Get your daily, bite-sized digest of blockchain and crypto news today – investigating the stories flying under the radar of today’s news.

In crypto news today:

- Why is crypto up today?

- Elevated Speculation Appetite and Improved Short-Term Profitability – Glassnode

- WazirX to ‘Socialize’ $230 Million Loss Among Customers

- Bitget Wallet Emerges as Second Largest Web3 Wallet after MetaMask in Japan

__________

Why is crypto up today?

There has been another shift in the market over the market, moving from the red to the green fields.

The global cryptocurrency market capitalization is up 3.1% to $2.59 trillion.

The total cryptocurrency trading volume in the last day is $63.8 billion.

Only three coins have seen their prices drop today – all below 1%.

JasmyCoin (JASMY) is down 0.9% to the price of $0.03186.

MANTRA (OM) fell 0.8% to $1.17, while Pyth Network (PYTH) decreased by 0.6% to $0.3937.

On the other hand, two Bitcoin forks are the day’s best performers.

Bitcoin Cash (BCH) has increased by 13.9% to $450.17, and Bitcoin SV (BSV) is up 11.8% to $50.56.

BRETT is the only other coin that recorded a double-digit rise: 10.9% to $0.1381.

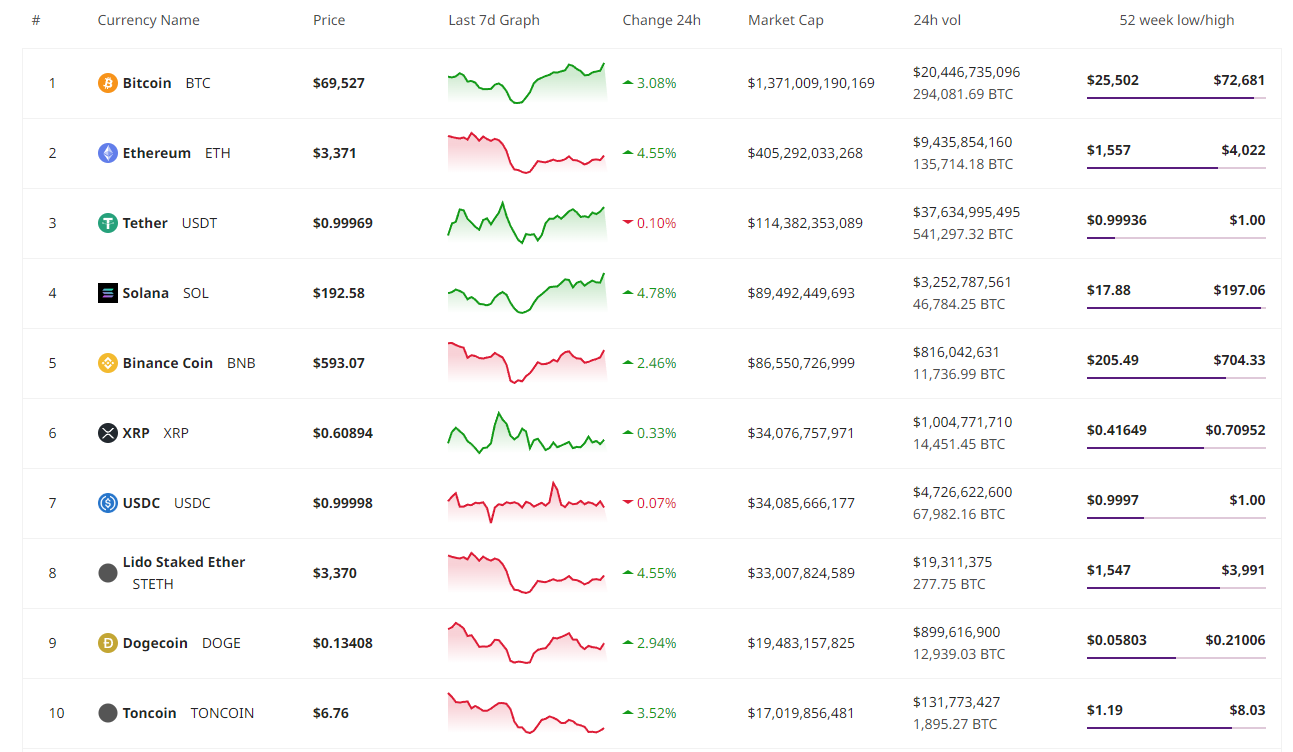

At the same time, all top 10 coins per market cap have increased over the past 24 hours.

Solana (SOL) is the best performer in this category. It’s up 4.8%, now trading at $192.6.

While XRP increased the least (0.3% to $0.60894), the rest of the list is up between 2.5% and 4.5%.

Bitcoin (BTC) is up 3.1%, currently trading at $69,527.

Ethereum (ETH)’s price rose 4.55%, reaching $3,371.

Meanwhile, the market’s upward movement occurred ahead of the crucial Federal Open Market Committee (FOMC) meeting scheduled for July 30-31.

Also, former VanEck advisor Gabor Gurbacs argued that the US Federal Reserve acquiring BTC would be a hedge against itself, diversify holdings, and safeguard against inflation.

Elevated Speculation Appetite and Improved Short-Term Profitability – Glassnode

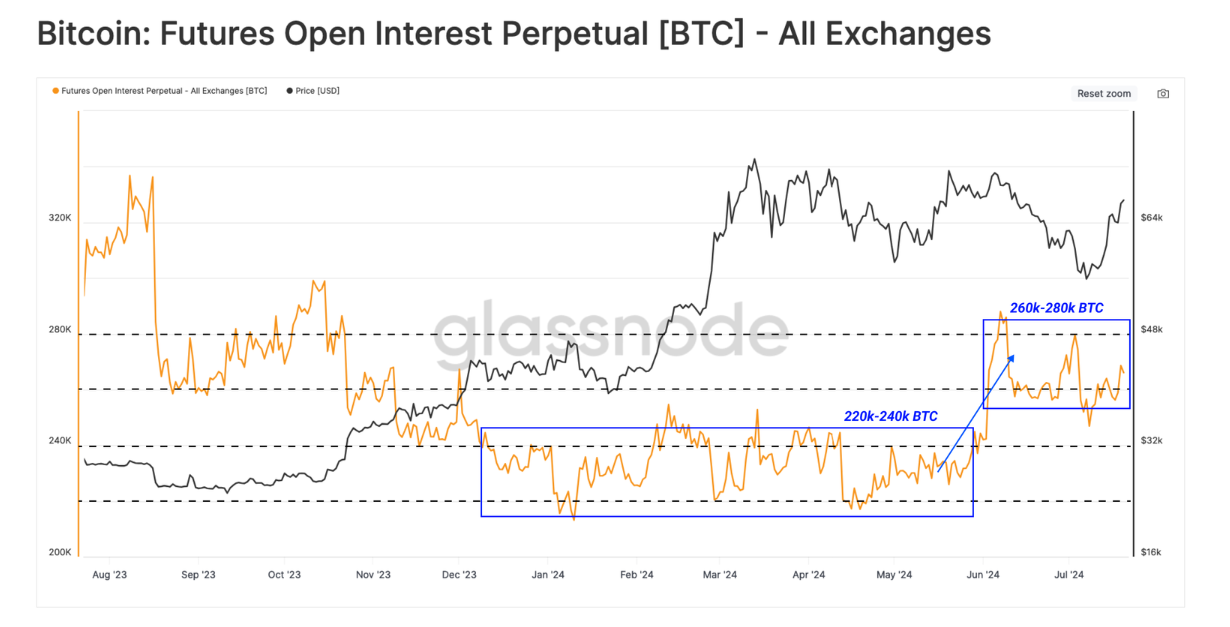

In crypto news today, open interest across perpetual futures has ranged between 220,000 and 240,000 BTC, according to a recent report by analytics firm Glassnode.

