Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key takeaways:

- Trump’s return may bring major changes to crypto, with promises of friendlier policies.

- Experts expect crypto prices to rise due to Trump’s influence on regulations and taxes.

- Trump plans to create a Bitcoin reserve, a crypto council, and replace key regulators.

- Some experts doubt if Trump will fulfill all his crypto promises.

- Crypto markets jumped after Trump’s win, reflecting hopes for better regulations.

As Donald Trump reclaims the White House, experts comment on the potential impact of his U.S. presidential election victory on the crypto industry, its future, crypto prices, regulations, taxes, and mining, among other sectors.

Trump Wins US Presidential Election

On November 5, 2024, Americans gave ex-President Donald Trump another term in the country’s highest office, defeating Vice-President Kamala Harris. The inauguration ceremony will be held on Jan. 20, 2025.

For weeks prior to the election, it had been said that this race was very narrow.

“In the end, this was not a tight race, and it was wrapped up quickly,” said Kathleen Brooks, research director at XTB. “The national opinion polls got this election very wrong.”

This outcome helped boost risk sentiment on election day and reduced the chance of civic unrest.

Notably, HTX Ventures, the global investment division of HTX, found that crypto companies became the main contributors to political donations in the U.S. in 2024.

Coinbase and Ripple were among the biggest corporate political donors, “contributing nearly 48% of total corporate donations,” the report claimed.

“These funds not only influence presidential candidates’ policies but also push for congressional election strategies in favor of cryptocurrency. As a result, the crypto industry has moved from behind the scenes into the public eye, becoming a vital force in U.S. politics.”

You might also like

Trump’s Crypto Plan

Many experts and industry insiders predict that a major change is coming.

For context, the administration of former President Joe Biden worked to tighten crypto regulations and create a strict regulatory framework. Because of unclear policies, crypto companies left the country in droves.

Vice President Harris seems to be slightly more crypto-friendly than Biden, but her statements remained limited and cautious. She promised to encourage “innovative technologies like AI and digital assets.” However, she failed to provide detailed plans on key points such as taxation, mining, and self-custody.

Harris did say she would tax unrealized gains on assets. But this “would have been very bad for holders of major assets such as BTC,” Swarm Markets’ co-founder Timo Lehes said.

When it comes to Donald Trump, though he had previously called Bitcoin and crypto in general a scam, he seems to have realized that there is money in it for him.

During this election campaign, he presented himself as a “crypto president” who would make the U.S. the “crypto capital of the planet and the Bitcoin superpower of the world.”

The Bitfinex exchange analysts commented that part of his campaign strategy was to impress US crypto investors. “Even though Trump was not particularly pro-crypto previously, his recognition that by supporting the industry, he would also receive support has meant that he was always the crypto market’s preferred candidate.”

Unlike Harris, Trump stated he would support mining and self-custody.

When it comes to taxes, Timo Lehes commented that Trump’s program will likely keep Government spending high, with the promise of tax cuts that will be fueled by debt.

“This is good in a world where fiat values are eroded, and inflation stays high, and will ultimately be good for crypto assets such as Bitcoin, seen as one of the best inflation hedges now available to investors,” said Lehes.

You might also like

Is Trump Now a Crypto Native?

Harrison Seletsky, director of business development at the digital identity platform SPACE ID, commented that Trump outlined several crypto-friendly policies. He committed to supporting the American crypto industry. “This is set to pave the way for further development of blockchain infrastructure.”

Trump’s proposals include creating a strategic Bitcoin stockpile, establishing a crypto presidential advisory council, and barring the Federal Reserve from issuing a central bank digital currency (CBDC).

He also said he’d replace crypto nemesis Gary Gensler as the Securities and Exchange Commission (SEC) Chair.

Zumo’s founder and CEO, Nick Jones, added that Trump is perceived as a significantly more crypto-friendly candidate. Therefore, “supporters will now hope for a more innovation-friendly environment.”

With Trump’s victory came a surge in crypto prices—how long it will last is another question.

