Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The global trade landscape took another hit as China and Canada retaliated against the latest round of US tariffs, inching the world’s largest economies closer to a full-blown trade war.

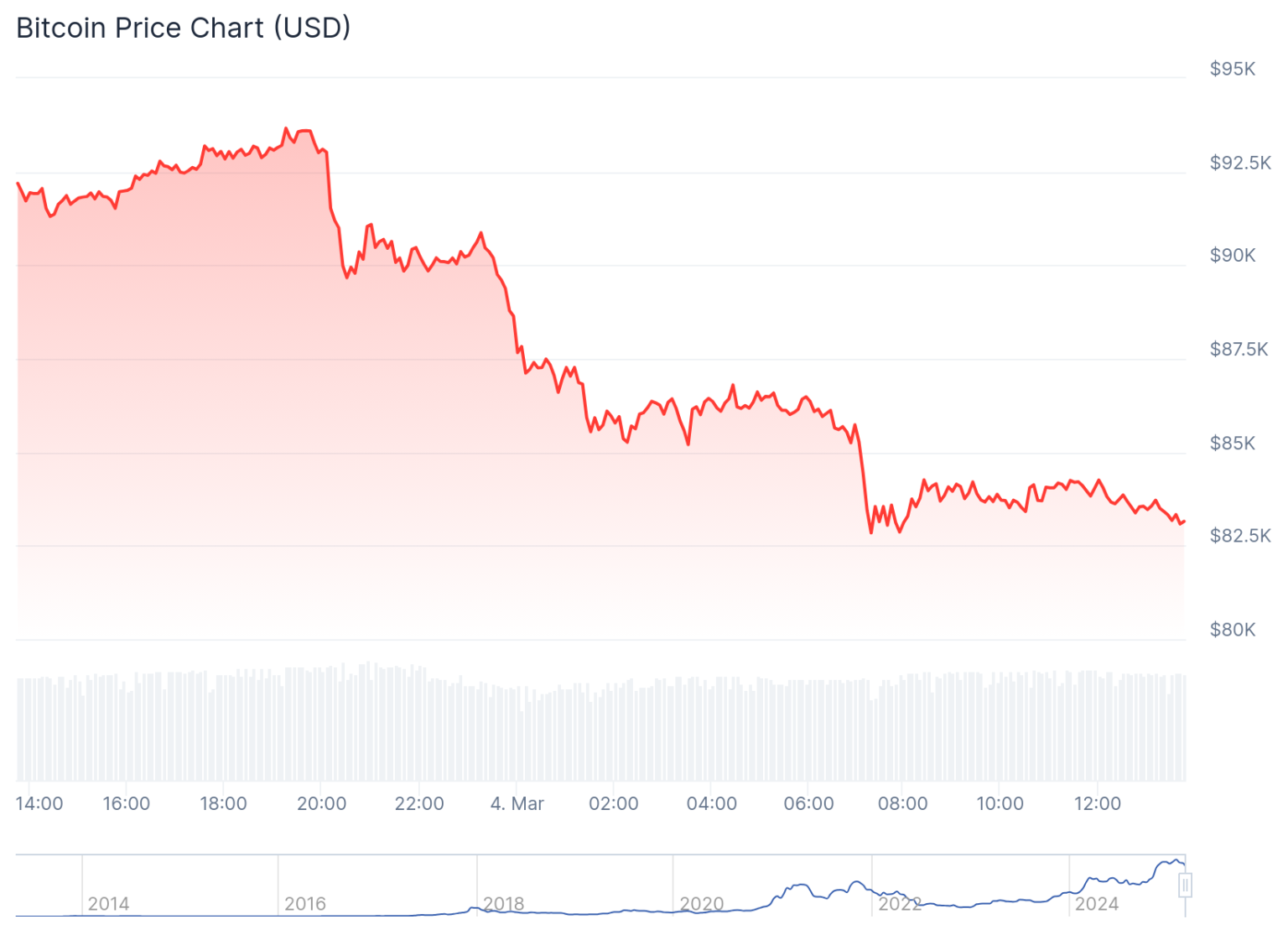

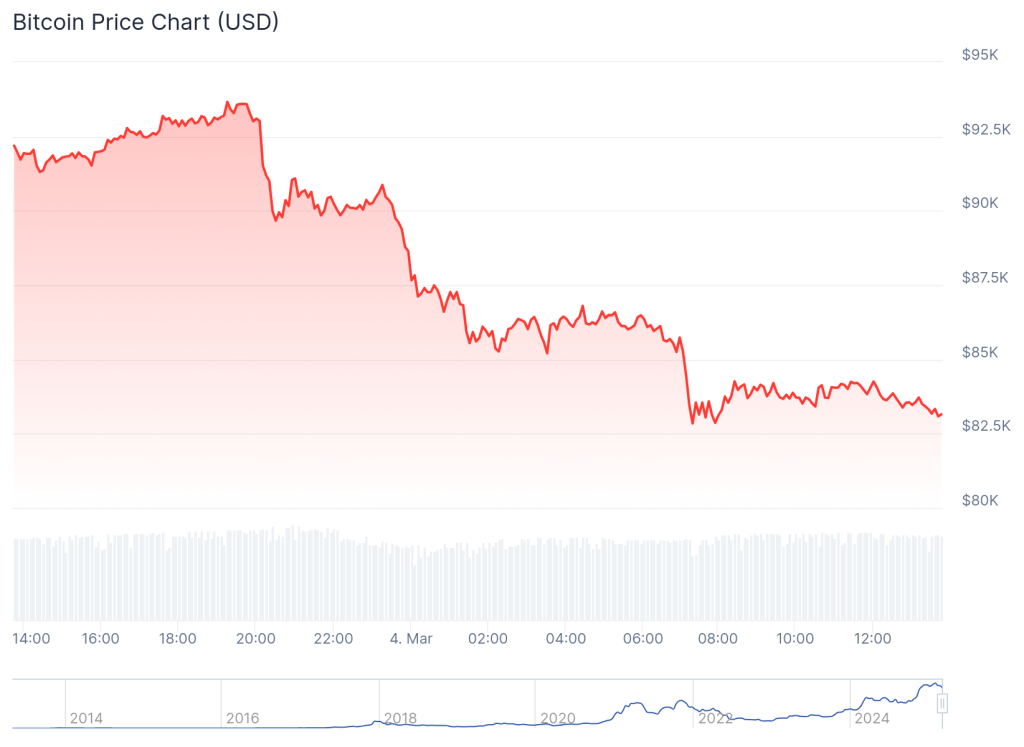

The crypto market was already under pressure before the retaliatory moves, with assets slipping 12% on Tuesday as investors continued to reassess risk exposure amid growing economic uncertainty.

Canada Slaps US Imports with 25% Tariffs

Canadian Prime Minister Justin Trudeau announced retaliatory tariffs late Monday, confirming that a 25% tariff on $20.8b worth of US imports would take effect on March 5. These countermeasures will remain in place until the US rolls back its tariffs on Canadian goods.

Notably, the duties will not apply to goods already in transit, ensuring minimal immediate disruption for shipments already en route.

This response follows US President Donald Trump’s decision to move forward with 25% tariffs on Canadian and Mexican goods, alongside 10% duties on Canadian energy products, after a temporary reprieve expired. Trudeau hinted at the possibility of additional measures, but details on specific goods targeted in this round remain unclear.

China Blacklists 25 US Firms in Response to New Tariffs

Meanwhile, China has responded to the latest US tariff hikes with a two-pronged approach. The country has raised import duties by 10%-15% on a variety of American agricultural and food products.

At the same time, Beijing has blacklisted 25 US firms, placing them under export and investment restrictions due to national security concerns.

