Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Bitcoin’s dominance in the cryptocurrency market is on the rise as it regains critical support levels, leaving altcoins struggling to maintain momentum. Trading at $98,466, Bitcoin shows a 4.30% recovery in the last 24 hours, driven by renewed investor interest and higher trading volumes.

This upward movement reflects a strong buy-in sentiment, as the cryptocurrency eyes the $100,000 mark.

Bitcoin’s Technical Outlook: Resistance at $99,500

Bitcoin faces a key resistance level at $99,500, a point where a downward trendline intersects with recent price activity. The formation of a tweezers top pattern on the 2-hour chart further adds to selling pressure at this level.

A breakout above $99,500could signal the beginning of a bullish continuation, targeting the next critical resistance levels at $102,650 and potentially $105,400.

On the downside, Bitcoin finds support at $95,675, with further safety nets at $92,230 and $89,850. The 50-day Exponential Moving Average (EMA) at $97,800 provides nearby technical support, while the Relative Strength Index (RSI) at 50 indicates neutral market conditions.

This balance suggests the market is at a tipping point, with a breakout or rejection at $99,460 likely to determine its next direction.

Bitcoin Dominance Surges: End of Altcoin Season?

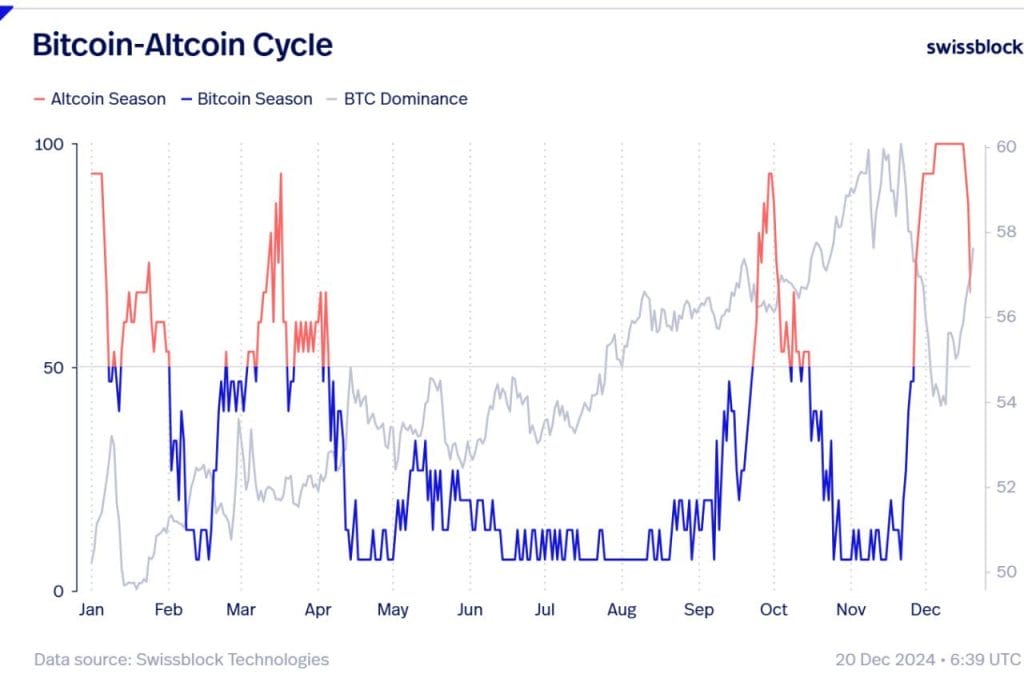

The attached chart underscores Bitcoin’s rising dominance, as altcoins lose ground amidst waning investor confidence. Altcoin season, represented by declining Bitcoin dominance earlier this year, seems to have ended as BTC regains market traction.

The blue curve representing Bitcoin dominance has steadily climbed, aligning with a price recovery, while the red altcoin dominance line falters.

A tweet by @Negentropic_ encapsulates the sentiment:

“Is This the End of Altcoin Season? Bitcoin dominance surges, leaving altcoins lagging. A BTC breakout could change the game.”

This narrative reflects a broader market shift as traders prefer Bitcoin’s relative stability during uncertain conditions.

For altcoins to regain momentum, Bitcoin would need to stabilize above $100,000, creating space for parallel growth in the market.

What This Means for Investors

Bitcoin’s price action at $99,460 is a make-or-break moment. A breakout above this key resistance could trigger a renewed rally, targeting $102,650 and beyond. However, failure to clear this level might lead to consolidation or a retest of the $95,675 support.

For altcoin enthusiasts, the market’s direction hinges on Bitcoin’s ability to maintain dominance. The chart highlights altcoin stagnation, signaling that this is not the ideal time to overleverage on altcoins. Instead, investors might consider accumulating undervalued assets in anticipation of the next cycle.

Key Insights:

- Critical Resistance: Bitcoin faces a pivotal challenge at $99,460, with targets at $102,650 and $105,380.

- Support Levels: Downside risk exists with supports at $95,675, $92,230, and $89,852.

- Dominance Shift: Bitcoin dominance rises, signaling an end to altcoin season.

–

You might also like

$BEST Wallet Raises $5.22M: Final Hours to Invest

Best Wallet continues revolutionizing Web3 by supporting thousands of cryptocurrencies across 50+ major blockchains, including Bitcoin and Ethereum. Offering seamless options to buy, sell, and swap both same- and cross-chain assets without requiring KYC verification, the platform is gaining significant traction.

The $BEST token presale has now raised an impressive $5,219,590.17, with only 5 hours until the next price increase. Tokens are still priced at $0.023275, making this a prime opportunity for investors to secure early benefits before the price rises.

Why Invest in $BEST?

- Utility-Driven: Designed for DeFi, staking, and seamless token claims.

- Expanding Ecosystem: Partnerships with trending platforms like Pepe Unchained.

- Engaged Community: Active participation across Twitter and Telegram.

Best Wallet combines user-focused features with a rapidly growing ecosystem, positioning itself as a leader in the Web3 space. Act now to secure $BEST tokens at the current price before the presale concludes!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.