Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The UK government introduced the Crime and Policing Bill on Thursday, a legislative proposal designed to strengthen law enforcement’s ability to confiscate illicit funds, including crypto-linked assets, from criminal activities.

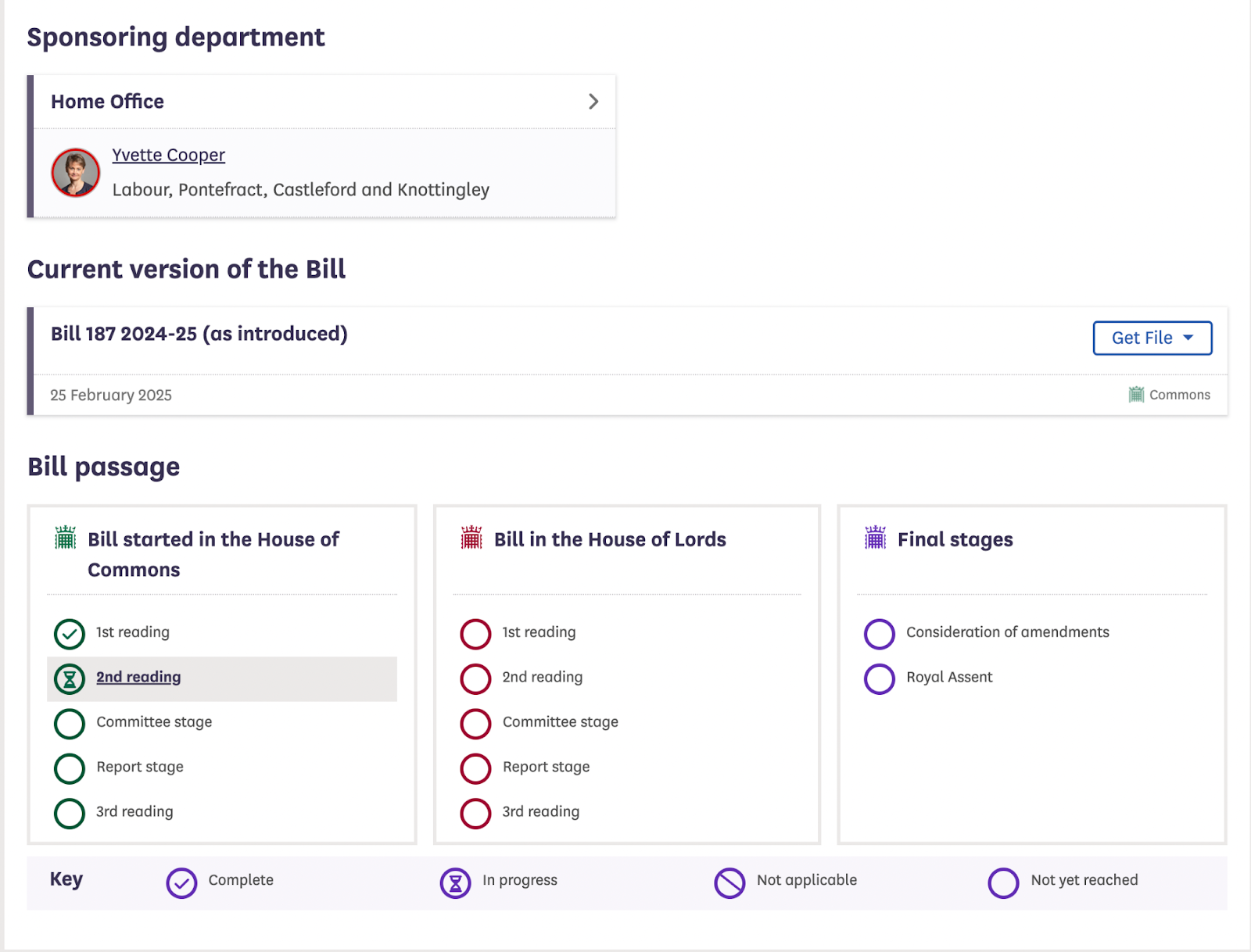

The bill, currently in its second reading in the House of Commons, is expected to introduce significant changes in how courts and police handle confiscated digital assets.

If passed, it would extend the Crown Court’s powers regarding confiscation orders, outlining conditions for how courts can retrieve funds and determine the value of destroyed crypto property in cases where assets cannot be sold.

The Home Office, under Labour MP Yvette Cooper, has framed the bill as a crucial step in bolstering law enforcement capabilities.

According to an official fact sheet, “This bill will strengthen the ability of the criminal justice system to pursue those who have benefited from criminal activity.”

This move builds on the Economic Crime and Corporate Transparency Act of 2023, which allowed authorities to freeze and seize crypto assets.

Overall, this legislative effort is part of a broader government strategy to limit financial crimes linked to digital assets.

A Response to Rising Crypto Crime and Regulatory Concerns

The introduction of the Crime and Policing Bill aligns with a broader regulatory trend in the UK, which has been tightening its oversight of digital assets over the past year.

In December 2024, the Financial Conduct Authority (FCA) proposed stricter crypto regulations to mitigate risks within the sector.

The FCA’s discussion paper, released on December 16, outlined plans to prohibit public crypto offerings by unregulated entities.

The FCA has called for financial firms to enhance information sharing and enforce stricter compliance measures to detect suspicious activities.

These proposed measures are likely to influence the UK’s crypto regulatory landscape, with implementation targeted for 2026.

The UK’s crypto regulatory framework has evolved rapidly, with increasing scrutiny on unregistered entities.

Since 2020, the FCA has actively monitored compliance with anti-money laundering regulations, leading to restrictions on unauthorized platforms.

In December 2024, the FCA blocked access to Pump.fun, citing concerns that the platform was operating without regulatory approval.

Reports have also highlighted the UK as a hotspot for crypto-related scams and fraudulent activities. Between January 2022 and October 2024, the UK accounted for 7% of global crypto scams.

These developments have reinforced the government’s push for a more defined regulatory framework.

A Broader Push for Comprehensive Crypto Regulation

The Crime and Policing Bill is part of a larger effort by the UK government to develop a comprehensive regulatory framework for the cryptocurrency sector.

In November 2024, Economic Secretary to the Treasury Tulip Siddiq announced plans to consolidate regulations for stablecoins and staking services under a unified regime.

“Doing everything in a single phase is simpler and it just makes more sense,” Siddiq stated at a London conference.

Previously, stablecoins were categorized under payment services regulations, but the government now views this classification as outdated.

Delays in regulatory action have prompted concerns within the industry, particularly as the European Union’s Markets in Crypto Assets (MiCA) regulation is already in effect and attracting crypto firms.

Due to regulatory uncertainty, some crypto businesses have hesitated to expand in the UK.

At the same time, other jurisdictions, including the United States, have ramped up efforts to join the competition of attracting digital asset firms.

As global regulatory efforts intensify, the UK’s proposed Crime and Policing Bill reflects a growing determination to establish a clearer legal framework for digital assets, potentially setting the stage for more extensive crypto regulations.