Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

A recent survey by the FDIC found that 6.2% of underbanked households in the U.S. used cryptocurrency, surpassing the 4.8% of fully banked households who did so in 2023.

Surveying nearly 60,000 households in 2023, the FDIC report showed that younger, higher-educated, working-age, Asian, and white households are more likely to adopt cryptocurrency.

4.8% of U.S. Households Owned Crypto in the Past Year

Published on Tuesday, the FDIC survey revealed that 4.8% of U.S. households used or owned cryptocurrency in 2023.

Most of these households (92.6%) treated crypto as an investment, while only 4.4% used it for payments or money transfers.

These statistics indicate that cryptocurrencies are more commonly viewed as long-term investments, with limited use for everyday transactions.

Underbanked Rates and Ethnic Disparities in 2023

The survey also found that around 14.2% of U.S. households were classified as underbanked in 2023.

This means nearly one in seven households either lack access to traditional banking services or rely on alternative financial products to manage their daily finances.

Underbanked households typically have a bank account but still depend on services outside the formal banking system for some of their financial needs.

In contrast, unbanked households do not have a bank account, while banked households fully utilize traditional banking services.

Additionally, the survey revealed behaviors within unbanked households.

Among these households, 66.2% used only cash for transactions, while 33.8% turned to prepaid cards or nonbank online payment services like PayPal, Venmo, or Cash App.

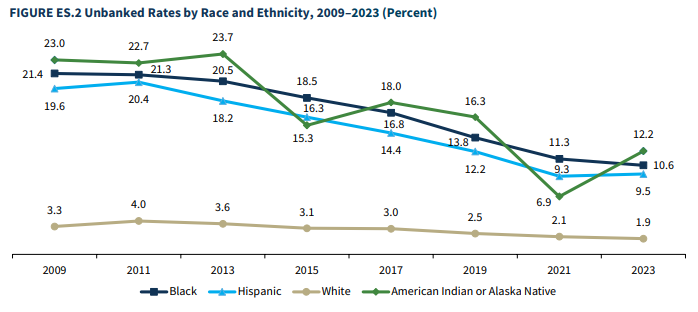

Since 2009, the FDIC has partnered with the U.S. Census Bureau to conduct a comprehensive biennial survey, tracking changes in banking behaviors across the country.

The unbanked rate peaked at 8.2% in 2011 and has now dropped to just 4.2% in the latest 2023 data.

This decline indicates that roughly 5.3 million more households have gained access to banking services in the past decade.

However, despite this overall reduction in unbanked households, disparities remain among racial and ethnic groups.

As of 2023, Black households had an unbanked rate of 10.6%, Hispanic households 9.5%, and American Indian or Alaska Native households 12.2%, compared to just 1.9% of White households.

Rise of Crypto Adoption Among U.S. Households

The FDIC survey’s findings align with a 2024 survey by Security.org, which detailed that 15% of the 258 million U.S. adults now own cryptocurrency.

The report also noted a substantial rise in female crypto ownership, increasing from 18% last year to 29% by the start of 2024, marking a shift in demographic participation.