Russell Shor, Senior Market Specialist at multi-asset trading platform Tradu, commented that “the surge reflects growing market excitement over Trump’s potential impact on crypto.” Shor said:

His plans for a strategic Bitcoin reserve and an SEC leadership overhaul “signal a major shift, sparking investor confidence in a crypto-friendly future.”

But Will He Fulfill His Promises?

It’s easy to see why Trump’s promises would appeal to crypto voters. But the question remains: how many of them will he actually attempt to make a reality—unless they directly benefit his bottom line?

Per Kathleen Brooks, research director at XTB, “the fact that Trump did not mention tariffs or global trade in his victory speech is helping to boost risk sentiment. However, it is early days, and there will be plenty of time in the future for Trump to talk about trade barriers.”

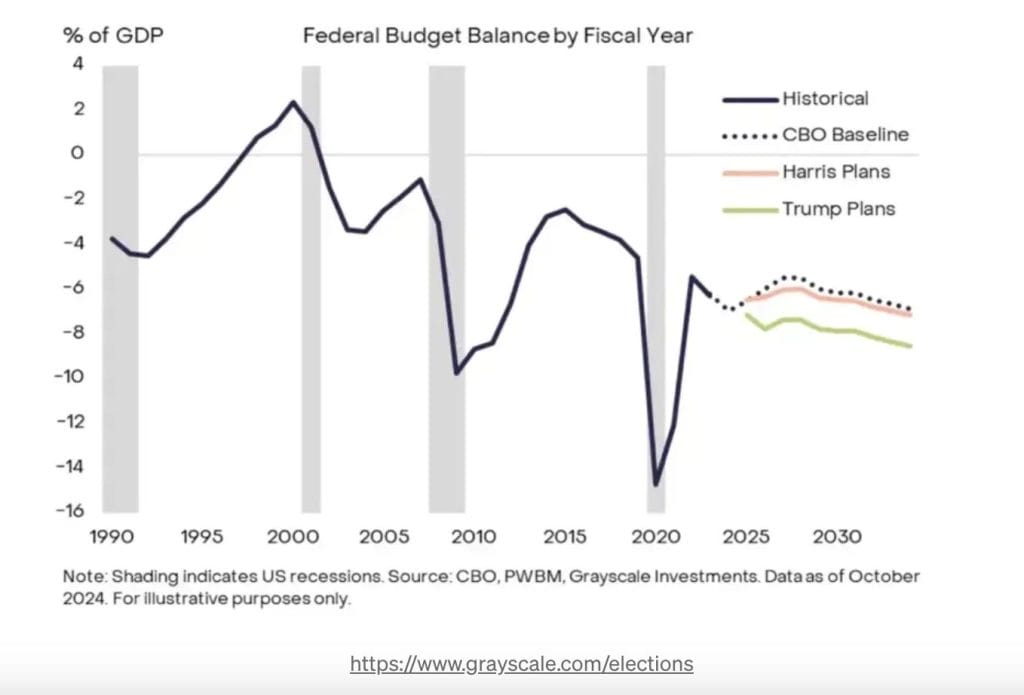

According to HTX Ventures, if Trump reinstates his 2017 tax cuts and lowers tax rates further, the deficit might climb to 7.8% of GDP.

Brooks also noted that, while Trump said he would pay off the debt, independent economists argue his presidency would boost it instead.

You might also like

Trump Benefiting Elon Musk, Hurting Competition

Trump’s win directly benefits his close supporters, including Tesla’s Elon Musk, who was one of the loudest during this election campaign.

Nikos Tzabouras, Senior Financial Editorial Writer at Tradu, commented that the new Trump presidency could greatly hurt the EV market and the renewables sector. He has pledged to dismantle the green energy policies enacted by the Biden administration. Tzabouras said:

“However, Tesla’s leadership allows it to withstand such a shift, which could hurt its competitors more. Furthermore, Elon Musk has already pivoted Tesla to become an AI and robotics company that’s trying to deploy fully autonomous driving.”

Musk’s latest endeavors would need regulatory approvals, which he may gain much faster thanks to Trump’s deregulation push.

