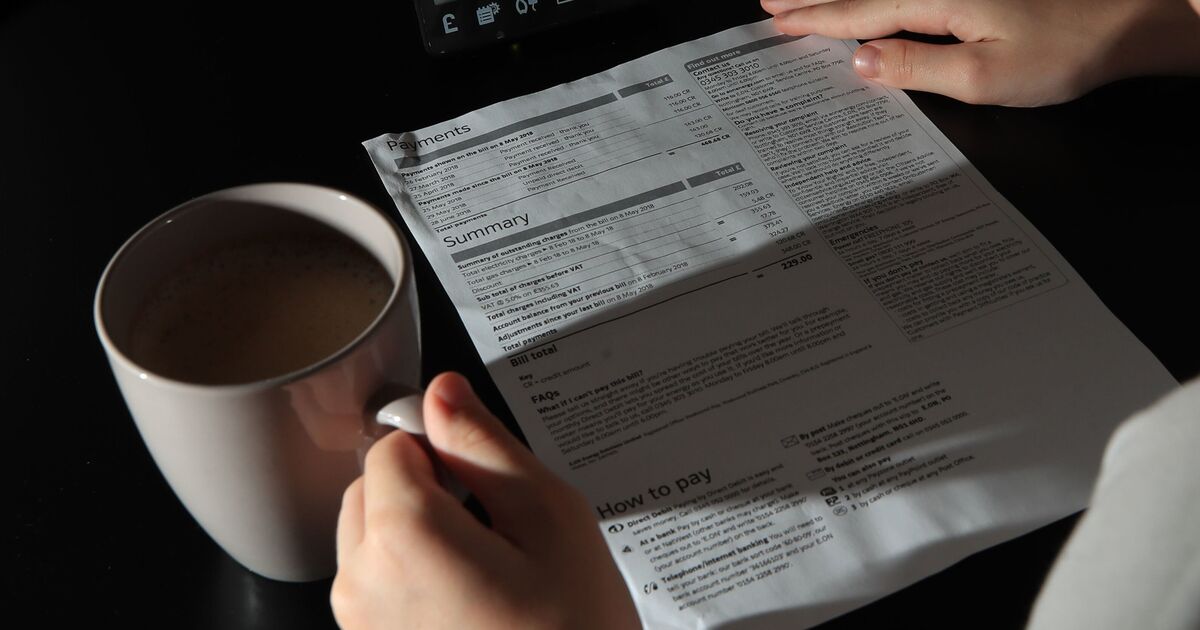

UK households have been warned they face an eyewatering 300 percent Council Tax bill rate following a change in the law set to be introduced in the next tax year.

The government has announced that a new law is set to come into effect from April 2025 which will give local councils the power to charge up to 300 percent council tax on empty homes.

The law has allowed additional council tax on empty homes since 2013 but from April 2025, councils will be able to charge a premium of up to 100% additional council tax (so a 200% bill) on second homes in their area.

If a home is empty for 10 years or more, this increases to 300%.

The new rules don’t apply to someone’s ‘main residence’, so a landlord letting out their second home would not be charged the higher rate, but if the same property was left empty for a year or more, it could start to be subject to the higher tax rate.

The Ministry of Housing, Communities and Local Government said: “From April 2025, councils will be able to use new powers to charge a premium of up to 100% additional council tax on second homes in their area, or parts of their area. For the purpose of council tax, second homes are dwellings which are substantially furnished but have no resident (i.e. it is not someone’s sole or main residence).

“The powers to charge the empty homes or second homes premium (or both) is discretionary, and it is for councils to decide whether to charge the premiums in their local area and at what rate, up to the statutory maximum.

“Councils have the discretion to decide whether to introduce a premium in their local area or parts of the area on long-term empty homes and second homes. They also have the discretion to decide on the level of the premium, up to the maximum statutory threshold.

“Where a council makes a determination to charge a premium on long-term empty dwellings, it may specify different percentages for dwellings based on the length of time for which they have been empty. This enables councils to take a stepped approach, with increases over time. These include:

-

up to 100% for homes empty between 1 and 5 years

-

up to 200% for homes empty between 5 and 10 years

-

up to 300% for homes empty for over 10 years

The regulations prescribe 9 classes of dwellings which are excluded from the council tax premiums, such as if the house is on the market for sale or to let, if it’s a ‘job related dwelling’, an occupied caravan or boat or is undergoing major refurbishments. Holiday homes where year-round occupancy is not allowed are also going to be exempt.