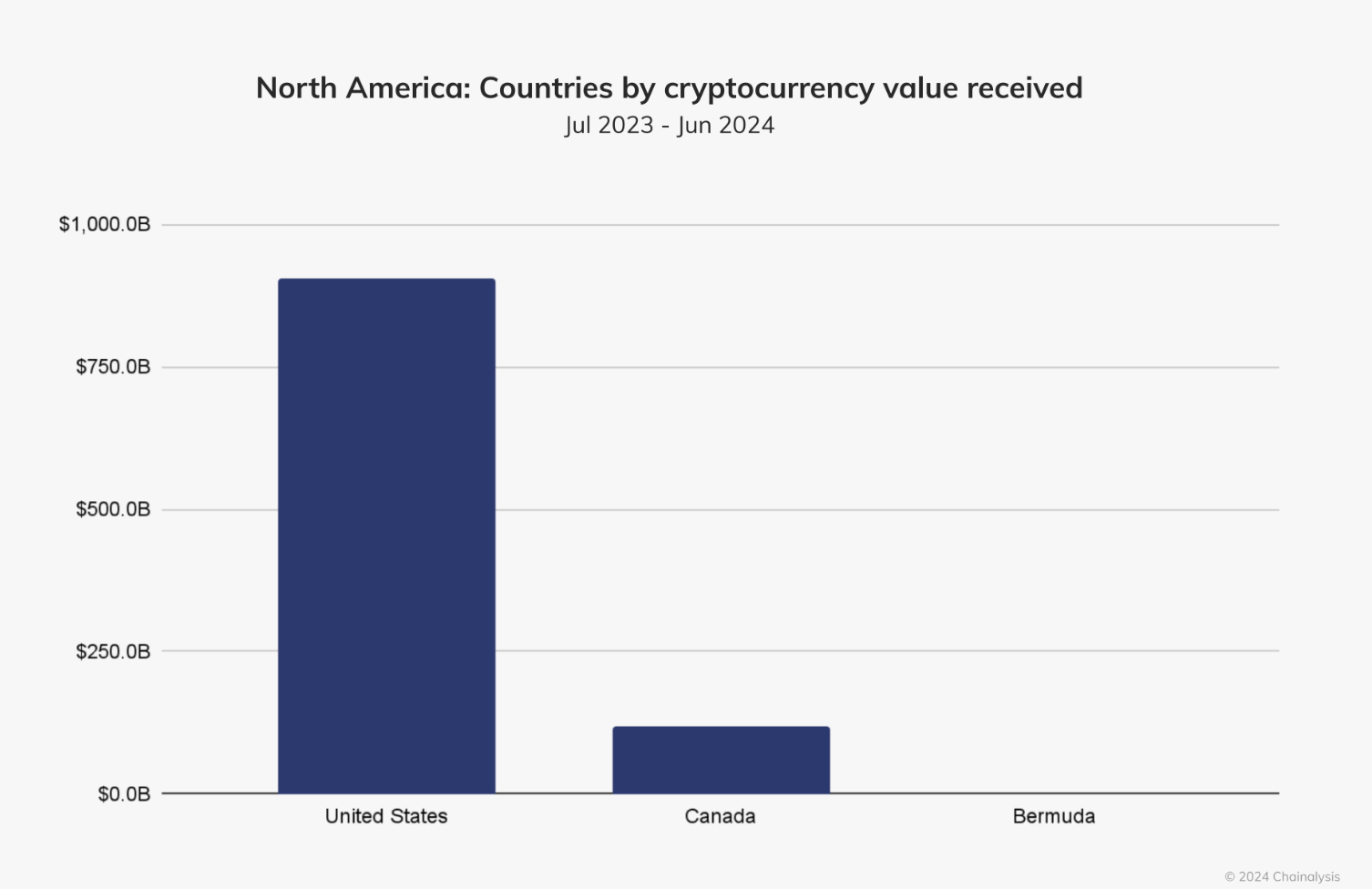

Blockchain analytics firm Chainalysis recently underscored North America’s dominance in the global cryptocurrency market.

According to the data, North America accounted for an estimated $1.3 trillion in on-chain value received, which made up about 22.5% of global activity.

This strong market presence was largely driven by institutional investors, with approximately 70% of the region’s crypto transactions involving over $1 million.

This shift reflects the increasing influence of large financial institutions in the region’s crypto market.

Looking ahead, the future of U.S. cryptocurrency adoption appears promising.

President-elect Donald Trump’s pro-crypto policies are expected to foster innovation, positioning the U.S. as a key player in digital asset regulation.

Following his election victory, Bitcoin’s price surged to over $90,000.

This shift could lead to even broader adoption, bringing cryptocurrencies closer to becoming a mainstream financial tool accessible to every American household.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.