The UK’s FCA has unveiled fresh guidance for crypto companies after assessing their adherence to financial promotion regulations.

On Wednesday, the regulator highlighted good and poor practices observed among certain firms. These have been incorporated into a new guide to assist the industry in meeting compliance standards.

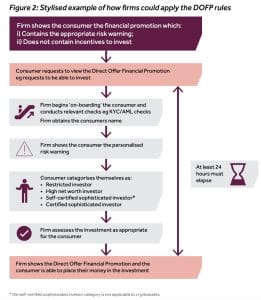

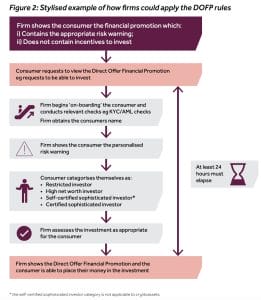

To safeguard consumers, regulations mandate that firms verify investor status – whether they are high-net-worth, sophisticated, or restricted – before promoting financial products. Also, the rules aim to protect those unable to absorb significant losses, by limiting ordinary investors to a maximum 10% allocation.

The UK instituted a global benchmark for crypto promotions last year, prioritizing consumer protection due to high-profile crypto failures. These stringent regulations aim to bolster investor safeguards within the volatile cryptocurrency market.

UK Regulator Outlines Effective Compliance Strategies for Crypto Firms

Previously, crypto firms around the world were unaccustomed to regulations. After new rules, they have have to undertake technological investments to meet compliance requirements. The FCA noted that it recognizes the industry’s challenges in navigating this new regulatory landscape, which includes the concurrent Travel Rule implementation.

The FCA has published examples of effective practices for crypto firms, prioritizing clear, standalone risk warnings for new investors. Optimal design includes dedicated warning pages and easily accessible exit options. Conversely, hindering consumer exit is deemed unacceptable.

Further, the regulator offered personalized guidance to all firms to enhance compliance. It said it expects firms to work proactively to improve standards across the board.