Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The Central Bank of the UAE is set to issue its Digital Dirham, a blockchain-based version of the country’s national currency AED, for retail use by the last quarter of 2025.

According to reports from the Khaleej Times, the CBDC will feature high security, tokenization, and smart contract integration, enabling instant settlements and multi-party transactions.

The CBDC will be a universally accepted payment method, made accessible through licensed financial institutions—banks, exchange houses, and fintech firms.

Additionally, the Central Bank of the UAE (CBUAE) has developed an integrated Digital Dirham platform and wallet, enabling retail, wholesale, and cross-border transactions.

Stablecoin Adoption in the UAE

The UAE’s journey toward a digital currency began in June 2024 with the rollout of a stablecoin regulatory framework, establishing licensing guidelines for Dirham-backed stablecoins.

This triggered several major initiatives, including a push from Tether to issue an AED-backed stablecoin on the TON blockchain.

On February 24, Circle received official authorization from the Dubai Financial Services Authority (DFSA) to recognize and operate stablecoins, USDC and EURC, within the Dubai International Financial Centre (DIFC).

However, as a sovereign-backed digital currency, the Digital Dirham stands to provide a higher level of security, regulatory oversight, and monetary authority than privately issued tokens.

CBUAE governor Khaled Mohamed Balama claims the initiative will “substantially enhance financial stability, inclusion, resilience, and combatting financial crime”

Long term, Blamam anticipates that Digital Dirham will “enable the development of innovative digital products, services, and new business models while reducing cost and increasing access to international markets.”

A CBDC stands to see considerable adoption in the UAE, ranking first among the world’s “most crypto-obsessed countries” in 2025, with a crypto ownership rate of 25.3%.

Global Push for CBDCs

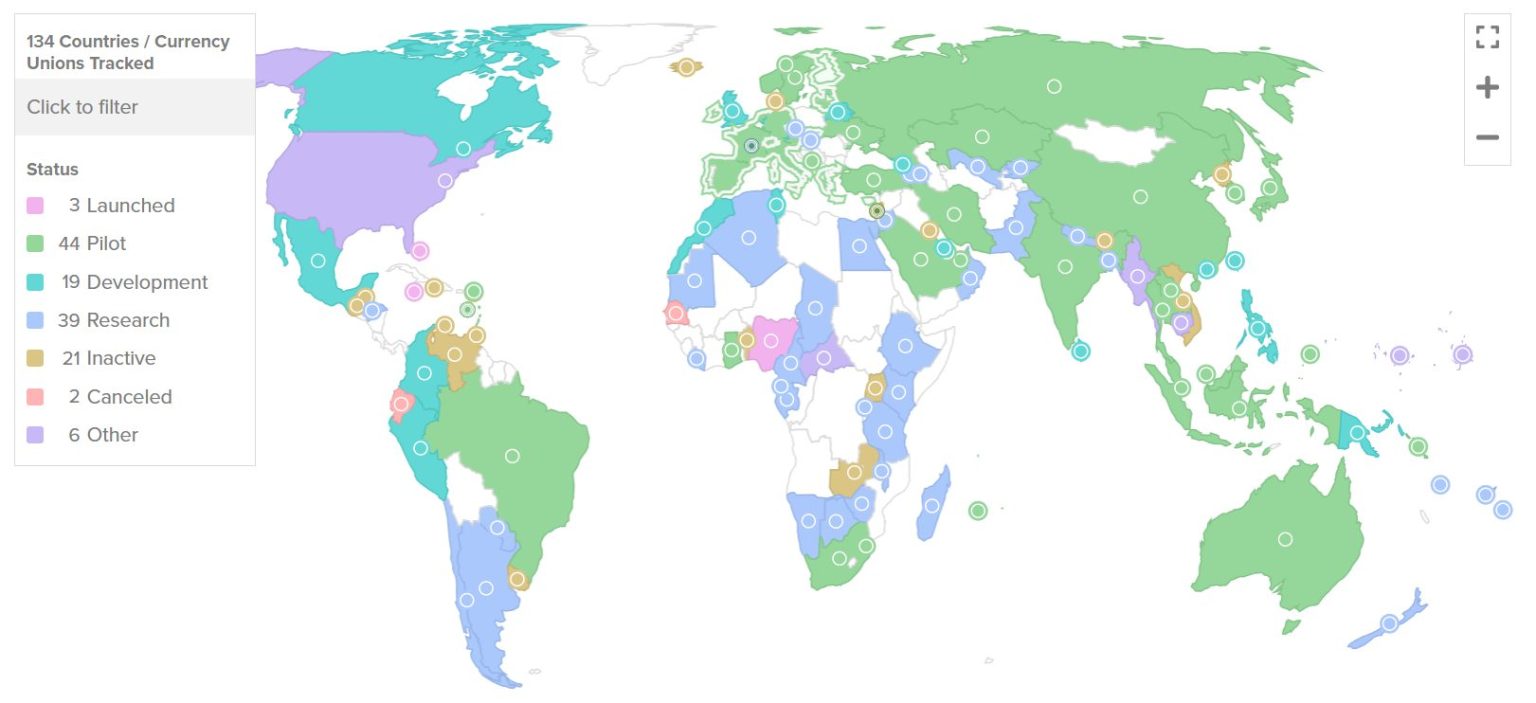

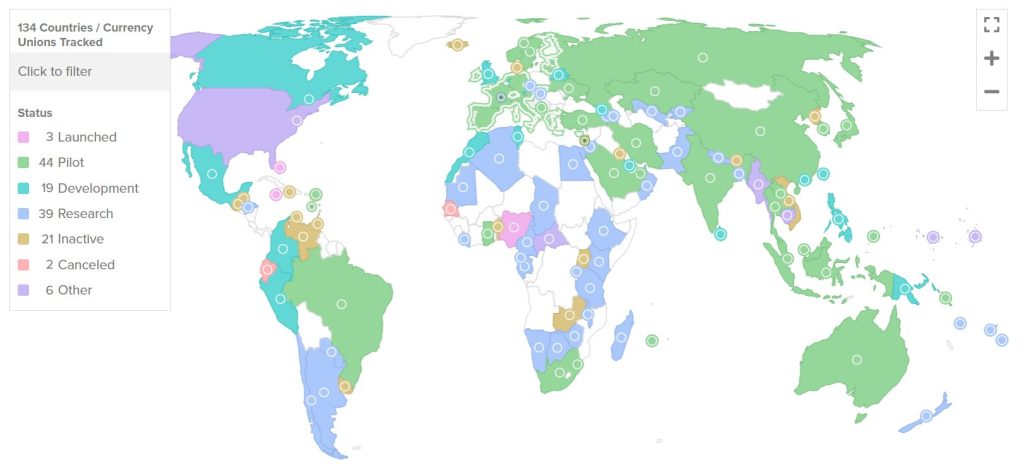

The UAE is currently in the testing phase of its Digital Dirham, joining 43 other countries running pilot programs for their own Central Bank Digital Currencies (CBDCs).

Most notably, the European Central Bank is conducting a multi-year trial of the Digital Euro.

The UK is on track to establish its own regulatory framework for stablecoins by 2026, as outlined in a crypto roadmap published by the Financial Conduct Authority (FCA).

Most recently, US lawmakers proposed the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act on March 26 to advance stablecoin regulation.