It explained that the value decreases fast during deleveraging events and increases during more speculative periods.

“More recently, open interest has risen into the 260k to 280k BTC range, indicating an elevated appetite for speculation since early June,” the report said.

The analysts further found that the short-term profitability has improved

The recent price surge has been a relief for Bitcoin Short-Term Holders (STHs), a proxy for new demand and recent buyers.

They saw over 90% of their supply fall into a loss in late July, putting them into a financially stressful position.

However, the rally has broken back above the STH cost basis. It returned 75% of the held supply to an unrealized profit.

“At present, all constituents of the Short-Term Holder cohort have returned to positive profitability, which highlights the strength of the prevailing uptrend. This is likely to be positive for overall investor sentiment,” the report noted.

WazirX to ‘Socialize’ $230 Million Loss Among Customers

Indian crypto exchange WazirX recently suffered a cyberattack that saw some $230 million stolen. This is the equivalent of 45% of the user funds on the platform.

On July 27, the exchange announced that it would implement “a fair and transparent socialized loss strategy to distribute the impact across all users equitably.”

The team has decided on the 55/45 approach, claiming that it “offers a faster, more flexible solution.”

55% of user assets will be made available for trading and/or withdrawals, depending upon the option a user selects.

The remaining 45% will be converted to USDT-equivalent tokens and locked.

They argued that this strategy “allows immediate access to a significant portion of your assets while maintaining the possibility of further recovery for those who choose to wait.”

In response to the recent cyber attack that led to the theft of $230 million (45% of user funds), we are committed to handling the situation fairly and transparently. We are implementing a socialized loss strategy to distribute the impact equitably among all users.

To manage the… pic.twitter.com/uOKvxWuEip

— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) July 27, 2024

The exchange will create “a balanced portfolio” for the unlocked portion (55%) using a basket of crypto assets derived from available assets on the platform.

If 55% of the unlocked portfolio includes affected tokens, the team will balance it by replacing the affected portion with a basket of unaffected assets.

“We are committed to continuing efforts to recover the stolen funds,” the announcement added.

“We will also explore options, such as airdrops and any other emerging ideas, as we continue on our path to recovery”

Bitget Wallet Emerges as Second Largest Web3 Wallet after MetaMask in Japan

In other crypto news today, cross-chain crypto wallet Bitget Wallet saw “robust growth” in the Japanese market in Q2 of 2024.

According to the press release, it recorded a 34% increase in new user adoption within the region.

Per data.ai, Bitget Wallet ranks second in Japan’s Web3 wallet market for downloads in the first half of this year, closely trailing MetaMask.

The recent introduction of its native token BWB saw “significant traction” in Japan, particularly through the token airdrop.

Per the CoinMarketCap data, BWB was ranked among the top ten most popular cryptocurrencies in Japan.

Having a great weekend? Check out our weekly recap 🩵

(TON)s of #TONNECT2024 campaigns happening right now with @CatsXWar, @avagoldcoin, @Tomarket_ai, and @the_yescoin! Don’t miss your opportunity to win some 👀

Get to winning ways on #BitgetWallet‘s Earning Center now!#TON pic.twitter.com/h8QBcEdCO7

— Bitget Wallet 🩵 (@BitgetWallet) July 28, 2024

“With the launch of BWB and a constant stream in innovative product features, we [Bitget Wallet] believe that the Japanese market will continue to acknowledge the utility and significance of our platform,” commented Alvin Kan, COO of Bitget Wallet.

Bitget Wallet’s future plans will revolve around the development of the Bitget Onchain Layer, an intermediary segment that aims to better connect users to Web3 with unparalleled ease, the team said.

__________

For the latest crypto news updates, bookmark this page and subscribe to our newsletter!