Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

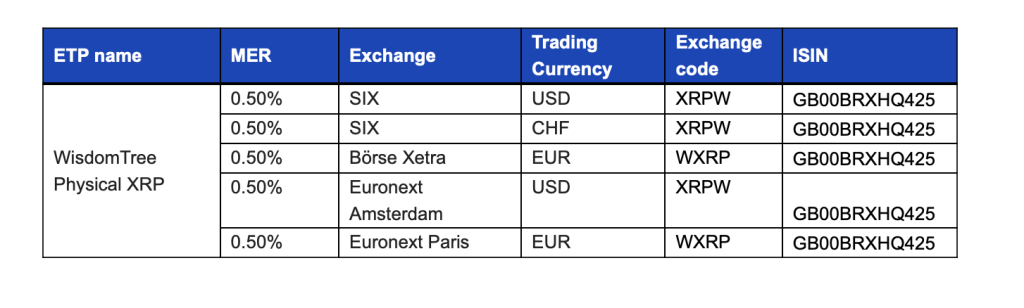

Asset manager WisdomTree Investments has launched the WisdomTree Physical XRP (XRPW) exchange-traded product (ETP) on Deutsche Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam.

The firm said the ETP has a management expense ratio of 0.50%, it stands as the most competitively priced ETP in Europe for XRP exposure. The product is trading under the ticker “XRPW.”

This latest ETP aims to give investors exposure to the spot price of XRP. The product is 100% physically backed by XRP. The underlying assets are stored in cold storage with regulated custodians.

What is XRP?

XRP is the native digital asset of the XRP Ledger (XRPL), a decentralized blockchain that uses a Proof-of-Association consensus mechanism. Unlike Proof-of-Work systems, XRPL’s design minimizes energy consumption while processing transactions within 3-5 seconds, explains WisdomTree.

Developed in 2012 as a payment-focused blockchain, XRP allows direct transactions without intermediaries, making it a widely used tool for cross-border payments.

XRP’s Role in Multi-Asset Portfolios

“With risk-on sentiment building, altcoin exposures like XRP could outperform a standard bitcoin and ether allocation,” said Dovile Silenskyte, director of digital assets research at WisdomTree.

XRP can sit alongside these mega caps in a multi-asset portfolio, reducing reliance on a single token and improving diversification,” adds Silenskyte.

She highlights the low correlation between cryptocurrencies and traditional assets, making them a valuable addition to an investment strategy.

WisdomTree already has many ETPs listed in Europe. The firm launched its first product, the WisdomTree Physical Bitcoin ETP, in December 2019.

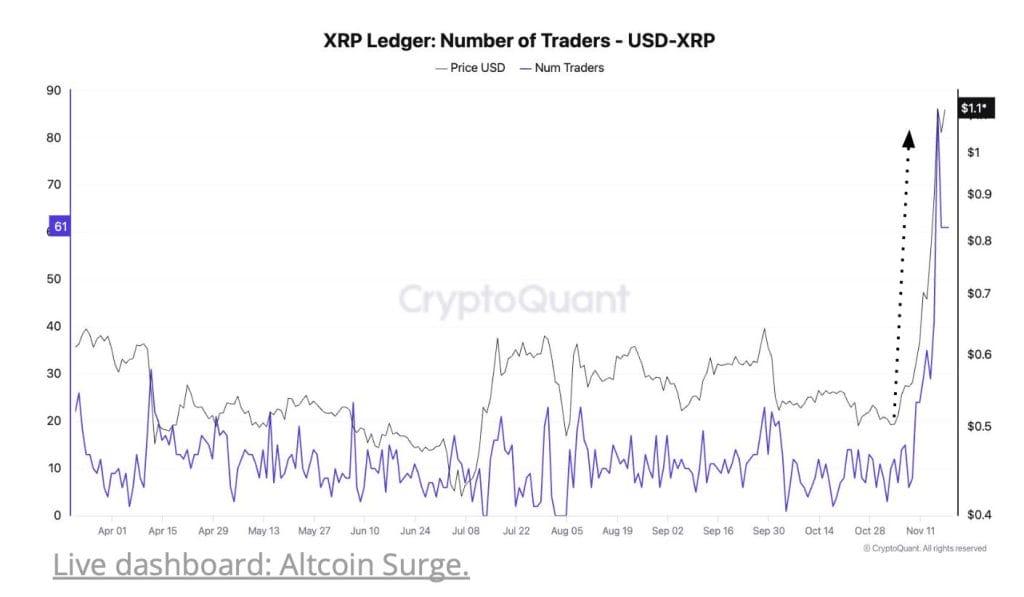

CryptoQuant reports XRP has seen a spike with its price rising 120% to $1.12, the highest since November 2021. This jump goes along with record-high decentralized exchange (DEX) activity on the XRP Ledger (XRPL).

XRP Surge Linked to DEX Activity on XRPL Network?

On November 15, DEX volume hit $3.5 million, marking a huge milestone for the new automated market maker (AMM) DEX launched in May 2024. The rise in XRP’s value shows renewed interest in XRPL with growing participation from traders and liquidity providers, reports CryptoQuant.