Your browser does not support the <audio> element.

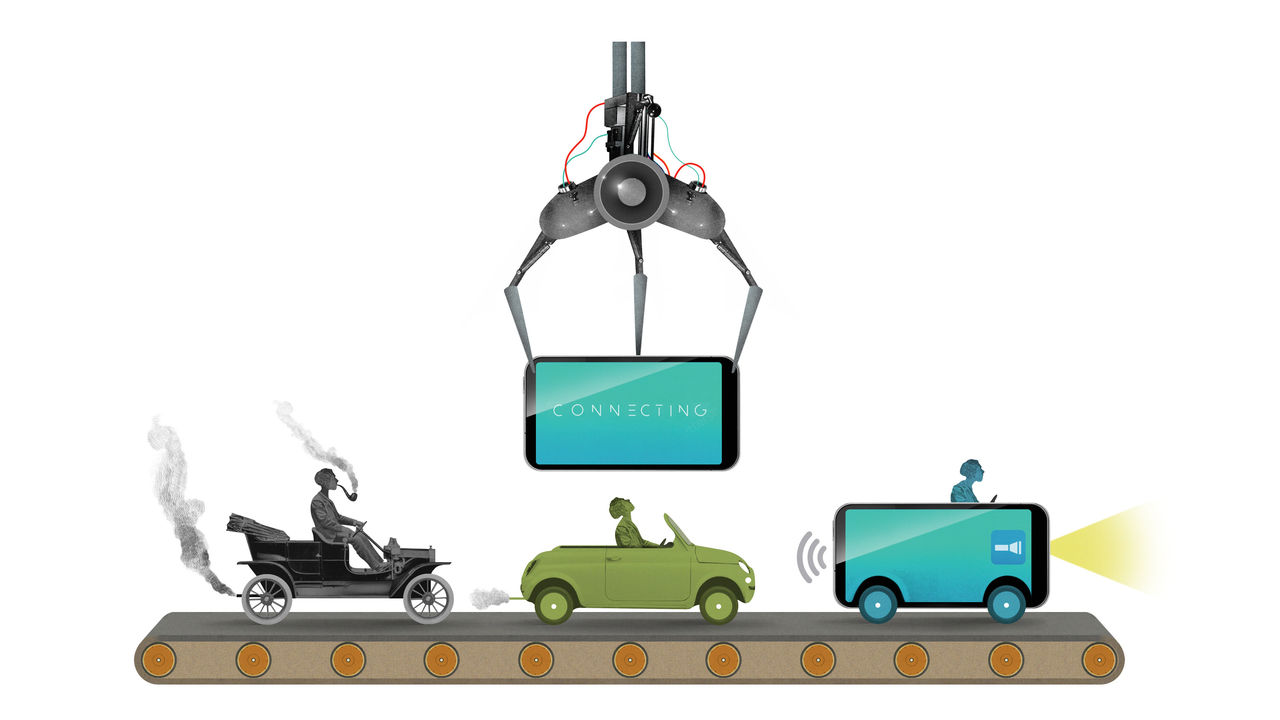

CARS AREN’T what they used to be. This is not a petrolhead’s lament. It is a statement of technological fact. These days even automobiles powered by a growling V8 engine contain a few kilometres of electrical wires, up from a few hundred metres in the 1990s, plus a thousand semiconductor chips and millions of lines of computer code to control everything from locks and antilock brakes to infotainment. And that is before you get to the electric vehicles (EVs) that are set to one day hog the world’s roads, a recent slowdown in sales notwithstanding, let alone to Elon Musk’s self-driving Cybercabs. The battery and other electronics make up more than half the value of components in an EV, compared with a tenth in that V8. Now, 17 years after Apple gave the world the iPhone and 13 since Toyota somewhat prematurely coined the phrase “smartphone on wheels”, modern cars have a lot in common with consumer gadgets.

