Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

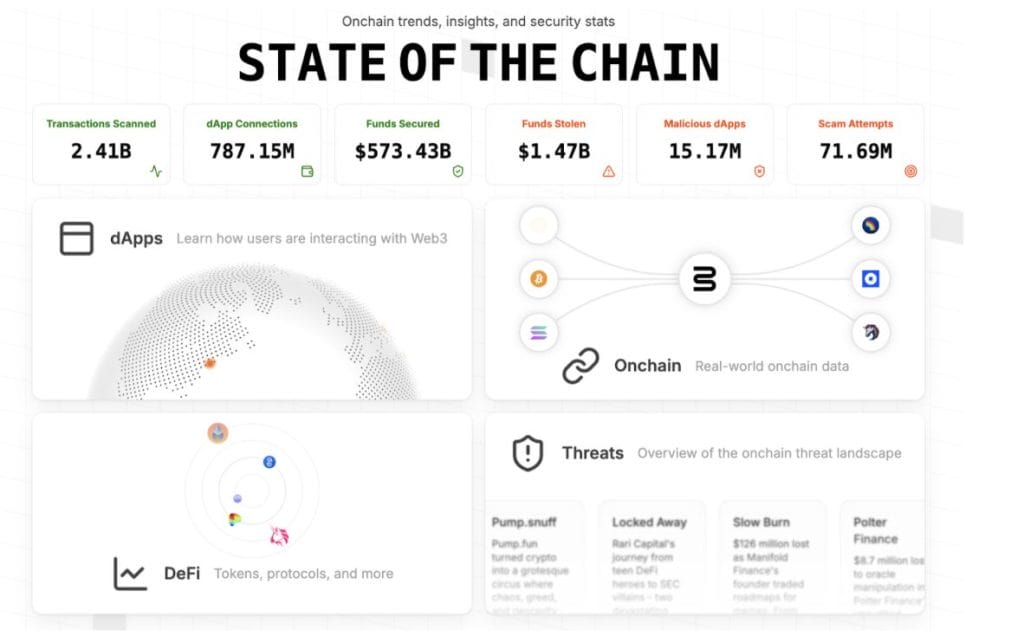

Web3 blockchain security firm Blockaid has launched a dashboard called State of the Chain, providing a look into 2024 onchain activity and security trends.

The firm said the interactive tool will give users customizable insights into decentralized applications (dApps), token activity, and other blockchain trends.

High Demand for Investigation and Compliance Services

There are already a number of firms such as Chainalysis and Elliptic that provide data on hacks in the digital assets space.

In a press release shared with Cryptonews, Blockaid said that State of the Chain offers a comprehensive review of blockchain activity, from transaction volumes and popular infrastructure to funds stolen and the most prevalent security threats. It can also shed light on emerging risks such as malicious tokens and scams, which continue to pose significant challenges in the Web3 space.

“Blockaid processes more transactions than almost any other Web3 infrastructure,” claims Ido Ben Natan, CEO and co-founder of Blockaid.

“The data shows that Web3 is growing, and threat actors aren’t stopping. Fortunately, investments by wallets and chains in security prevented 71 million attacks that would have otherwise resulted in greater losses,” said Natan.

Key Highlights from the Blockaid Dashboard

Blockaid claims its platform prevented 71 million attacks in 2024, saving users from significant financial losses. Despite security efforts, cryptocurrency scams and fraud resulted in over a billion in user losses.

According to the firm 59.3% of new tokens launched in 2024 were identified as malicious.Rug pull scams accounted for 27% of all malicious tokens, highlighting their continued threat to users and investors.

In July Blockaid identified a sophisticated domain registry attack compromising multiple decentralized finance (DeFi) applications, redirecting users to malicious websites.

The incident sparked discussion on the vulnerabilities of DeFi applications that rely on Web2 infrastructure.