Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The stock prices of Upbit, the South Korean market-leading crypto exchange, are continuing to slump, but experts have claimed the platform could soon make a strong recovery.

The exchange has been rocked this month by sanctions from the regulatory Financial Intelligence Unit and news of a tax probe from the National Tax Service.

Upbit Stock: Prices Plummet

The FIU punished Upbit’s operator Dunamu with a three-month restriction order on the activities of new users after ruling that the platform mishandled thousands of KYC verifications.

The same body also ordered the dismissal of the company’s compliance and reporting leads. It will follow up at a later date with fines.

The tax body, meanwhile, thinks that customers may have used the exchange to evade taxes by using Upbit to send their funds to overseas platforms.

The platform is also in the political spotlight, with many lawmakers criticizing Seoul for allowing Upbit to become a “monopoly,” with over 70% of the domestic crypto market share.

Further issues continue to dog the exchange, with regulators suggesting the exchange has failed to follow crypto “market rules.”

Per the South Korean media outlet Nogaek, Upbit now finds itself under “sudden all-out pressure from the regulatory authorities.”

And this pressure, the media outlet wrote, has “put the brakes on its rapid growth.”

Quoting data from South Korean unlisted stock price data providers, Dunama shares “have been falling for the past three months.”

30% Drop in Upbit Stock Prices

The providers say that Upbit prices have tumbled from 217,000 won on December 17, 2024, to 153,000 won in late February, a fall of almost 30%.

The media outlet added that the latest investigations will see Upbit’s “overseas remittance and transaction history” placed under scrutiny.

Investigators also want to probe Upbit’s operations in Singapore, Thailand, and Indonesia via its Southeast Asia subsidiaries.

The outlet suggested that if Upbit is found guilty of tax offenses, punishments “may go beyond simple fines” and instead result in “criminal cases.”

However, the media outlet also said that some experts had opined that Upbit’s current “crisis” could transform into “an opportunity for another leap forward.”

Market experts said that if Upbit could “overcome” the hurdles it now faces, it is likely to return to “a strong growth path” and a stock price “rebound.”

They added that they expected the crypto market to experience a “long-term growth curve.”

