BBC Moneybox on energy bill support

If you’re grappling with energy costs amid the cost of living crisis or dealing with debts to your supplier, assistance may be available, with companies offering up to £2,000 to help cover bills.

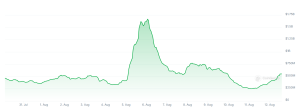

Since July 1, the cap on energy prices has been set at £1,568 a year for an average household that uses electricity and gas and pays by direct debit.

According to Ofgem, the energy watchdog, the typical household consists of 2.4 people and consumes 242 kWh of electricity and 1,000 kWh of gas per month.

The price cap dropped by £122 a year for the average household from 1 July 2024, following steep increases in 2022/23.

However, costs are still significantly higher than they were a few years ago, so if you’re still finding it difficult to make payments, several companies, including British Gas and Octopus Energy, are offering grants and other forms of support. Each company has different schemes and criteria for accessing help – here’s everything you need to know.

British Gas has earmarked £200million to assist customers facing financial hardship through its Energy Support Fund. Since 2021, over 2.2million British Gas customers have received energy debt write-off grants of up to £2,000.

To qualify, customers must be seeking a grant to clear an outstanding debt on a current gas, electricity or dual fuel energy account related to their primary residence. The debt to be cleared must range between £250 and £2,000.

Customers will only be eligible for one grant in a 12-month period and must be in, or facing, fuel poverty.

British Gas has rolled out a “You Pay: We Pay” initiative, promising to match 100% of energy payments from customers in financial distress. The £15 million programme aims to support users at risk of sinking into debt.

To learn more and apply, visit British Gas’s website.

ScottishPower isn’t far behind in the goodwill stakes; the company has delivered over £60m to help customers grappling with energy bills via its Hardship Fund. To qualify, you must be on benefits such as Employment and Support Allowance, Jobseeker’s Allowance, or Universal Credit among others, or have a low household income or special circumstances like illness affecting your finances.

Successful applicants can see their debts cleared in part or full. For applications, reach out to a debt advice agency like Step Change either online or by calling 0800 138 1111.

Meanwhile, EDF has established the Consumer Support Fund which issues grants to vulnerable customers overwhelmed by energy debt, also assisting in the procurement of imperative white goods. Applications go through the EDF Let’s Talk website, but an independent debt advice is a prerequisite for eligibility.

You will also need to provide your EDF account number, current debt balance and details of your household finances and vulnerability.

Utilita Giving, the charity partner of Utilita, offers vulnerable customers grants to help clear energy debt. The charity operates a number of schemes and currently its Helping Hand Fund is open for applications.

This fund provides grants to wipe or reduce energy debts. Applications can be made via the charity’s website by providing details of your gas/electricity debt, as well as your household finances, including benefits and pensions.

In addition, Utilita partners with the charity IncomeMax who work with customers facing financial difficulties to ensure they’re claiming every benefit to which they are entitled. Over the last three years, this has led to more than £3million of extra income being claimed by customers.

The price cap dropped by £122 a year for the average household from 1 July 2024 (Image: Getty)

The energy firm also collaborates with Let’s Talk, to provide replacement white goods, including fridges and washing machines, and boiler replacement service Leap to offer new boilers or fully-funded repairs.

Utility Warehouse offers financial assistance payments of up to £140 to customers about to go into debt, or those who have run out of credit on their prepayment meter. The scheme is operated by Citizens Advice Plymouth, which also helps Utility Warehouse customers with budgeting advice and benefits assessments.

In the past year, the team has assisted 6,000 customers in increasing their combined disposable income by £9million through reducing unnecessary expenditure and claiming additional benefits. Utility Warehouse is planning to expand its team of advisors by an additional 50% this winter and more than double the amount of financial support available due to higher than expected energy costs.

Information on how to access support can be found on its website.

Octopus Energy customers have the opportunity to apply for support from its £30million Octo Assist fund. The fund has already aided over 70,000 customers with energy debt.

The energy company also provides customers with free electric blankets, thermal imaging cameras and advice on reducing energy bills and budgeting. Applications can be made online via the Octopus website.

E. ON’s Next Energy Fund offers grants to customers struggling with energy debts and replaces appliances that are broken or in poor condition.

Applicants will need to provide proof of household income, including evidence of entitlement to benefits, pension details and confirmation of any medical conditions. Before receiving help, you’ll also need to demonstrate your commitment to financial stability by making regular payments over a three-month period.

Customers can apply online on the provider’s site. If you’re unable to get help through one of these funds, there are other forms of support available.

The Household Support Fund is accessible to thousands across England. The support you’re entitled to varies based on your location, but typically, assistance is provided if you’re on a low income or benefits.

Some households are receiving energy vouchers, while others are getting payments directly into their bank accounts. You can determine your council area using the government’s council locator tool.

Simply input your postcode and it will direct you to the local authority you should contact for help. Additionally, you may be eligible for a cost of living payment to cover your energy bills.

Thousands qualify for the £300 payments designed to assist with essential bills. Winter Fuel Allowances will also be distributed to those on Pension Credit, or other means-tested benefits.

British Gas has earmarked £200million to assist customers (Image: Getty)

Previously, Winter Fuel Allowance payments were universal for those over 66, but the Government has announced that the number of people who will qualify for up to £300 in energy bill help would be reduced ahead of this year’s payments. So, what help is available for energy bills?

There are several ways to get help paying your energy bills if you’re finding it hard to make ends meet.

If you find yourself in debt, it’s always worth approaching your supplier to see if they can arrange a repayment plan before resorting to a prepayment meter. This would involve paying off your debt in instalments over a specified period.

If the repayment plan offered by your supplier seems unaffordable, don’t hesitate to negotiate for a better deal. Various energy firms offer grant schemes to customers who are struggling to pay their bills.

However, eligibility criteria and the amount you can receive depend on your financial situation and the specific supplier. For instance, British Gas or Scottish Gas customers facing difficulties with their energy bills can access grants of up to £2,000.

British Gas also provides assistance through its British Gas Energy Trust and Individuals Family Fund. You don’t need to be a British Gas customer to apply for the latter fund.

EDF, E. ON, Octopus Energy and Scottish Power also offer grants to customers in need.

Thousands of vulnerable households are missing out on additional help and protections by not registering for the Priority Services Register (PSR). This service offers support to vulnerable households, such as the elderly or ill, with benefits including advance warning of blackouts, free gas safety checks and extra support if you’re struggling. Contact your energy firm to see if you can apply.