World Liberty Financial, a crypto venture connected to U.S. President Donald Trump, has intensified its Ethereum (ETH) buying spree with another multimillion-dollar purchase.

The platform spent $2 million in USDC to acquire 561 ETH at a price of $3,567, according to on-chain data from Arkham Intelligence reported by Lookonchain.

World Liberty Adds to ETH Stash as Institutional Interest in Ethereum Grows

This latest transaction brings World Liberty Financial’s total Ethereum holdings to 76,849 ETH, valued at approximately $281 million at current prices.

The group’s average entry price now stands at around $3,291, putting its unrealized gains at over $28 million.

Just a day before the latest acquisition, the firm converted $13 million worth of USDC into 3,473 ETH, building on a buying streak that has drawn increasing attention.

Last week, it picked up 3,000 ETH for $10 million. In May, it spent $3.5 million to purchase another 1,580 ETH. The strategy has been clear; steadily accumulating and holding as Ethereum continues to climb.

World Liberty Financial’s activity comes as Ethereum sees growing interest from institutional players. Financial firms and tech-focused treasuries have started adding ETH to their balance sheets, signaling a shift in sentiment around the digital asset.

Companies like BitMine Immersion Technologies and SharpLink Gaming have significantly ramped up their Ethereum exposure.

BitMine briefly held the top spot among public ETH holders with over 300,000 ETH before SharpLink took the lead.

SharpLink reported a purchase of nearly 80,000 ETH last week alone, pushing its total to 360,807 ETH. The company’s average purchase price was around $3,238, with its holdings now valued at roughly $1.3 billion.

BlackRock has also indicated growing interest in Ethereum, expanding its digital asset exposure as ETH becomes more integrated into financial portfolios.

World Liberty’s continued buying spree suggests the Trump-linked platform sees long-term upside in Ethereum’s role in the evolving digital asset market.

ETH Cooling After $3,800 Rejection, But Long-Term Trend Remains Bullish

The buying comes just as Ethereum has just marked the one-year anniversary of its U.S. spot ETF debut, a milestone that has coincided with a renewed inflow surge and growing institutional exposure.

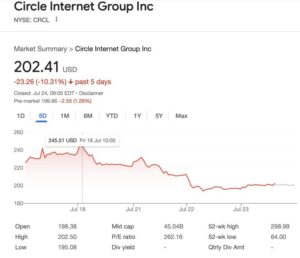

Ethereum’s price action appears to be justifying the World Liberty’s strategy of continuous accumulation. The cryptocurrency has fallen by 1% in the last 24 hours and is currently trading near $3,628. Over the past week, ETH has risen 5.5%, and over the last month, it has surged more than 51%.

Notably, Ethereum is facing short-term pressure after rejecting the $3,835–$3,850 resistance zone. Despite this, multiple analysts maintain a broadly bullish view, pointing to an overall structure that still supports continuation to higher levels.

A key Fibonacci resistance at 0.786 ($3,713) has been breached, and price remains well above the 50-day moving average, suggesting a healthy trend is intact. While ETH momentarily dropped below the psychological $4,000 mark, the chart suggests that the dip is minor in the context of a longer-term uptrend.

The $4,100 resistance level is expected to give way if momentum continues, with targets projected at $5,790 and even $8,513 based on Fibonacci extensions.

Shorter-term structures, however, indicate the possibility of a corrective phase before another leg up. On the 15-minute timeframe, ETH is hovering near the “premium” zone, a typical area where smart money might take profits.

Liquidity zones lie below, between $3,700 and $3,624, which analysts see as likely areas for price to revisit before reaccumulation. Volume indicators suggest that any retracement could be part of a healthy correction within a broader uptrend.

ETH’s market structure remains bullish across intraday and hourly timeframes, with analysts pointing to liquidity grabs and reaccumulation patterns below current prices.

If the price retraces to support near $3,720 or the equilibrium level of $3,624, smart money could re-enter, potentially driving the price beyond current resistance levels.

While Ether may still be consolidating below major resistance, both price action and market structure indicate that any correction could serve as a setup for continuation.