Dogwifhat ($WIF), the Solana-based memecoin featuring its iconic pink-hat-wearing dog mascot, has regained bullish momentum in the crypto market.

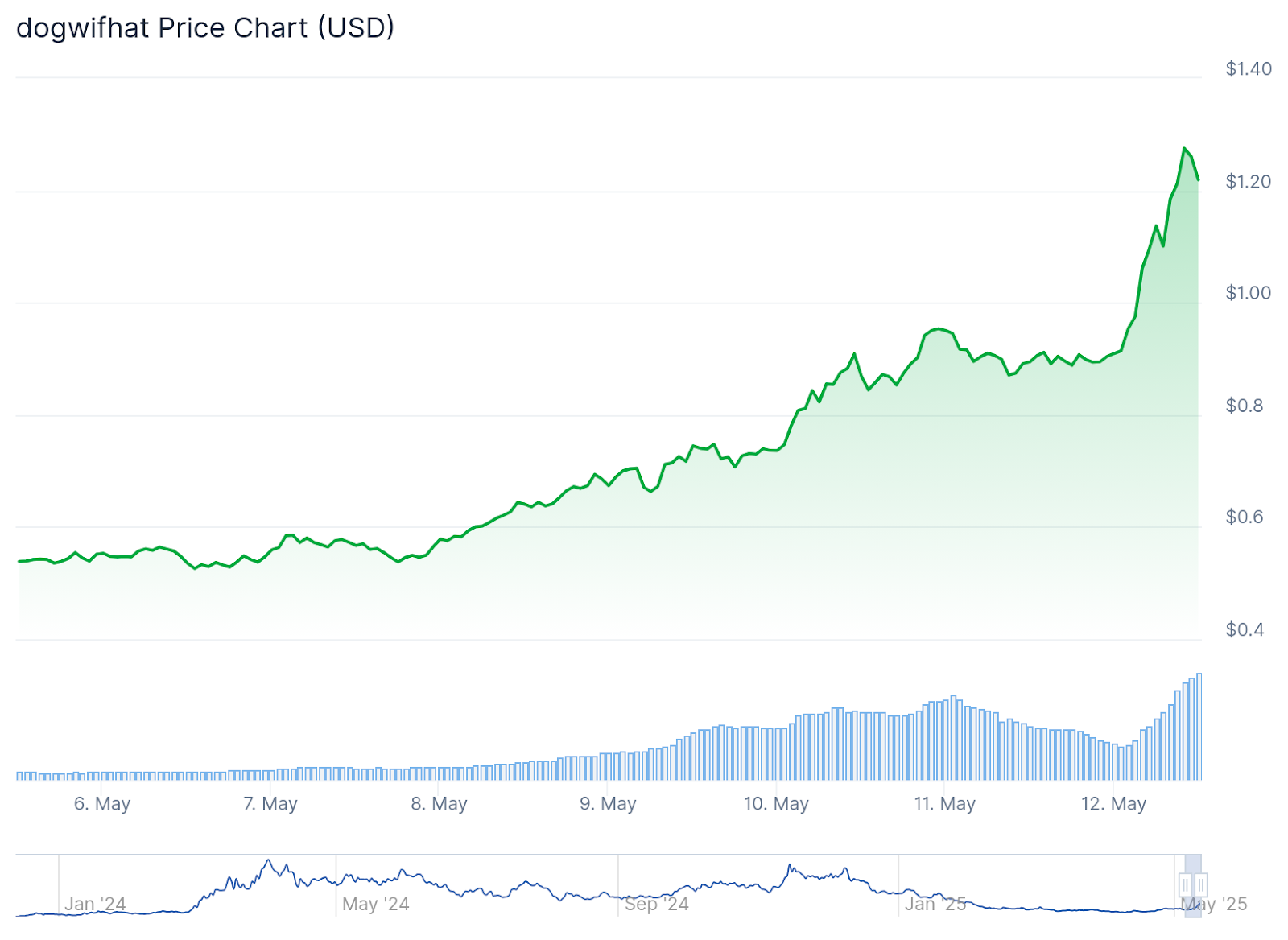

Over the past 24 hours, $WIF has jumped more than 45%. It is now trading around $1.30, with trading volume soaring to $1.27 billion.

This renewed surge has propelled $WIF back into the top 70 cryptocurrencies by market capitalization, for the first time since January.

After peaking near $4.8 in late 2024, the token crashed to a low of $0.3173 last month. Yet, the project staged a powerful comeback.

Since that bottom, $WIF has rebounded by over 200%, making it one of the top-performing assets in recent weeks.

Early $WIF Investors Still Up Over 550,000% Despite Volatility

Despite remaining 60% below its all-time high, early investors still boast lifetime gains exceeding 550,000% since its debut in November 2023.

Currently ranked as the seventh-largest memecoin, DogWifHat sits behind other popular tokens like $FARTCOIN, $BONK, and $TRUMP but outperforms them all in weekly gains.

The latest price action follows a May 11 tweet from well-known crypto trader Ansem, who hinted at a resurgence in WIF’s volume.

At the time, $WIF was trading near $0.80.

Since then, crypto Twitter has seen numerous traders report leveraged gains ranging from 100% to as high as 15,000%

Derivatives data from Coinglass suggests the rally may continue.

In the past 24 hours, open interest in $WIF has increased by 38.97%, with over $500 million worth of positions opened, bringing the long/short ratio to 0.994.

This indicates that most traders are expecting further upside.

BingX Volume Spikes Hint at Asia-Led $WIF Accumulation

With WIF already listed on major exchanges like Binance, Bybit, Coinbase, OKX, and even Robinhood, short-term targets between $2 and $3 are circulating among bullish traders.

However, technical analysts warn of strong resistance near the $1.50 level, where the price may face short-term selling pressure.

https://twitter.com/CryptomechanicX/status/1921824844523405631

Some believe any pullback from this point is an opportunity to enter before another leg higher.

Optimism in the market has been boosted by the recent U.S.-China agreement to ease tariffs temporarily, which has reignited a risk-on sentiment among speculative traders, particularly in Asia.

Chinese traders have been piling into memecoins like DogWifHat and Dogecoin ($DOGE), signaling a renewed appetite for high-risk assets.

Singapore-based crypto exchange BingX, popular among Chinese users, has reported a 69% increase in $WIF/$USDT trading volume over the past day.

Open interest in that pair also rose by 62.14%, with $WIF/$USDC and $WIF/$USD contracts seeing at least 35% gains in open interest.

$1.60 Resistance Zone in Focus as $WIF Eyes $2 Target

Technically, $WIF has broken out of a prolonged consolidation range, building a base between $0.35 and $0.45 with resistance near $0.60.

A breakout above a descending trendline, drawn from January’s highs, triggered the current rally.

The price chart now shows a textbook accumulation breakout pattern. Momentum indicators, including the MACD, continue to favor the bulls.

The MACD line is accelerating above the signal line, with an expanding green histogram, a strong sign of upward momentum with no signs of bearish divergence.

$WIF is currently trading within a key resistance zone between $1.30 and $1.60, a range that previously acted as a supply zone earlier this year.

The shaded purple arc suggests a potential area of short-term exhaustion or consolidation before any further move higher.

https://x.com/pooop_real/status/1921737426675831294

If it breaks above $1.60, the next significant target lies at the psychological $2.00 level.

In the event of a retracement, $0.90, the prior breakout zone, is likely to offer immediate support, with stronger support at $0.60.