“Additionally, Elon Musk could have an open door to the White House, with President Trump talking for a long time about the Tesla CEO, during the post-election speech.”

Tesla shares were up a whopping 11% to $279.15 at the time of this writing on November 6, and they continue climbing.

Tesla’s share price “leaped in after-hours trading, riding the wave of positive sentiment and the possibility of Musk helping to run the U.S. in some capacity,” commented Kate Leaman, chief market analyst at AvaTrade.

Boris Bohrer-Bilowitzki, CEO of digital identity authentication and regulation company Concordium, also noted Trump’s close relationship with Musk, saying that the latter is “likely to play a key role in the next Trump administration.”

However, per the CEO, Musk’s involvement in the government “can only be a win for the [crypto] industry.”

What Happens Next For Crypto?

What happens next for crypto now that Trump has won is anyone’s guess. But experts seem to agree that his win is beneficial for crypto, at least in the short term.

Bitfinex analysts expect “a new wave of hope” to enter the market, as well as a significant amount of capital to be unlocked for crypto ventures in the short term.

Notably, AvaTrade’s Kate Leaman, like many other analysts, noted that Trump’s victory will lead to short-term market gains.

Swarm Markets’ co-founder Timo Lehes argued that the logic of the crypto market reacting positively is “fairly simple.” Trump is seen as much more favorable to the sector than a Harris administration might have been. Lehes said:

“This comes principally down to the view of how regulators in the US treat crypto. If we look at the last four years of the Biden administration, then this tells you all you need to know about how crypto has been treated by the Democrats.”

What he called “the Trump relief rally” is “a euphoric response to the potential for this regulatory bullying to now end.”

OKX Chief Commercial Officer Lennix Lai seems to agree that BTC’s all-time high was likely a result of Trump’s win. It signals that we are currently in “a potential paradigm shift into the next phase of growth for crypto.”

Lai said that if Trump implements his promised crypto policies, the move would have broad global repercussions.

“We hope forward-looking regulation that protects the industry, users and cultivates crypto innovation in America becomes a bipartisan topic in the future,” said Lai.

Clear Regulations Incoming, But Maybe Not in Short-Term

Many insiders seem to anticipate clearer regulation and “aggressive deregulation,” as AvaTrade’s Kate Leaman put it.

Anmol Singh, Founder of Zeta Markets, said he expects a relaxation in the crypto regulatory landscape, given Trump’s focus on deregulating the financial and tech sectors.

The Founder argued this would accelerate investment and capital inflows into crypto. It would increase innovation and adoption, enable crypto firms to innovate and move faster, and potentially open doors for more exchange-traded fund (ETF) approvals.

Rhys Bidder, Deputy Director of the Qatar Centre for Global Banking & Finance at King’s Business School and Senior Lecturer in Finance, sets out what this might look like:

Trump’s SEC candidate could be “more positively disposed” to crypto. They could lead the agency away from “regulation by enforcement” towards a “more restrained, less ambiguous and perhaps even supportive approach,” said Rhys Bidder, Deputy Director of the Qatar Centre for Global Banking and Finance at King’s Business School and Senior Lecturer in Finance.

Some SEC members have already supported such an approach and “even pockets of bipartisan support” for crypto in DC.

“As such, we could see a rapid change in the crypto regulatory and legislative environment,” Bidder said.

Things to watch for are how the SEC modulates its approach to whether certain crypto assets are securities as opposed to commodities, how they are assessed for taxes and financial regulation purposes, whether the government will include BTC in the strategic reserve, and whether the mining of bitcoin (with its enormous energy demands that were drawing the attention of environmentalists) is looked upon more favorably.

However, there could also be some tension between traditional finance (TradFi) Trump supporters and decentralized finance (DeFi) supporters.

All this said, Bitfinex analysts do not expect any action from Trump in the short term, “particularly as multiple complex issues need to be resolved,” including which cryptos should be classified as securities.

Solana’s Victories and Return of US Companies

One of the beneficiaries of clearer regulations could be Solana, as it may get its ETF approval under the Trump presidency, Singh suggested.

