have become increasingly popular in emerging markets, serving as a store of value, inflation hedge, and efficient tool for cross-border transactions.

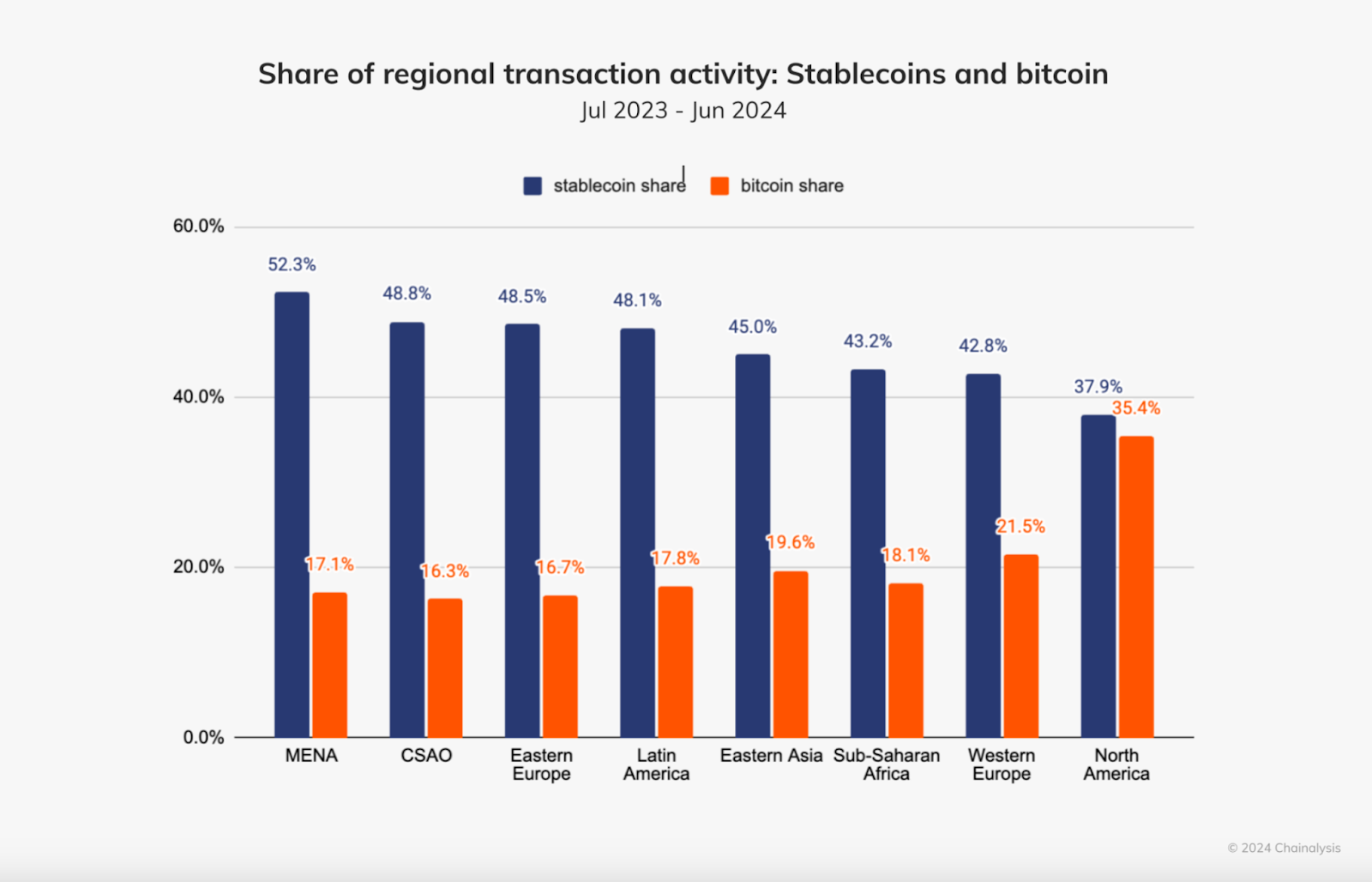

A recent Chainalysis report reveals that regions such as Africa, Eastern Europe, Latin America, and Asia have embraced stablecoins at a much higher rate than Bitcoin (BTC), with stablecoin transactions making up nearly half of all crypto activity in some cases.

Conversely, the US and North America report the lowest stablecoin adoption in the region, though stablecoins still maintain a notable presence in the market.

A Visa-sponsored report further supports these findings and provides insights into the real-world use cases of stablecoins. Researchers surveyed approximately 2,541 adults, including 500 crypto users from Nigeria, Indonesia, Turkey, Brazil and India – countries where stablecoins play a critical role in financial inclusion.

While access to crypto remains the primary motivation for using stablecoins, the survey highlights that many users rely on stablecoins to access US dollars, earn returns, and facilitate transactions.

Data from DefiLlama shows that the total market capitalization of stablecoins reached $226.515 billion as of Feb. 24. Over the past week, the market cap has increased by $1.014 billion, marking an increase of 0.45%.

Among the stablecoins, USDT holds a dominant market share of 63%.