Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ripple’s XRP, one of the most prominent cryptocurrencies, has demonstrated notable resilience despite renewed regulatory challenges.

Bitget chief analyst Ryan Lee, explains that XRP often serves as a bellwether for how regulators interact with the cryptocurrency industry as a whole.

Earlier in October, XRP experienced an 18% price drop due to mounting legal uncertainties with the U.S. Securities and Exchange Commission (SEC).

The latest developments have once again placed Ripple under scrutiny, sparking concerns about the token’s future and its impact on the broader crypto market.

According to Lee, “The SEC’s appeal in the XRP case has attracted market attention, raising concerns about its potential effects on both XRP’s price and overall market sentiment.” With the legal battle between Ripple and the SEC far from over, XRP’s future remains uncertain, causing ripples through the cryptocurrency landscape.

Regulatory Uncertainty and Market Sentiment

Lee identifies several key factors contributing to the ongoing volatility surrounding XRP. One of the primary concerns is the regulatory uncertainty created by the SEC’s ongoing legal battle. The SEC’s recent appeal challenges the favorable ruling Ripple received earlier in 2023, which had provided a temporary boost to XRP’s market confidence. Now, with the appeal process ongoing, investors are grappling with uncertainty.

“Firstly, market uncertainty is likely to increase,” Lee explains.

“Investors may adopt a more cautious stance, as the final legal outcome remains uncertain. This hesitation could translate into short-term price volatility for XRP, as the market waits for more concrete results.”

This regulatory ambiguity has already had a tangible effect on XRP. The token saw a sharp 18% decline in early October as the SEC announced its appeal. This decline serves as a reminder of how sensitive XRP is to regulatory developments, a theme that has persisted throughout its legal journey.

Price Pressure and Long-Term Prospects

Beyond uncertainty, XRP is facing immediate price pressure, which could intensify depending on the outcome of the SEC’s appeal. Lee suggests that a negative ruling could further depress the token’s price.

“Should the appeal result in a negative ruling, overturning the previous decision in Ripple’s favor, it could lead to a price decline,” Lee notes. However, he also highlights that if investors maintain confidence in Ripple’s ability to continue fighting the SEC successfully, the token’s price might stabilize or even rise.

In the long term, the situation becomes more complex. As the legal process drags on, Lee warns that market sentiment surrounding XRP could weaken, especially given how closely the asset is tied to regulatory updates.

“If the appeal process drags on, market sentiment around XRP may weaken, given how dependent the asset is on regulatory updates. Yet, Ripple’s continued innovation in its product offerings and strategic partnerships in the payments space could mitigate some of the regulatory concerns, helping to stabilize its position in the market,” he explains.

Broader Market Implications

The scrutiny on XRP could have ripple effects across the broader cryptocurrency market. As a major player in the crypto space, XRP often sets a precedent for how regulators approach the sector. According to Lee, significant price swings or legal decisions affecting XRP could also impact other cryptocurrencies facing similar regulatory challenges.

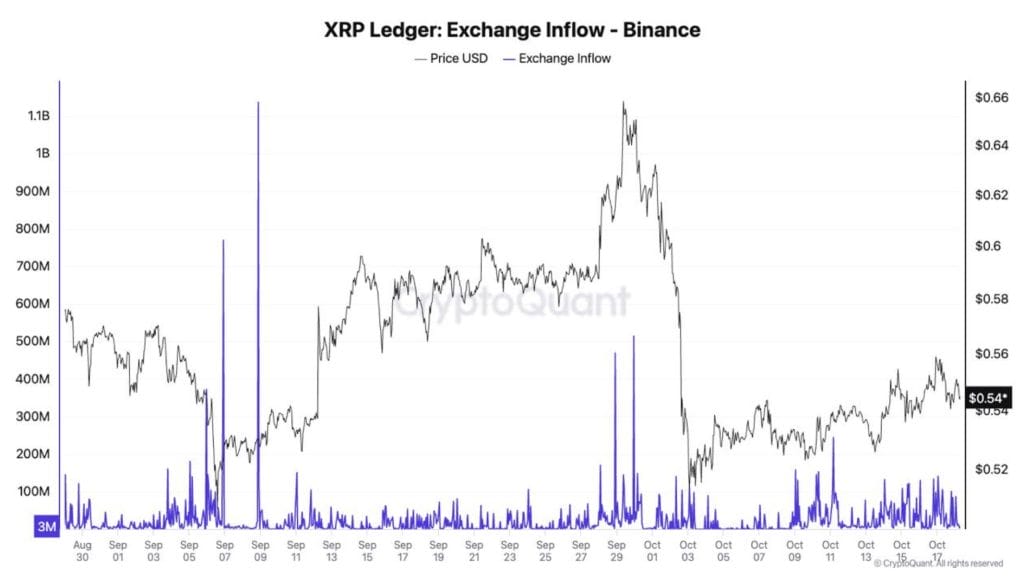

CryptoQuant’s head of research, Julio Moreno, provides further insights into the immediate impact of the SEC’s actions on XRP. “The price of XRP declined almost 10% on October 2, after the SEC filed to appeal the 2023 court ruling,” Moreno notes. He highlights that a few days before the appeal, there was increasing activity of XRP being sent to exchanges, with almost one billion XRP going to Binance. However, since then, the flow of XRP to exchanges has calmed, suggesting a temporary stabilization.

Price Predictions and Future Outlook

Looking ahead, much of XRP’s price action will depend on the resolution of the ongoing legal battle. Lee predicts a volatile year-end for XRP, with its price fluctuating between $0.50 and $0.80, contingent on regulatory developments. “A favorable ruling or increased international support for Ripple could lead to a notable price