One Taiwanese company would like them to share another commonality—namely itself. Foxconn wants to be to carmakers what it already is to Apple and other consumer-electronics brands, which is to say their contract manufacturer of choice. On October 8th the firm unveiled two new EV “reference” models, an unexpectedly handsome people-carrier and an ungainlier small bus. They join a line-up of six earlier designs for car companies to pick from, fine-tune to their liking and slap their badge on. One of these, an SUV, has become a domestic EV bestseller for Luxgen, a 15-year-old Taiwanese carmaker. Next year Foxconn aims to be mass-producing a version of it with an American partner. One day it would love to be churning out Teslas.

If an EV is a smartphone on wheels, why not build it like a smartphone? And who better to do this than the world’s leading assembler of electronics? For Foxconn, the $4trn global car market is a big prize as smartphone sales tail off. For EV newcomers with no manufacturing chops and legacy car giants with the wrong sort, farming out assembly could be a way out of “production hell”, as Mr Musk once memorably described Tesla’s efforts to expand capacity. And what automotive CEO would pass up an opportunity to be more like Tim Cook at Apple, overseeing a revered brand, ungodly profits and a $3.5trn market capitalisation?

This should not be a huge leap for carmakers. Their suppliers nowadays contribute two-thirds of the value of a vehicle, estimates Matteo Fini of S&P Global Mobility, a research group, leaving them to do the design, final assembly, marketing and distribution. Moreover, integrating all the disparate subsystems is a growing headache. Already some BMWs, Jaguars and Toyotas, notably low-volume, high-margin coupés and convertibles, are put together by contractors such as Magna Styer. In 1999 Ford toyed with getting out of metal-bending entirely in order to focus on the immaterial bits of the business. As a Ford executive summed it up to The Economist at the time, “Auto companies are seen as firms which invest a lot and get little return. Consumer companies are seen as investing little and earning a lot.”

That idea proved too futuristic for turn-of-the-century Detroit and was ditched. But the executive’s words rang true then and ring truer today. Ford and Apple each maintain $40bn or so in fixed assets and spend $8bn-10bn a year on capital investments. Yet in 2023 the iPhone-maker raked in more than twice Ford’s revenue and 23 times its net profit. Even if you add its $30bn in research and development (R&D) costs to its capital expenditure, Apple is matched by Volkswagen and Toyota, the world’s two biggest carmakers, neither of which sells as much. As a share of revenue, Apple’s combined R&D and capital spending, at 10%, is dwarfed by that of BYD, China’s EV champion, which last year spent 27%.

There are two problems with the Apple comparison. First, the challenge of replicating one of the best businesses ever may intimidate even car bosses known for their lorry-sized egos. Second, Apple relied on contract manufacturers for its iPhone from the beginning, making it impossible to tell how much of its outperformance is down to this strategy rather than some other commercial je ne sais quoi.

An earlier consumer-electronics pioneer offers a more instructive analogy. In 1993 Hewlett-Packard, then one of the world’s biggest makers of computer hardware, began outsourcing the production of its PCs, printers and servers. By 2000 virtually all its computers were made by third parties. In that period Hp increased its revenues from $20bn to $49bn. It pulled this off while barely growing its fixed-asset base and nearly halving the share of sales going on R&D and capital expenditure, from 16-18% in 1988-92 to 9% by the end of the decade. Its global workforce shrank from 96,000 to 88,500. Net profit more than trebled. Return on equity improved from 12% in the early 1990s to an average of 19% between 1994 and 2000.

HP sauce

Now imagine that Toyota or Volkswagen trimmed their outlays along similar lines. Cutting their R&D and capital spending by half would free up $19bn apiece in each firm’s cashflow after capital expenses. Assuming their shares kept trading at a typical recent multiple of this free cashflow, Volkswagen would stand to gain $170bn in market value and Toyota some $270bn, more than doubling and quadrupling their market values, respectively.

This presupposes other things being equal (they aren’t), powerful labour unions giving the nod (they wouldn’t) and Foxconn remaining content with margins that make gaps in a Rolls-Royce’s bodywork look gaping (fat chance). And it still leaves the car firms a country mile behind Apple. But as they struggle to reinvent themselves for the electric-vehicle age, understanding what made consumer electronics so successful is a good place to start. ■

If you want to write directly to Schumpeter, email him at [email protected]

Subscribers to The Economist can sign up to our new Opinion newsletter, which brings together the best of our leaders, columns, guest essays and reader correspondence.