Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

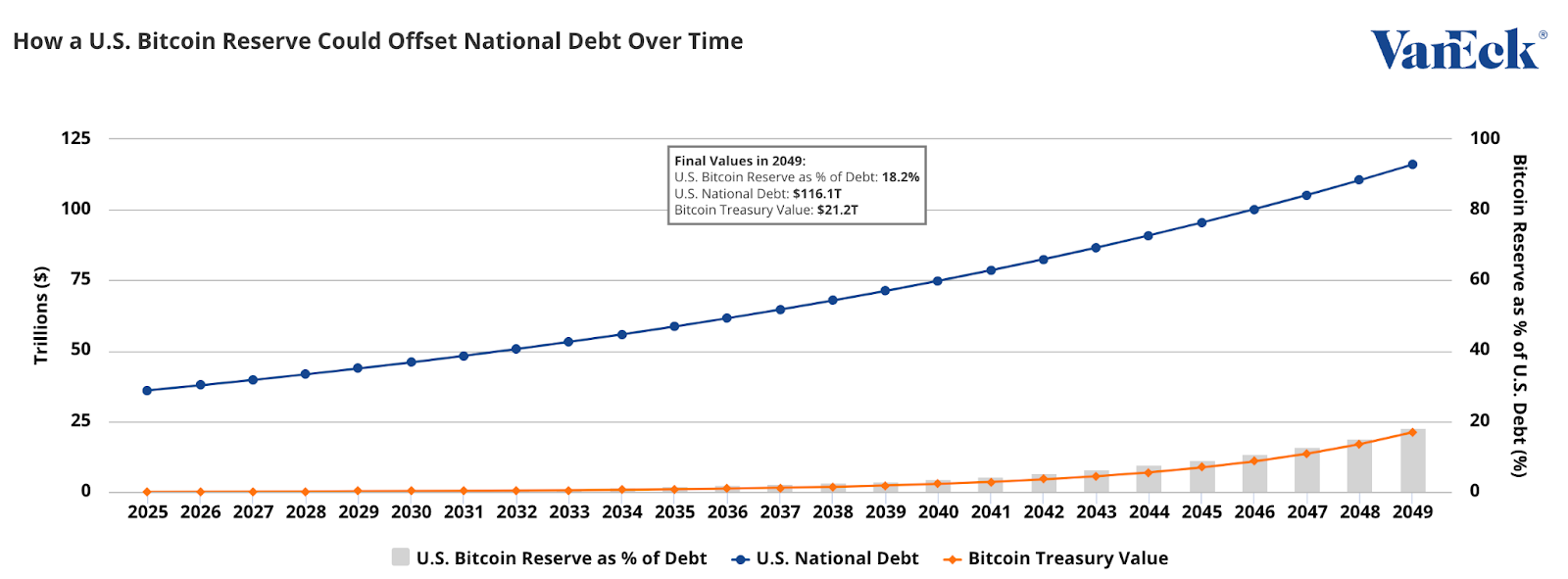

Investment firm VanEck has modeled the potential impact of a US strategic Bitcoin reserve, suggesting that accumulating Bitcoin (BTC) could help offset a portion of the country’s mounting national debt.

The analysis, inspired by the Bitcoin Act, outlines a scenario in which the US Treasury acquires up to 1 million Bitcoin over five years and holds it as a long-term store of value to strengthen the nation’s balance sheet.

🚨 A US Strategic Bitcoin Reserve Could Help Offset National Debt: VanEck Research

We modeled the opportunity, and just posted a tool on our website so you can make your own assumptions.

Link in reply ⬇️@SenLummis pic.twitter.com/rq7LQOrn9p

— matthew sigel, recovering CFA (@matthew_sigel) February 20, 2025

Bitcoin as a Hedge Against National Debt?

The US national debt is projected to soar from $36 trillion in 2025 to $116 trillion by 2049, assuming a 5% annual growth rate.

In contrast, VanEck’s report explores a scenario where Bitcoin, acquired at an average price of $100,000 in 2025, appreciates at 25% annually, reaching approximately $21 million per BTC by 2049. Under this assumption, a reserve of 1 million Bitcoins could be worth $21 trillion, effectively covering 18% of US debt by that time.

VanEck’s model is not a direct prediction but rather an exploration of hypothetical financial outcomes if Bitcoin were integrated into US strategic reserves. The findings suggest that Bitcoin’s long-term appreciation could provide a significant economic buffer, much like traditional sovereign reserves of gold.

Senator Cynthia Lummis Backs the Concept

The idea of a national Bitcoin reserve has gained traction among some policymakers. Senator Cynthia Lummis, chair of the US Senate Banking Subcommittee on Digital Assets, publicly supported VanEck’s research in a Feb. 21 X post.

Good idea. https://t.co/OzPAFieCJ5

— Cynthia Lummis 🦬 (@CynthiaMLummis) February 20, 2025

Lummis has been an outspoken advocate for Bitcoin’s integration into the US financial system, arguing that digital assets could provide fiscal resilience in an era of rising debt and inflationary pressures.

However, while VanEck’s model presents an optimistic scenario, it also underscores Bitcoin’s volatility and uncertainty. VanEck analysts also added that their projections do not guarantee future performance and should not be interpreted as financial advice.

Global Central Banks Debate Bitcoin’s Role in Reserves

Beyond the US, some central banks are exploring Bitcoin’s potential in reserve management.

Earlier this month, Czech National Bank (CNB) Governor Aleš Michl stated that the institution is studying Bitcoin, arguing that central banks should not dismiss it outright. CNB has launched a Bitcoin test portfolio to analyze its risks, volatility, and long-term viability. While Michl insists this is not an endorsement, he believes understanding Bitcoin’s technology could strengthen financial institutions.

Despite growing interest, many European financial leaders remain skeptical.

In February, Joachim Nagel, governor of Germany’s Bundesbank, compared Bitcoin to “digital tulips,” warning of speculative risks.

In January, ECB President Christine Lagarde rejected Bitcoin as a reserve asset, citing concerns over liquidity and stability.

As the debate continues, Bitcoin’s role in sovereign finance remains uncertain but increasingly discussed.