Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

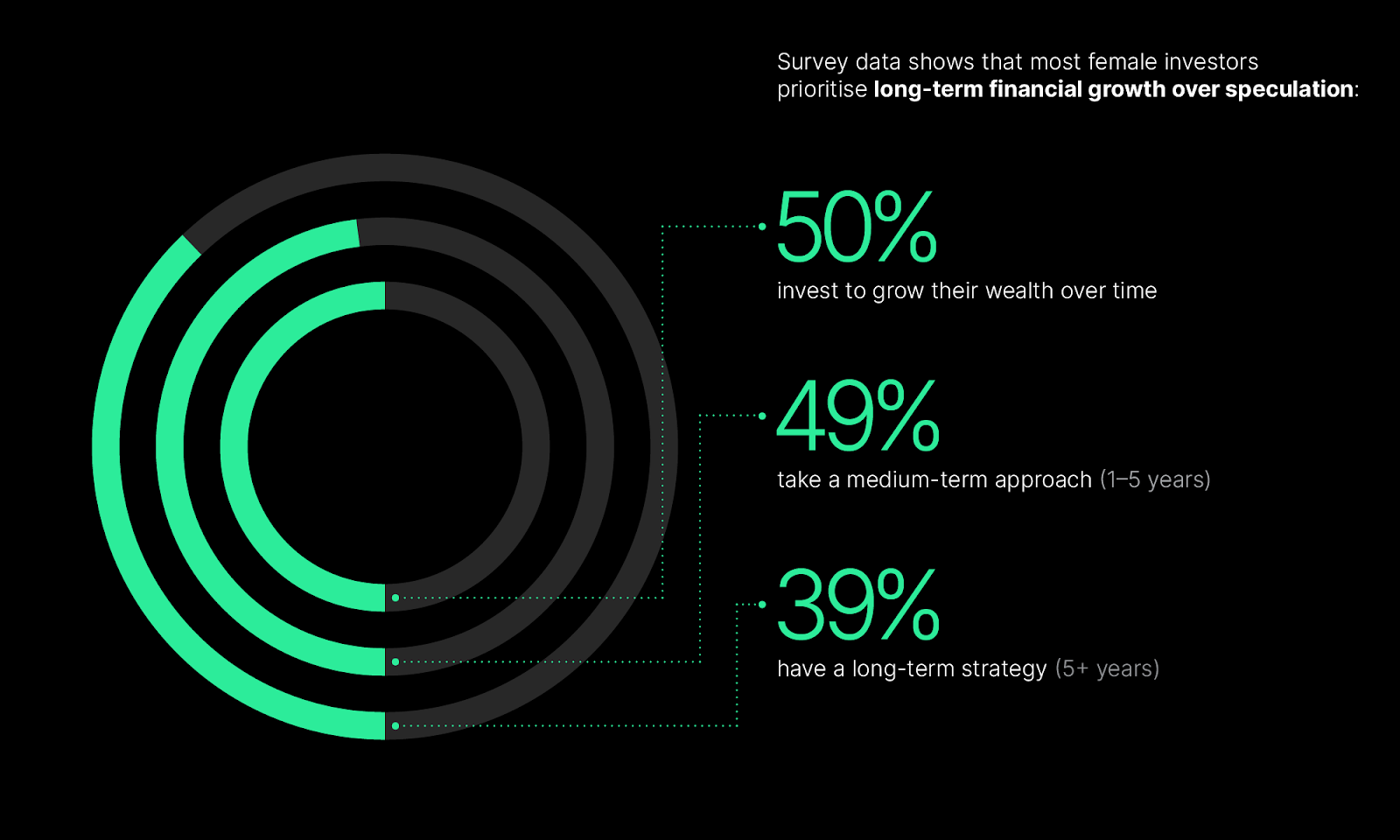

A new survey by European cryptocurrency platform Bitpanda, which currently has over 6 million users, shows that female investors prefer long-term strategies when investing in cryptocurrencies.

The study found that 81% of female investors consider themselves inexperienced, yet many are committed to holding their investments for several years in order to grow their wealth over time. Nearly 49% plan to invest for 1-5 years, while 39% have a time horizon of more than five years.

Women Show Strong Preference for Long-Term Investing

Unlike short-term traders, women investors on Bitpanda tend to hold their assets longer. According to the data, half of female investors focus on long-term financial growth, aiming for stability rather than quick gains.

When it comes to choosing assets, women favor well-known cryptocurrencies. The survey found that 30% of female investors pick Bitcoin (BTC) as their first investment, compared to 24% of men. In total, 54% of women invest in established digital assets like Bitcoin, Ether (ETH), or Ripple (XRP).

Lack of Knowledge and Financial Barriers

Despite their interest in crypto, many women face obstacles when investing.

The survey highlights two main challenges. 24% of female investors cite a lack of financial knowledge as their biggest hurdle, while 41% say limited disposable income prevents them from reaching their investment goals.

These findings suggest that while more women are entering the crypto space, education and financial accessibility remain key factors in shaping their investment decisions.

However, the study also indicates a steady increase in female participation in the crypto market.

Women who started investing in January 2024 have grown their portfolios by an average of 8.1% over the past year, signaling growing confidence in digital assets.

More Women Enter Crypto Space

The trend of more women entering the cryptocurrency market is also reflected in another study conducted by Mudrex, an Indian crypto platform. Mudrex found that the number of female crypto investors surged tenfold in 2024-2025 compared to the previous year.

The data reveals that women aged 25-30 represent the largest group of female crypto investors, making up 53% of the total. The second-largest segment is women aged 31-35, accounting for 36%, followed by younger investors aged 18-24 at 11%.

Investment preferences among women in the Mudrex survey align with the Bitpanda findings, reinforcing the popularity of Bitcoin and Ether as the top choices. Other well-known cryptocurrencies like Ripple, Litecoin (LTC), and Solana (SOL) also rank high. Interestingly, meme coins such as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe Coin (PEPE) are gaining traction, reflecting women’s interest in trending tokens.

The survey also found that 62% of women investors discuss financial decisions with family and friends, while 38% prefer independent decision-making.

Additionally, 65% of women trade individual cryptocurrencies, while 45% opt for coin sets, which are curated baskets of tokens designed to diversify portfolios.