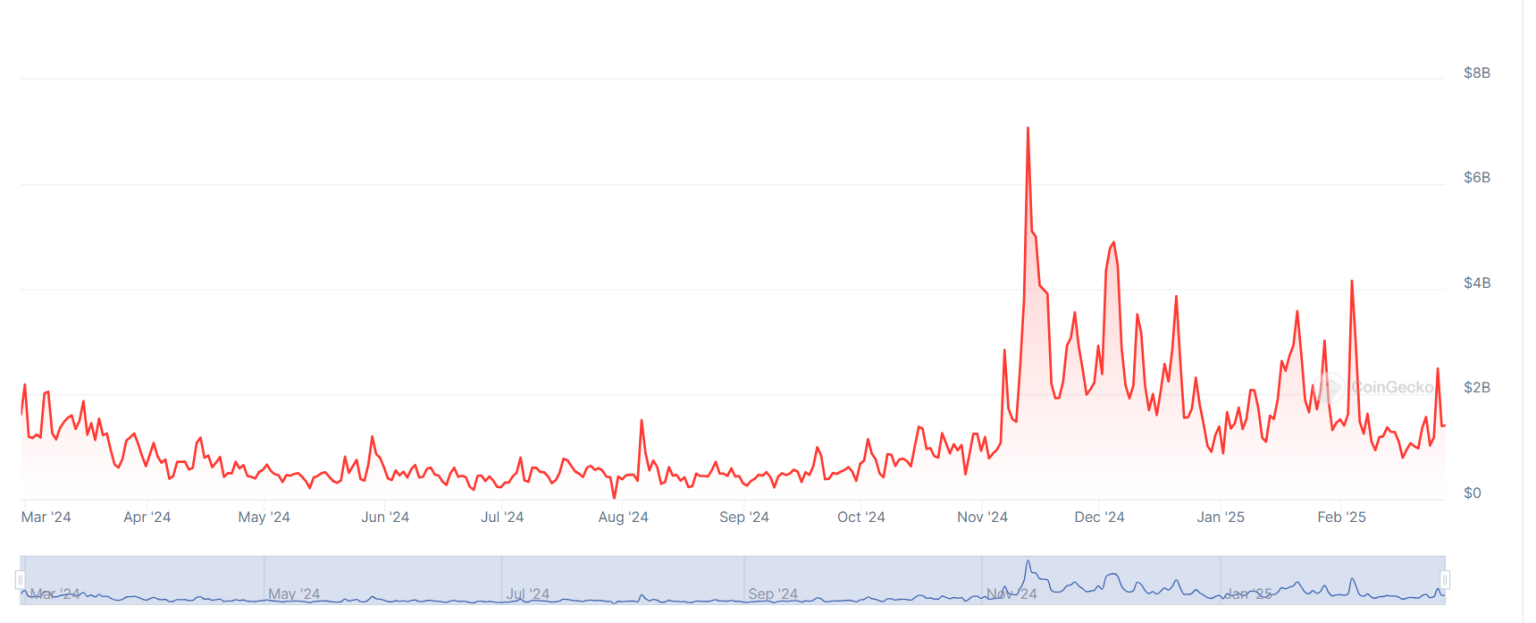

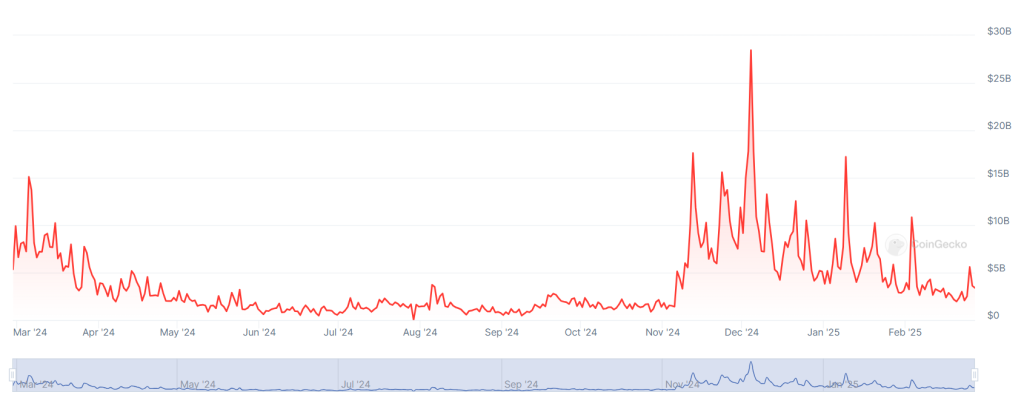

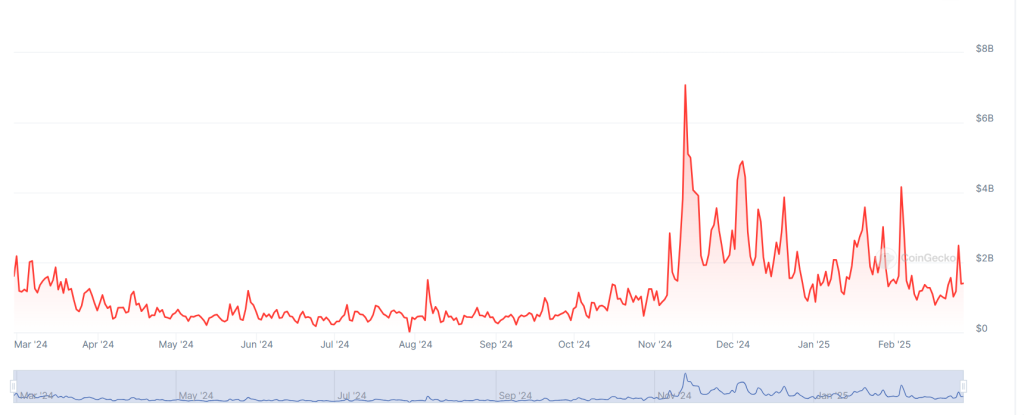

Like many major crypto exchanges, Upbit’s financial performance is closely linked to Bitcoin (BTC) prices.

Corporate Investment Hope?

During previous BTC bull markets, Upbit’s performance improved as traders became more active on its platform.

High trading volumes result in more commission fee-derived revenue for Upbit and many of its main competitors.

The South Korean crypto market will also receive further stimulus this year, as regulators finally allow corporations to buy BTC using their balance sheets.

Many domestic firms are highly likely to want to place orders via Upbit due to its perceived financial stability and market dominance. The media outlet wrote:

“Regulatory scrutiny will have a negative impact on Upbit in the short term. But if Upbit is incorporated into the [financial] system and becomes established in the long term, analysts think this could actually become an opportunity for stable growth.”

Will Upbit Convince Regulators It Can ‘Play Fair?’

The outlet concluded that if Upbit can convince regulators and politicians it will “play fair,” its stock price “will continue to rise.”

Dunamu is thought to have previously explored the possibility of launching on the New York Stock Exchange.

However, it appears to have shelved these plans during the most recent crypto winter. Instead, its closest rival Bithumb is now leading the race to become the first South Korean crypto exchange to go public.