Your browser does not support the <audio> element.

WHAT IS THE ideal job to outsource to artificial intelligence? Today’s AIs, in particular the ChatGPT-like generative sort, have a leaky memory, cannot handle physical objects and are worse than humans at interacting with humans. Where they excel is in manipulating numbers and symbols, especially within well-defined tasks such as writing bits of computer code. This happens to be the forte of giant existing outsourcing businesses—India’s information-technology (IT) companies. Seven of them, including the two biggest, Tata Consultancy Services (TCS) and Infosys, collectively laid off 75,000 employees last year. The firms say this reduction, equivalent to about 4% of their combined workforce, has nothing to do with AI and reflects the broader slowdown in the tech sector. In reality, they say, AI is an opportunity, not a threat.

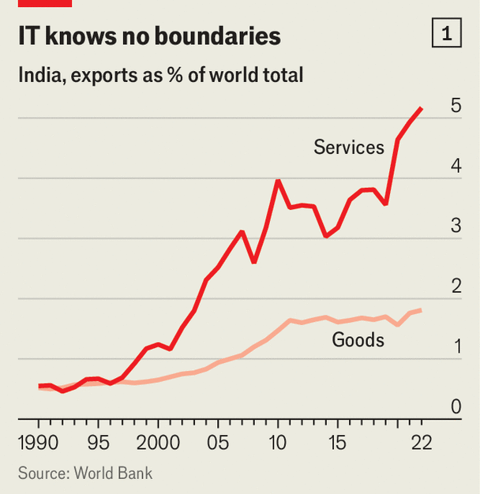

Business services are critical to India’s economy. The sector employs 5m people, or less than 1% of Indian workers, but contributes 7% of GDP and nearly a quarter of total exports. Simple services such as call centres account for a fifth of those foreign revenues. Three-fifths are generated by IT services such as moving data to the computing cloud. The rest comes from sophisticated processes tailored for individual clients. Capital Economics, a research firm, calculates that an extreme case, in which AI wiped out the industry entirely and the resources were not reallocated, would knock nearly one percentage point off annual GDP growth over the next decade in India. In a likelier scenario of “a slow demise”, the country would grow 0.3-0.4 percentage points less fast.

The simplest jobs are the most vulnerable. Data from Upwork, a freelancing platform, shows that earnings for uncomplicated writing tasks like copy-editing fell by 5% between ChatGPT’s launch in November 2022 and April 2023, relative to roles less affected by AI. In the year after Dall-E 2, an image-creation model, was launched in April 2022, wages for jobs like graphic design fell by 7-14%. Some companies are using AI to deal with simple customer-service requests and repetitive data-processing tasks. In April K. Krithivasan, chief executive of TCS, predicted that “maybe a year or so down the line” chatbots could do much of the work of a call-centre employee. In time, he mused, AI could foretell gripes and alleviate them before a customer ever picks up the phone.

But Mr Krithivasan and fellow Indian IT bosses believe that in the age of AI the world is going to need more tech workers, not fewer—and a lot of them will come from India. They are thinking how to turn the AI revolution to their firms’ advantage.

One way is to use AI to boost the firms’ productivity. Infosys has rolled out AI helpers to all 330,000 of its employees. It says this has already led to a 10-30% reduction in the time needed to build some new applications. Sales assistants who previously waited hours or days to get input from colleagues in order to answer clients’ questions can now respond in 30 minutes.

The hope is that added efficiency will greatly boost demand for such services. Another source of fresh demand—and the IT companies’ second big opportunity—is for all-new tasks tied to clients’ deployment of AI in their organisations. The IT firms have been preparing for this. A paper last year by Alexander Copestake of the IMF and colleagues identified “near-exponential growth” in demand for AI-related skills in India’s service sector since 2016. Two in five Indian AI job postings in the 2010s were in Bangalore, which is home to Infosys and where TCS has a large campus.

These recruits have been busy. Infosys has already built AI tools, such as chatbots that answer queries based on internal company data, for 50 clients. An executive at TCS says his teams have been developing voice assistants for customers since before anyone heard of ChatGPT. Some liken the current AI moment to the lead-up to the year 2000, when Western businesses raced to prevent their computer systems from being fatally flummoxed by the zeroes marking the new millennium. Fear of the “Y2K bug” enriched the Indian IT firms. A series of mini-Y2Ks, as clients rush to stay ahead of the fast-changing technology, may create another bonanza.

The outsourcing giants hope that AI will also help them win back some business they have been losing to their multinational clients’ own Indian IT operations. In-house “global capability centres” have been mushrooming in India in recent years. They make it easier for companies to safeguard sensitive data and intellectual property. But if AI tools become an off-the-shelf commodity like cloud storage, then economies of scale could give the IT-services specialists an edge. Last June Infosys acquired the IT centre in India belonging to Danske Bank, a Danish lender.

Nandan Nilekani, chairman and co-founder of Infosys, argues that his company and its Indian IT rivals will benefit from what he calls “velocity of experience”. Already, he observes, one client wants a coding “copilot”; another wants better customer support; a third wants to predict how a wildfire might affect an energy utility. Solving these diverse problems makes firms like Infosys well-suited to tackle new scenarios, he explains. In time, it may help them avoid a cliff-edge. ■

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.