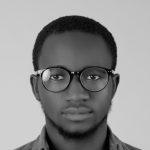

The prominent Ethereum-based decentralized exchange (DEX) platform Uniswap (UNI) delivered an impressive performance, surging more than 24% within a single trading session.

Currently priced at $8.34, $UNI has bounced back over 90% from its April bottom of $4.60.

This strong recovery has propelled Uniswap back into the top 30 cryptocurrencies by market capitalization, overtaking several DeFi protocols including PancakeSwap, Aave, and Jupiter. In terms of market cap and price momentum, Uniswap trails only Hyperliquid.

SEC DeFi Exemption Sparks “Summer 2.0” Rally Hopes for Uniswap

The recent Uniswap surge aligns with the U.S. SEC releasing a comprehensive statement indicating that DeFi platforms would receive exemptions from certain regulatory constraints, sparking sentiment around a potential DeFi Summer 2.0 revival across the cryptocurrency market.

$UNI has successfully broken through its 100-day accumulation phase and remains the second-largest DEX by trading volume, trailing only BNB Chain’s PancakeSwap.

Given these strong fundamentals and technical indicators, numerous cryptocurrency traders believe macro conditions and indicators support Uniswap’s continued upward momentum.

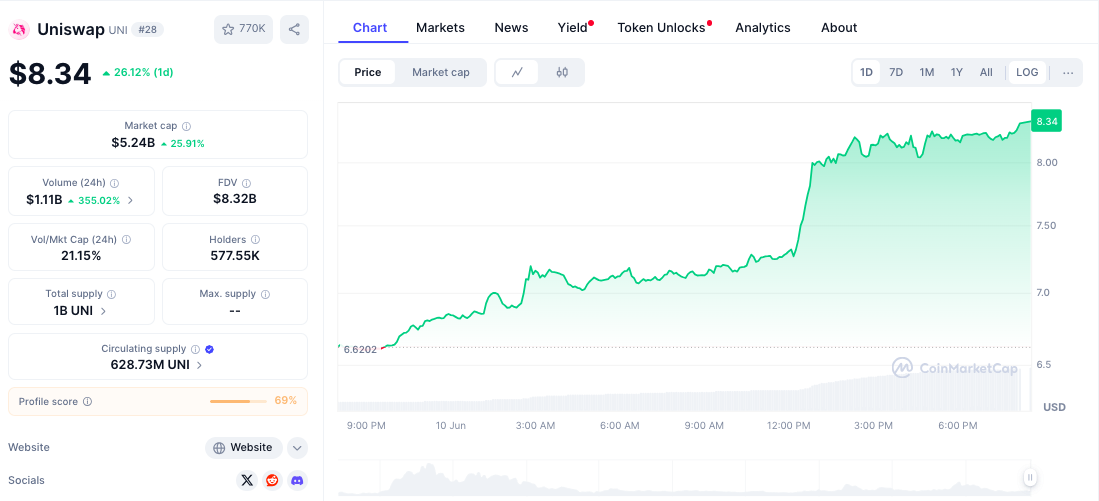

According to Token Terminal data, Uniswap’s monthly trading volume exceeded its 2021 peak of $80 billion, reaching over $88 billion as of May 2025.

Approximately half of this volume, representing over $40 billion, originates from Ethereum layer-2 (L2) solutions, primarily Arbitrum, Optimism, and Base.

Analysts Target $27–$44 “Parabolic Breakout” for $UNI

As Uniswap reclaims its former prominence, several market analysts present ambitious price forecasts for the $UNI token.

Prominent Bitcoin advocate Bitcoinsensus noted that UNI has remained within a Right-Angled Ascending Broadening Wedge formation for three years and is approaching the pattern’s upper boundary.

He confirmed that this price action historically indicates an eventual breakout above the top line, often leading to parabolic moves. His analysis projects a $27.40 target for $UNI once the DeFi sector gains renewed momentum.

Another technical analyst suggested that Uniswap could revisit its May 2021 peak of $44.97, representing a potential 480% increase from current price levels.

Technical Analysis: $UNI Smashes 3-Year Wedge Pattern

The Uniswap ($UNI/USDT) daily chart reveals that the token’s breakout occurred following an extended consolidation period within the $5.50–$6.50 range, clearly defined by the blue horizontal zone.

This decisive upward movement indicates renewed bullish sentiment, backed by substantial volume reaching $1.44 billion.

From a technical standpoint, UNI has successfully escaped a descending wedge formation, representing a textbook bullish reversal pattern.

The immediate upside objective sits at the first major resistance level of $11.6.

Should $UNI sustain this positive momentum and clear that threshold, the intermediate target will reach $15.5. Subsequently, a major resistance area at $18 will become relevant only after a convincing breach of the $16 level.

Additionally, the MACD indicator displays a bullish crossover, with the MACD line (blue) advancing above the trigger line (orange), confirming the momentum shift.

Considering the breakout from consolidation, elevated volume activity, and bullish MACD crossover, UNI’s price trajectory now favors the upside, with $11.6 serving as the next key level to monitor.