Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin’s price recently surged to around $64,000, driven by speculation of potential Federal Reserve interest rate cuts and an influx of nearly $252 million into Bitcoin ETFs in a single day.

This surge in market confidence is pushing Bitcoin closer to its previous all-time highs, showcasing the cryptocurrency’s robust performance amid evolving economic landscapes.

Trump and NY Governor Hochul Push Nuclear Power for Bitcoin Mining

Former President Donald Trump and New York Governor Kathy Hochul have proposed shifting to nuclear energy to meet the substantial electricity demands of the artificial intelligence industry and advance climate goals.

This plan has already impacted the Bitcoin market, causing a notable price increase.

Nuclear energy, being more efficient and cost-effective compared to solar and wind power, could revolutionize Bitcoin mining by significantly lowering energy costs.

Key Points:

- Efficient and cost-effective

- Potentially lowers mining costs

- Increases market optimism

As Bitcoin recently underwent halving, the potential for reduced energy expenses has generated optimism, suggesting nuclear power could make mining more affordable and accessible to smaller operations.

This shift has fueled bullish sentiment in the Bitcoin market, driven by the prospect of lower operational costs.

Bitcoin Surges to $64K Amid Fed Rate Cut Speculation

Bitcoin prices surged to around $64,000 as market confidence grew, driven by speculation that the Federal Reserve may reduce interest rates in September. The anticipation of this potential rate cut has bolstered the value of Bitcoin and other cryptocurrencies, with Bitcoin briefly touching $65,000 over the weekend.

Supporting this upward momentum, stablecoin expansion and significant inflows into Bitcoin ETFs have further strengthened the market. On Friday alone, U.S. Bitcoin ETFs recorded nearly $252 million in daily net inflows, highlighting increased investor interest.

Analysts suggest these developments could lead to further positive momentum, possibly pushing Bitcoin to new all-time highs.

This optimism is also benefiting other cryptocurrencies like Solana and Ethereum, with Ethereum eyeing a recovery to its 2021 peak of $4,600.

The broader crypto market is gaining strength, fueled by expectations of a favorable Fed decision.

Bitcoin Rises to $65K Amid Fed Speculation and Saylor’s Endorsement

Bitcoin surged to $65,000 as speculation about potential Federal Reserve monetary policy relaxation and increased demand for U.S. Bitcoin ETFs boosted market confidence.

Michael Saylor, celebrating this milestone, tweeted that his company’s Bitcoin strategy outperformed major S&P 500 firms like Nvidia and Marathon Oil over the past four years, dubbing himself a “Bitcoin Standard.”

Federal Reserve Chairman Jerome Powell’s hints at possible interest rate cuts have also contributed to Bitcoin’s rise, improving liquidity in international markets.

Despite the slight decline to around $63,189, Bitcoin remains strong, indicating sustained investor confidence.

Technical Outlook: Key Levels to Watch for Bitcoin Price

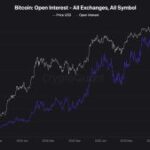

Currently trading at $63,400, Bitcoin (BTC/USD) is facing strong resistance near the $65,000 level, a critical psychological threshold reinforced by a double-top pattern on the 4-hour chart.

The presence of several Doji candles just below this resistance suggests that the uptrend may be losing steam. If Bitcoin fails to break through this level, a bearish correction could be imminent.

In the event of a price reversal, immediate support is expected around $62,600. Should the price dip further, the next key support level is near $62,000.

This level is particularly important as it aligns with an upward trendline, offering additional buying interest.

The 50-day Exponential Moving Average (EMA), currently at $62,100, also supports this trend, adding another layer of strength to this support zone.

Bitcoin Adoption Accelerates as New Crypto Platform Raises Nearly $800,000 in Presale

As Bitcoin’s momentum continues to rise, a new crypto project is gaining attention with a successful $791,366 presale launch.

With a $13.5 billion market cap, Bitcoin remains a dominant force in the crypto world, often hailed as the “digital gold” of the blockchain ecosystem.

Leveraging Bitcoin’s influence, the newly launched platform, Crypto All-Stars, is transforming the staking landscape by integrating Bitcoin with popular meme coins.

Although Bitcoin itself isn’t a meme coin, its market impact is significant, and projects like Crypto All-Stars are harnessing this by offering innovative staking opportunities for Bitcoin holders alongside meme coins.

Since its launch last week, Crypto All-Stars has attracted substantial interest, raising $730,000 during its presale. The project’s strategic token allocation aims to support growth and sustainability, making it an attractive option for investors.

If you’re a meme coin holder looking to maximize your investment, Crypto All-Stars offers a compelling alternative to Sun Wukong. Visit the website to purchase $STARS with ETH, USDT, BNB, or even by card.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.