“Solana is expected to be the most impacted asset after the U.S. election results, and it is poised to influence regulatory policies in the crypto market,” he said.

He added that its categorization as a security could benefit considerably from a regulatory relaxation.

“While Bitcoin and Ethereum have already been classified as commodities by regulatory authorities, meaning their regulatory landscape might not shift dramatically, Solana is still viewed as a security by the SEC. This distinction positions it to gain more from any regulatory easing.”

Additionally, HTX Ventures argued that Trump’s victory could encourage crypto companies to list in the U.S.

The researchers said a clearer regulatory framework and a more relaxed regulatory environment could reverse the current trend of crypto companies moving out of the US market and blocking US IP addresses.

You might also like

How High Will Crypto Prices Go? $100,000 on the Table

While it’s not possible to make accurate price predictions, analysts seem to agree that, at least short-term, Trump’s victory will push the market upwards. However, not everybody thinks this is the only reason for the market to go green.

XTB’s Kathleen Brooks said that the Republican’s win will likely dominate markets for the long term.

That said, there was “no talk about tariffs or making Bitcoin a mainstream currency“ in Trump’s first speech as the expected President-elect. This may be one reason BTC backed away from hitting 75,000 in the first push upwards immediately post-election.

Nick Forster, Founder of on-chain options DeFi protocol Derive.xyz, argued that “the options market still sees a 15% chance for Bitcoin to surpass $100,000 by the end of the year.“ This highlights a significant optimism in the longer-term market trajectory.

John Glover, Chief Investment Officer of crypto lending platform Ledn, also argued that should Donald Trump win, there may be “a quick jump up” to some $82,000 followed by a period of sideways-to-lower trading back into $68,000-72,000 area “before we make the push to complete the larger 5 Wave pattern at or above $100,000 in Q2 of next year.”

He added that a break and close below $63,000 “could open up the potential for a correction down to $55,000-62,000, but that is not my preferred count.”

Meanwhile, research and brokerage firm Bernstein analysts predicted that BTC may hit a whopping $200,000 by the end of 2025, regardless of the person in the White House.

“The Bitcoin genie is out of the bottle, and it is hard to reverse this course. Our Bitcoin price target for the end of 2025 remains $200,000 independent of the election outcome.”

You might also like

Macroeconomics Over Politics

All this said we should expect uncertainty in macroeconomic policy to continue, leading to more short-term volatility, OKX’s Lennix Lai said.

“The market had also priced in a Trump win, which has created short-term euphoria as we’ve seen with today’s all-time high, but retrenchments on the way to further all-time highs are likely.”

Meanwhile, Rob Hadick, General Partner at Dragonfly, stated that “there’s a lot more going on” in the crypto market, besides political outcomes.

Significant factors such as potential interest rate cuts and increased liquidity drive the BTC price rise.

Crypto Market Immediately Post-Election: Bitcoin Hits All-Time High

On November 6 (UTC time), Bitcoin hit its new all-time high of $75,358. By the time of writing, it fell 1.8% to $74,246. Overall, it increased 6.8% over the past 24 hours.

At one point, there was not a single red coin among the top 100 coins per market cap. This was a rally many termed ‘Trump Pump.’ Swarm Markets’ Timo Lehes commented that cryptoassets, in general, were surging as BTC hit this new ATH.

Tradu’s Russell Shor said that Bitcoin “rocketed” to a record height. This reflected the “growing market excitement over Trump’s potential impact on crypto” and “investor confidence in a crypto-friendly future.”

Meanwhile, Nick Forster of Derive.xyz noted that options markets are signaling that the election-driven volatility for BTC “may have already reached its peak.” The one-week implied volatility has adjusted down to 68%.

“This recalibration suggests anticipated daily moves around 3.5% for both ETH and BTC over the next nine days,” he argued.

At the time of writing, Ethereum was up 8.3% in 24 hours. It traded at $2,642, far from its $4,878 all-time high.

“We’re still seeing expectations for short-dated volatility to remain above normal,” Forster added.

You might also like