While previous retaliatory measures from China targeted well-known brands, this time, Beijing has avoided going after household names, instead focusing on defense contractors involved in US arms sales to Taiwan.

The timing of China’s move is crucial—it came just as the additional 10% U.S. duty on Chinese goods kicked in, effectively raising the cumulative tariff burden to 20% on certain exports. The White House justified this latest tariff hike as a response to what it sees as Chinese inaction on controlling illicit drug flows into the US, further complicating already fraught trade negotiations.

Crypto Market Sinks Despite Trump’s Policy Push

The crypto market, which initially surged on Trump’s weekend proposal to establish a U.S. strategic crypto reserve, has since reversed course. Tuesday’s 12% decline in total market capitalization shows how investors are grappling with conflicting signals—bullish sentiment around potential US crypto adoption is being tempered by broader economic instability triggered by escalating trade tensions.

While Bitcoin and Ethereum led the retreat, smaller altcoins were hit harder as traders rotated capital into defensive assets. The renewed trade war rhetoric also spilled over into traditional markets, with equities experiencing volatility as investors moved away from riskier assets that lack protection from geopolitical headwinds.

Markets Brace for US Response as Canada and China Push Back

With Canada’s tariffs now in effect and China taking a more targeted retaliatory approach, all eyes are on how Washington will respond. Trump has previously suggested that additional levies could be on the table if trade partners refuse to comply with US demands.

If the situation worsens, the ongoing uncertainty could continue to weigh on risk assets, including crypto, which has increasingly mirrored macroeconomic trends in recent years.